Active Management - The Only Life Raft Left?

Always ask the why question!

I had a lot of amazing feedback from the last article and I am glad it was helpful! If there is anything I have learned over the past year it’s that people just want a simple explanation of how things work. Sooooo let’s go over a very simple question, WHY in the world should I know that long list of data points, economic signals, asset markets, and positioning?

Very simple answer, it’s the only way to survive the coming environment.

When we think about wealth management or trading, there is no need to be a perma bear or perma bull. There is no need for catchy headlines or some elaborate narrative about how everything has changed. In the first article I wrote on this Substack, I laid out a very clear and reasonable argument for why during certain periods of time, active management outperforms passive management.

I would encourage you to read it:

The main idea from the article: When there is a higher frequency of growth, inflation, and liquidity shocks, more active portfolio decisions are needed to maintain the same returns.

For example, moving forward, if we have both stocks and bonds chop in a range for the next decade, you could very easily come out the other side with flat to negative returns. Just because your financial advisor said the “average historical return of a 60/40 portfolio is 9%” doesn’t mean it will continue into the future. In fact, when we look back far enough, we actually see that there are many decades where 60/40 does poorly. 2022 was not an anomaly!

If you want to dig into this topic more, you can read the work by people like Christopher Cole and his dragon portfolio. Here is a summary of it: https://barnedhidbur.medium.com/the-dragon-portfolio-4bfddd22bc0b

This is also an exceptional paper on the stock-bond correlation: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3075816

Again, this is not meant to scare people or cause people to make foolish decisions. It simply means we need to ensure our portfolio strategy takes into account a regime where stocks and bonds BOTH have negative returns.

Active Management:

This is why I bring up active management. There is nothing wrong with passive products but there are certain periods of time when passive products are not nimble enough to maintain the same level of returns when market volatility increases. If you are ok with lower returns then passive products might be fine for you. If you want to compound your wealth faster and attempt to maneuver some volatility, then perhaps active management can be a good option.

I would again point people to the Resolve Masterclass that I referenced in my first article. They do a great job of framing how to make these decisions. You never make these decisions off the cuff. You create robust models and strategies for your decision making and you implement those decisions with consistency over time.

However, in order to make active decisions, you need to be able to correctly analyze the market environment and the distribution of probable outcomes. Remember, we are working with distributions of probabilities, not a known future.

Someone who has done an exceptional job at explaining this regime change is Whitney Baker at Totem Macro. Here is her Twitter:

She has a couple of interviews and reports online that I want to share:

https://mebfaber.com/wp-content/uploads/2022/01/TOTEM-MACRO-2021.12.13-Put-Down.pdf

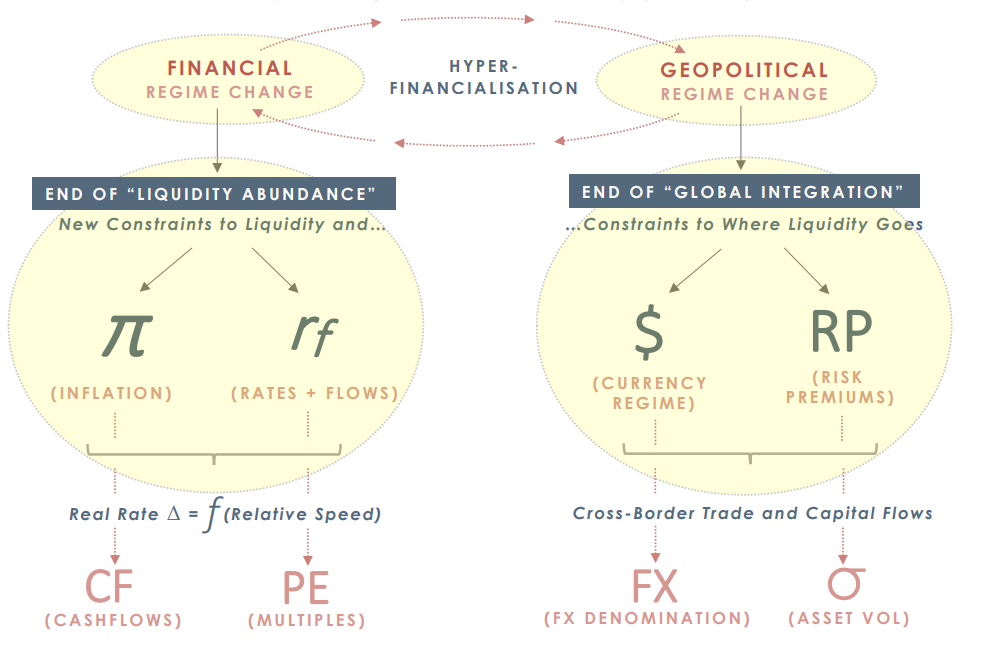

The main idea is that BOTH the geopolitical regime and the financial regime are changing at the same time.

And the distribution of returns across assets will be very different.

I think these two visuals are incredibly helpful in framing this conversation because she first says, ok what are the regimes that take place, and let’s backtest these over centuries instead of using recency bias from the past decade. Then she asks, how is each asset likely to act in these different regimes?

This is the simple process of active management. Define the regime, identify the probability of an asset’s return in that regime, and then implement a strategy for capturing those returns.

How will this look moving forward?

Everyone I talked to who holds passive products was pretty annoyed last year when both stocks and bonds went down at the same time. This was the first time in a long time that the overall portfolio had negative returns. But their advisor said, just sit through the drawdown because “over the long term” we will be fine. Well, guess what, stocks and bonds have rallied a bit from their October 2022 low: here is the risk parity ETF.

Right now, there is a little less pressure on financial advisors because we have had some positive returns YTD. However, eventually, we will begin to see the limitations of passive products as nimbleness is required to avoid additional drawdowns.

Until we exit the volatility of this regime (which could be years!), actively managed global macro will rule the day.

Does it begin to make sense WHY we might need to know all of those data points I put in the last article? We want to build a comprehensive picture of the regime, identify the distribution of returns for all assets, and then figure out how we can capture those returns in a low-risk manner. It’s like anything else in life, if you want the reward, you have to put in the time or pay someone to do it for you.

Now that you know the WHY behind making these types of decisions, we can dig into each category (economic data, asset markets, positioning etc.) that I shared in the previous article. I will break down each category, explain how you should think about it, show you how it connects to the big picture, and then make sure you have free resources to stay up to date with everything. Stay tuned for the coming articles on that!

AND TO BE CLEAR, none of this is financial advice! But I am always happy to point you to resources!

Charts!

Alright before we finish, let’s go through some charts:

Here is the Nasdaq (blue) and Russell (orange) futures. Ever since the banking crisis, a divergence has occurred. This is because the Russell has more exposure to banks and small caps. I am watching this divergence along with credit spreads.

Gold has been a lifesaver for portfolios over the past year. I think its going to take some type of catalyst to push gold to all-time highs but it’s likely to happen given the cyclical setup for real rates. I wouldn’t be getting long here though. Just waiting patiently for now.

If the FED really is done with hiking, the Yen is likely to break down from here:

Weston has been doing a great job breaking down the Yen if you want to look into this more:

These are just some broader thoughts but eventually, after we get the foundation built for understanding everything I laid out in the previous article, we will begin running a lot of trade write-ups. That is where the real fun begins!

Thanks for reading!