AI & The New Age Of Economics

The future of macro

Fundamental Change:

Fundamental technological shifts that transform how energy is input, processed, and output always coincide with major melt-ups and melt downs in financial markets. These disruptions reshape entire economic systems. In this article, I’ll break down the core shifts happening around AI and machine learning—and explain how they’re tied to macroeconomic dynamics and financial markets.

These changes are so much bigger than a 5-10% move in equities, Bitcoin, or bonds. We always want to account for incremental changes on lower timeframes, but if you miss how the structure of technology is shifting, catching those smaller moves won’t even matter.

I am working through all of these things in real time with people I have hired in the AI and ML space. It’s new for everyone, and understanding the fundamental concepts behind the media narratives is probably one of the biggest premiums to extract in macro right now.

If you are a paid subscriber here, I will be sharing all of the models, processes, and insights that we develop. I have always said, if you are long the Capital Flows Substack and a long-term thinker, then you will get all of the future value. In truth, people on social media, Substack, and especially Twitter are the new venture capital bets. The shift in technology is concentrating high degrees of leverage in individuals or small teams. VCs are going to start providing less and less value in this realm because permissionless leverage is at the lowest cost it has ever been.

(see the previous article I wrote here)

Transformed Energy:

I want to start by explaining the shift in thinking and processing:

Idea #1: We’ve entered an era of information overload—where the sheer volume of data, signals, and variables far exceeds human capacity to parse meaningfully. Traditional analysis began with a specific instance, searching for historical parallels to contextualize or forecast outcomes. It was narrow by design, limited by both cognitive bandwidth and available data. Today’s large language models (LLMs) and machine learning systems reverse that paradigm. They start with the entire data landscape—all potential scenarios, patterns, and outcomes—and systematically winnow it down based on statistical relevance, context, and probability. This shift from analog intuition to digital abstraction enables a far more comprehensive—and often counterintuitive—understanding of complex systems.

The problem with this is that everyone is blasted with an almost infinite amount of ways to think about systems.

Idea #2: AI and machine learning become most effective when paired with a clear understanding of the causal mechanics within a specific domain. It's not enough to add industry terms to a prompt (“Hey ChatGPT, apply this framework to industrial manufacturing”)—models must be structured around how the domain actually functions. This includes understanding operational constraints, incentive structures, and feedback dynamics. By embedding this domain logic directly into the architecture or workflow of the model, you can meaningfully narrow the range of possible outcomes and focus on scenarios that are grounded in real-world mechanics. This is essential for moving from general pattern recognition to reliable, context-aware decision-making. It ensures you don’t mistake the map for the terrain—and in doing so, you produce information that is not only true but actionable.

You can know an infinite amount of true things from ChatGPT, but that doesn’t mean it is providing the TYPE of insight you need for action.

Idea #3: At a first-principles level, business functions as a system of energy transfer—inputs like time, attention, and capital are directed through a structure to generate outputs such as value, revenue, and influence. AI changes this structure at its core. By compressing the cost, time, and complexity of certain tasks, it alters not just the rate of transfer, but the pathways through which energy moves. Leverage increases because the same unit of input can now create outsized output, and speed accelerates as friction is removed from once-manual processes. But this also reshapes how volatility transmits through the system: decisions ripple faster, feedback loops tighten, and small inputs can generate disproportionate consequences. In essence, AI doesn’t just optimize the system—it redefines its topology, requiring a new understanding of where energy concentrates, how it moves, and where the structural fault lines now lie.

Technology always creates a higher probability for extreme outcomes because volatility and leverage are being compressed.

Winner Take All:

Each of the dynamics described—winnowing infinite outcomes through domain-specific logic, restructuring inputs and outputs through energy-efficient AI systems, and elevating human judgment to a point of leverage—converge into a broader structural truth: AI is driving markets toward rapid winner-take-most outcomes. The ability to embed deep causal understanding into models, redesign service delivery architectures, and realign energy flows is no longer a long-term competitive edge—it’s a short-term existential race. Markets are being redefined not by slow accumulation but by sudden concentration. Those who build context-aware systems that filter noise, compress entropy, and channel attention with precision will claim a disproportionate share—often locking in dominance for years. The window for positioning as the default solution in any vertical is narrow, and once it closes, the compounding effects of distribution, data, and trust create a moat that’s nearly impossible to cross.

Implications On Macro:

31. the "ai bubble" is actually an excise tax on vcs who can't tell the difference between genuine innovation and repackaged openai apis.

39. in 18 months, 80% of the “ai startup” category will look like spam. the rest will become infrastructure.

46. i don't know how long this window stays open, but we're in a moment where all the rules of building businesses are being rewritten. for the people playing with these new tools, creating audiences and communities, you've got an unfair advantage.

From GREG ISENBERG Link

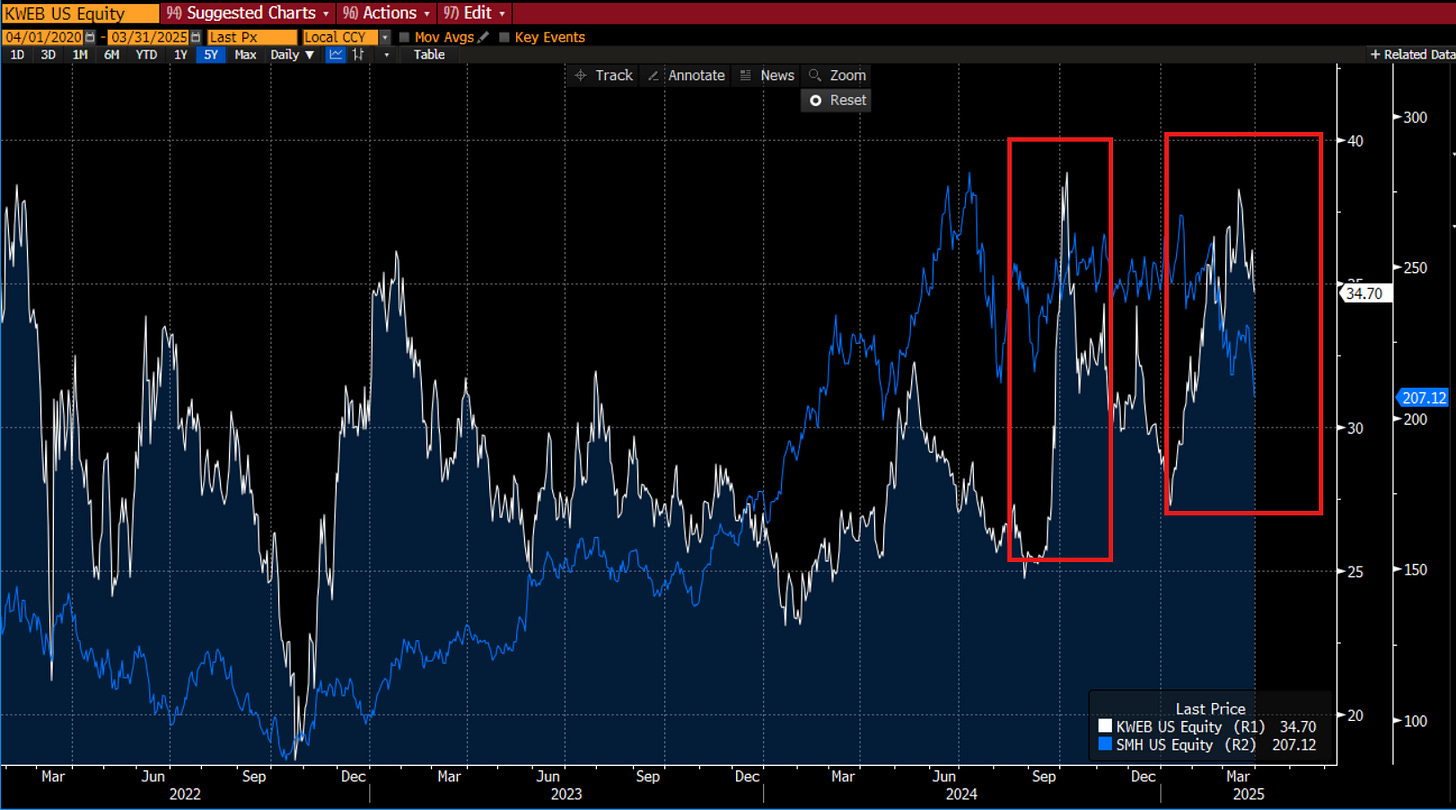

We have seen the first stage of this technological change in the Semiconductor sector (SMH ETF in the chart below) as the melt up was led by NVDA.

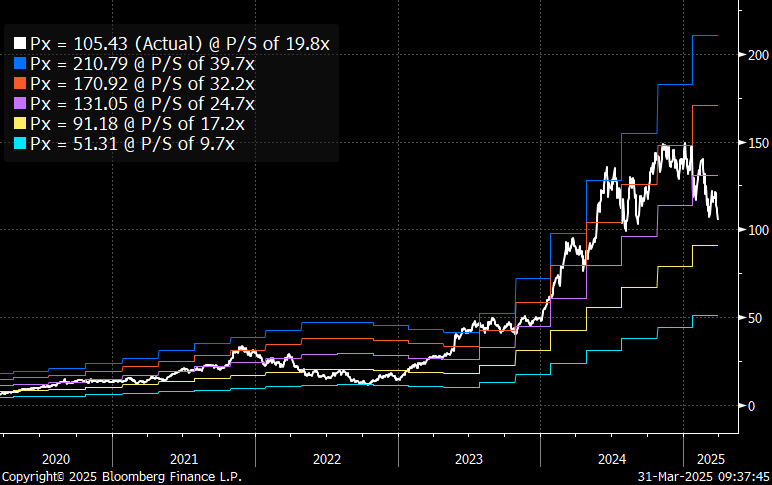

We have come off the highs in valuation for NVDA 0.00%↑ and are moving back to the bottom end of the range:

We are seeing the geopolitics take center stage in the rotation, and this will continue to be a macro power play:

The picks and shovels of the structural shift (semiconductors) are already priced an extreme in less than a year. While all of us will be trading Semi’s to the upside and downside over the next 5 years, understanding the opportunities on a structural basis is THE KEY. Semi’s are old news now.

Main oppurtunities I am thinking about:

1. AI-Native Vertical SaaS

Explanation: AI will power the next wave of $1–100M/year vertical software businesses.

Timing: 0–6 months

1st Order: SaaS startups disrupt niche verticals.

2nd Order: Traditional vendors lose market share.

3rd Order: Labor markets shift toward AI integrators.

2. Content Backlog Weaponization

Explanation: Creator content is being silently used to train competing AI tools.

Timing: 6–18 months

1st Order: AI uses public data to create competitive content.

2nd Order: Copyright tensions explode.

3rd Order: Regulation around data rights tightens.

3. AI Rebuilding Software From Zero

Explanation: AI isn’t enhancing legacy tools; it's rebuilding them from scratch.

Timing: 6–18 months

1st Order: Legacy software categories are replaced.

2nd Order: UX expectations are reset.

3rd Order: Entire categories are restructured around AI.

4. Digital Employers > Employees

Explanation: AI will manage labor, not just assist it—redefining work hierarchies.

Timing: 18+ months

1st Order: AI agents manage human workers.

2nd Order: Gig coordination platforms are disrupted.

3rd Order: Major labor force realignment occurs.

5. Recursive AI Replacement Loops

Explanation: AI trainers may unknowingly automate themselves out of relevance.

Timing: 6–18 months

1st Order: AI replaces its own trainers.

2nd Order: Training costs collapse.

3rd Order: Ethical debates over recursion and job redundancy intensify.

6. Productized Services at Scale

Explanation: AI enables high-margin services to scale like software.

Timing: 0–6 months

1st Order: Services turn into subscription products.

2nd Order: Agencies lose pricing power.

3rd Order: SMB valuations rise due to scalable margins.

7. Community as the Real Moat

Explanation: In a world of commoditized tech, community remains defensible.

Timing: 6–18 months

1st Order: Community-led products outperform.

2nd Order: User ownership models proliferate.

3rd Order: New digital institutions and economies form.

8. Compressed Innovation Timeline

Explanation: AI is improving at a pace that shortens product and business cycles.

Timing: 0–6 months

1st Order: Generative AI capabilities leap rapidly.

2nd Order: Shorter time-to-market becomes the norm.

3rd Order: Incumbents struggle to adapt fast enough.

9. Context Is the Advantage

Explanation: AI assistants will only be useful with persistent memory and relationships.

Timing: 6–18 months

1st Order: Assistants gain memory/context.

2nd Order: Tool retention and daily use rise.

3rd Order: Emotional trust in AI becomes a product moat.

10. Tier 3 Support Automation

Explanation: Even complex support tasks will soon be handled by AI.

Timing: 18+ months

1st Order: AI automates complex, multi-step support.

2nd Order: Senior support roles shrink.

3rd Order: Customer service orgs are flattened.

11. Binary Outcomes Over Mediocrity

Explanation: AI enables faster experimentation—no more “zombie startups.”

Timing: 0–6 months

1st Order: Faster validation/kills of new ideas.

2nd Order: Startup death rate rises.

3rd Order: Capital becomes more efficiently deployed.

12. Identity Will Trigger the Backlash

Explanation: Public outrage will erupt over digital identity misuse by AI systems.

Timing: 6–18 months

1st Order: People realize their data is being exploited.

2nd Order: Lawsuits and regulatory pressure emerge.

3rd Order: Consent-based data markets become normalized.

13. Taste as the Last Scarcity

Explanation: When execution is commoditized, taste and judgment become key differentiators.

Timing: 0–6 months

1st Order: Tasteful creators outperform.

2nd Order: Human-led brands stand out.

3rd Order: Taste-led tools emerge as new infrastructure.

14. Predictive Intelligence Will Quietly Dominate

Explanation: Forecasting is more valuable and defensible than content generation.

Timing: 6–18 months

1st Order: Vertical-specific prediction tools are built.

2nd Order: Decision-making becomes AI-assisted.

3rd Order: Economic planning and modeling are reinvented.

15. Distribution > Product

Explanation: In a flooded AI market, attention and reach are king.

Timing: 0–6 months

1st Order: Distribution channels win over product quality.

2nd Order: Community and creator-led startups surge.

3rd Order: Aggregator businesses dominate entire verticals.

16. The SMB Ghost Stack

Explanation: Small businesses will be run by one founder and five bots.

Timing: 6–18 months

1st Order: Back-office functions become automated.

2nd Order: Solo founders operate like 10-person teams.

3rd Order: The number of one-person million-dollar businesses explodes.

17. Education Will Be Bypassed, Not Disrupted

Explanation: Young people will choose building and learning online over school.

Timing: 18+ months

1st Order: Teens abandon traditional education paths.

2nd Order: Creator-entrepreneurs multiply.

3rd Order: Universities lose cultural and economic relevance.

18. AI Workflow Design as a Career

Explanation: The most valuable people won't code—they'll design systems.

Timing: 0–6 months

1st Order: Demand for AI ops and workflow engineers rises.

2nd Order: Automation-first startups thrive.

3rd Order: Systems thinking becomes a core professional skill.

19. Interface Becomes Identity

Explanation: When AI tools speak, brand voice and emotional tone become central UX.

Timing: 6–18 months

1st Order: Interfaces adopt personality and tone.

2nd Order: Emotional resonance drives retention.

3rd Order: Personality-first products reshape SaaS and consumer tech.

The Culmination:

If you take away one thing from all of this its that you need to be long individuals who have massive upside in learning, adapting on the fly (they MUST be extemporaneous), and changing at an accelerating speed. Over the last 3 months, the rate at which I have had to change my systems and processes (for the better) due to new updates in AI and ML has been massive.

The amazing thing about this environment is that since 2020, everyone has become a trader and focused on short-term wins. These people are just going to miss the structural trend cause they are chasing short-term trades instead of building a structure for processing information flow.

I’ll share more on this in the coming days with the things I have been building in the shadows

Continue to accelerate

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Love this. And I'm with you 100% on vertical AI agents. If we think bigger than ourselves for a minute though, is there a way to make this a collective effort? If we each figure out how to automate our expertise and infuse an AI with our experience, could we literally hyperscale our own individual economic value while at the same time have time to enjoy life, explore for the sake of exploring, etc.

So good, as usual. Have to bookmark and reread. Kinda have to sip it like whiskey.