Alpha Report: A storm is coming / the next big swing

Mapping the flows and risk reward of Bitcoin, equities and bonds

Big Picture:

We remain in a regime where growth is positive and inflation is decelerating but the most recent CPI print indicates the speed at which inflation is decelerating presents additional hurdles and tensions for positioning. This carries outsized importance because positioning in financial markets across stocks, bonds, and FX is considerably offsides.

The context for this report falls within the macro report and podcast which can be found here:

And here:

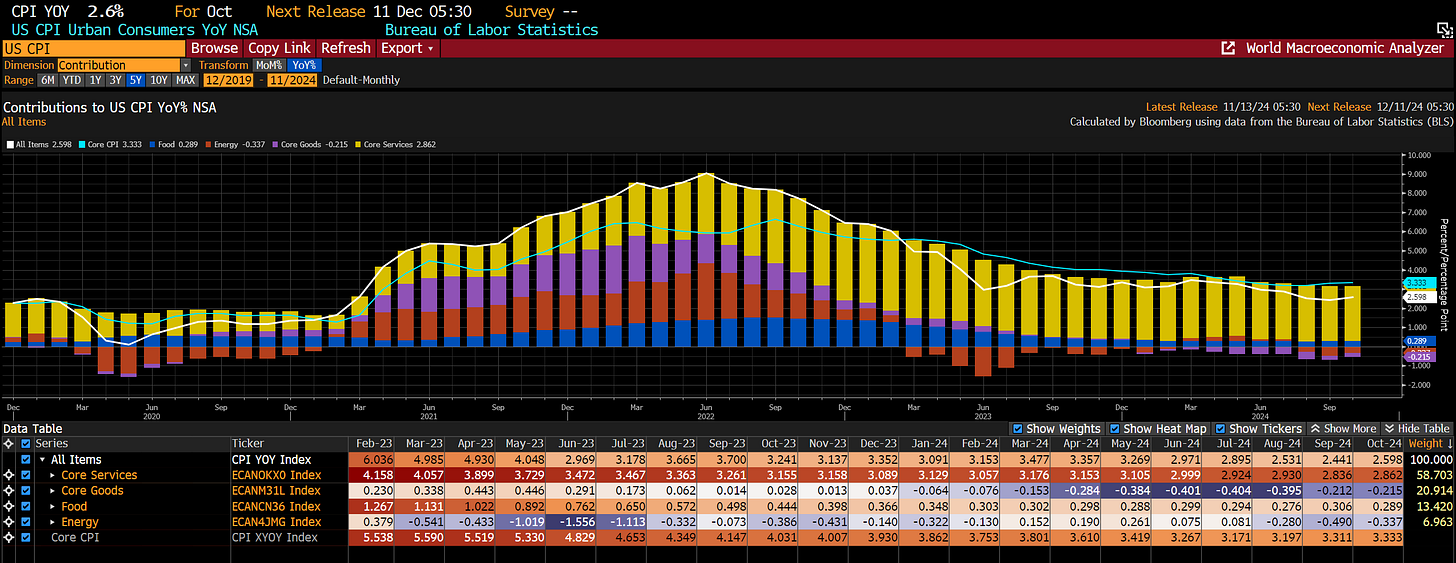

CPI Breakdown:

The headline CPI number accelerated on an incremental basis just marginally with the goods line item showing less contraction.

The core CPI number has greater significance right now because both goods and services moved up:

The largest component of services, shelter, accelerated marginally but functionally came in flat:

The implication of this print determines HOW FAST the Fed cuts vs pauses in 2025. Right now the December contract is pricing an 86% probability of a cut in December and a 31% probability of a cut in January. In other words, the market is saying “cut in December and pause in January.”

You will notice the 2-year is fairly elevated relative to inflation, almost to the extent that its flirting with the “higher for longer” regime we saw in 2023.

When we look at the relationship between the economic surprise index and the 2 year, we are seeing a fairly elevated level of rates due to the surprise in growth.

The chart of the economic surprise index and the 2 year illustrates this as well:

The main idea is that we have seen a Fed mistake of starting a cutting cycle with 50bps overlapping with a surprise in growth and inflation. This overlaps with positioning growing increasingly offsides in equities, bonds, Bitcoin and metals.

Positioning Set Up And The Next Move For Markets:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.