Alpha Report: A systematic dismantling of market expectations

The lies of central banks and the implications for interest rates

I have been laying out how growth is accelerating and credit issuance is increasing in the system. This is occurring as markets are significantly misinterpreting HOW central banks are likely to respond. In addition to this, central bankers themselves are actively misinterpreting the data.

I want to focus on how this is directly connected to markets and WHERE we are likely to go. notice that the Russell has been in a range where volatility is now compressing. We had a gap UP at the beginning of May on positive tariff news and then we tried testing this level in the middle of May but reverted back up. Since this time, we have been compressing in volatility.

This range compression during May has also occurred in crude and bonds. Why? because we are in a bit of a holding pattern until the NFP print tomorrow, CPI print next week, and the June FOMC meeting. All of these flows are connected.

Notice that ZN and ZT made a reversal on the news event this morning about a phone call between Trump and Xi. In my view, this was likely to happen on tomorrows NFP print but the news functioned as an early excuse for bonds to retrace down marginally, especially in ZT.

We are not in an environment where the Fed can be doing aggressive rate cuts. On top of this, we are seeing a compression in crude at a higher level over the last 3 trading sessions. If we break out from here with inflation swaps already elevated this this creates MORE downward pressure on bonds.

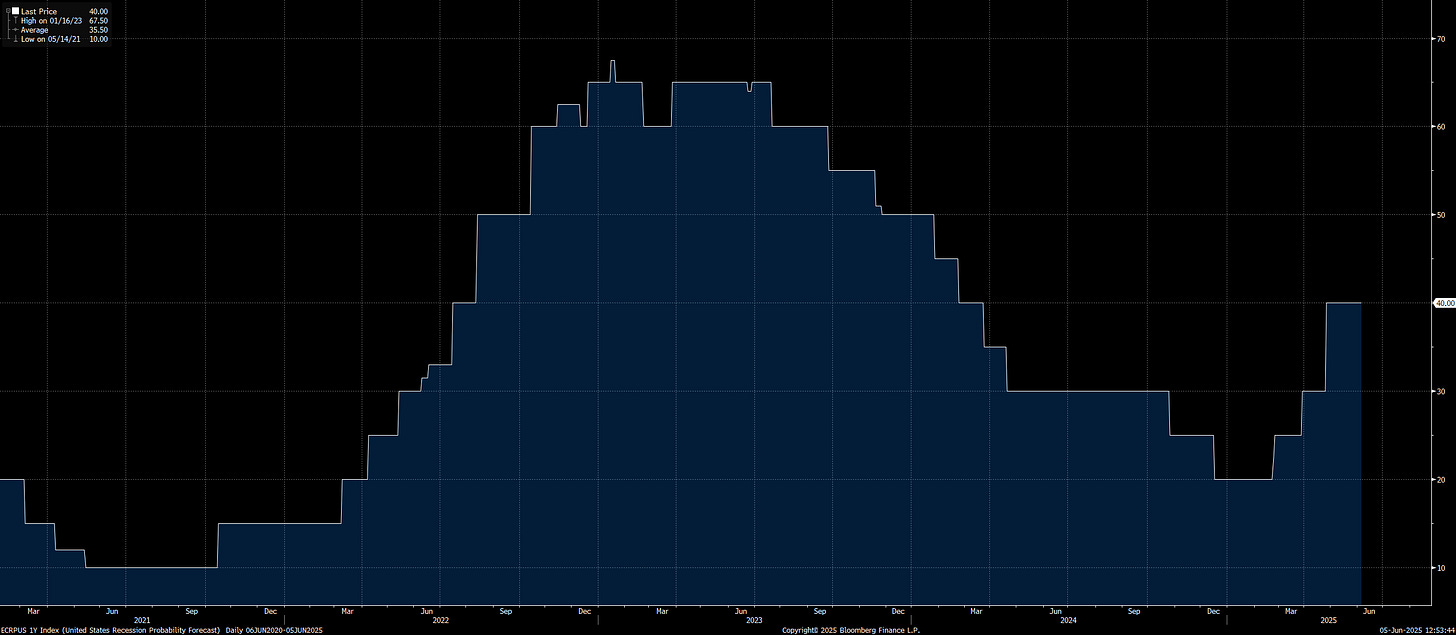

As I have said, economists expect recession probabilities to be at 40%. This is insane! If this turns out NOT to be true, we are likely to move UP in the Russell, UP in crude, and DOWN in bonds. The short-term compression in the price action I noted at the beginning directly connects to this thesis because the NFP print, CPI print, and June FOMC will function as macro-clearing events for managers to unwind their hedges.

All of the news about Trump and Elon disagreeing is all noise.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Both Trump and Elon have ample experience creating theater to move assets down before the big rip. I’ve seen enough. These days, when my nation’s leaders are stoking interpersonal drama, I’m long.

What’s your strategy for dealing with all this bond market turbulence?