We ended last week’s inauguration flows with equities higher and the TRUMP Coin lower. The fact that the president of the United States launched a memecoin is a sign of our political regime shift.

Regardless of where macro goes, there is a clear shift in how institutions are going to concentrate and transmit power. Every major CEO is recognizing they need to shift their stance and rhetoric or they will be left behind. Even Mark Zuckerberg and Sam Altman made noticeable shifts that even seemed comical given their previous statements.

The point about these signals is not about a political agenda but HOW these actions influence the capital flows in the economy. In this report, we are going to cover the macro developments that have taken place and touch on a few important observations for this regime.

Macro Tear Sheets/Model:

All of the Macro Tear Sheets and Dashboards are here:

I also just recorded a podcast on Blockworks that I would encourage everyone to check out:

Crypto/AI Merging:

There is clearly an excessive amount of focus on crypto, AI, and US dominance right now. CEOs have been focusing on AI for over a year now:

And the AI theme is beginning to interact with deregulation as Trump comes into office.

As this takes place, interest rates have moved up but the focus on them has gone DOWN.

We have seen bankruptcies and the unemployment rate tick up marginally as the perceived risk around interest rates has gone down (likely underappreciated now):

The All-In-Podcast (link) is a perfect example of how AI and crypto are being focused on more. We are seeing the merging of prominent business figures with government policy:

The Twitter feeds of prominent business figures will now be used to align two things: 1) Talking your book, 2) promoting positive US policy toward your book.

All of this “positive news” took place over the past week and Bitcoin still wasn’t able to make a durable move higher.

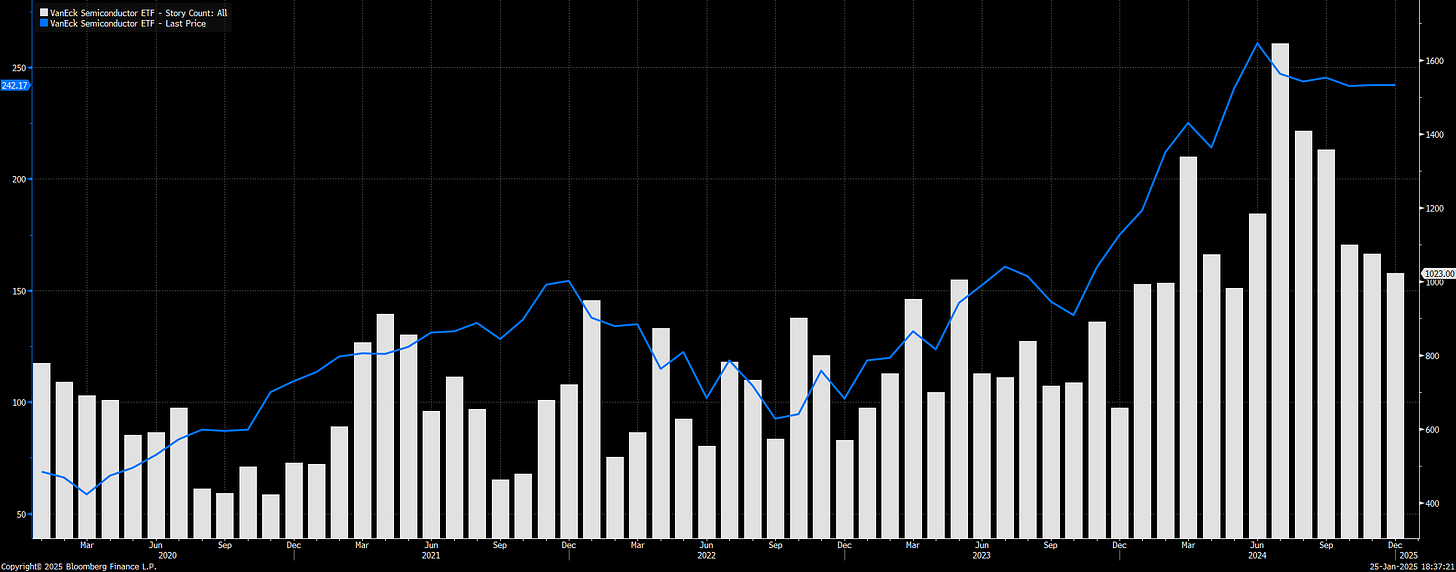

This dynamic with Bitcoin and AI is likely connected as the SMH 0.00%↑ ETF isn’t making a new high. This isn’t necessarily calling for a “top” but an observation of the signals that feed into how incremental probabilities develop:

Update on Equity View:

I want to take a moment and provide an update on the equity view I laid out because understanding HOW to take bets across various momentum regimes is critical to success in markets.

The initial view I laid out is here:

ES remains just below all-time highs and we are back at this level from the last FOMC:

I want to explain HOW and WHY you take certain bets depending on the momentum regime.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.