Big Picture:

We are approaching an important level at 5200 in ES here, and I want to take a moment and zoom out to WHY things are taking place because this informs WHERE we are going:

As we came into this year, everyone knew that equities were at an elevated valuation:

However, earnings expectations have functionally remained flat:

Underlying growth has weakened, but we are NOT seeing the type of real-time signals that would indicate a recession. The economic surprise index is marginally negative but not going off a cliff:

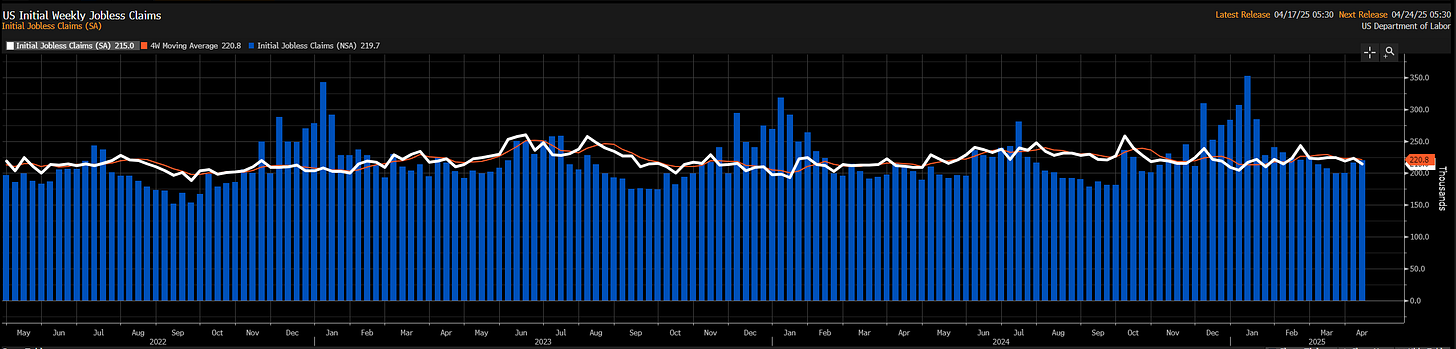

Weekly initial claims are not spiking, which means people are NOT being laid off:

Let me just say, when the weekly store visits and sales at Abercrombie & Fitch are accelerating, we are not in a recession or even close to one: (chart is weekly visits and sales to Abercrombie & Fitch stores)

Even though we are normalizing at a lower level, companies like DraftKings are still positive on a YoY basis for sales:

What’s Happening?

So, growth isn’t collapsing, but tariffs are rising, which has been THE main driver in pushing equities down YTD. The wider ranges in ES continue to show that the market is pricing in a wider distribution of outcomes.

This is why the macro report I wrote is important right now:

These tariff changes are taking place in a larger context and it’s still unclear exactly what will happen: (visuals from the macro report)

Dig Deeper:

In my view, we would need a significant catalyst shift in terms of the tariff side of things or growth for a durable leg down and a break BELOW 5k in ES. Remember, we had the 10% rally off the lows from the 5k level, which is a very rare occurrence historically.

On top of this, the yield curve has steepened over the last 2-3 trading days because long-end rates are moving UP. When the curve bear steepens or does a steepener twist (long end rates move up more than short end rates) it’s the market saying that long-term nominal GDP expectations are not collapsing relative to how the short end of the curve is set up. In simple terms, the yield curve isn’t screaming recession since we had the 10% rally in ES.

The implication of this is that we are pricing a change in the composition of underlying drivers in growth but not a collapse in growth. This was one of the things I laid out in the macro report because if we get a major Capex boom, the 10-year will make new highs almost immediately (good luck Bessent).

So, where are we likely to go in ES? Given where the macro drivers are right now, we are likely to remain range-bound above 5k or rally marginally, barring any crazy tariff news:

If we have an actual change in the composition of things, the type of lead lag rotations we have seen in sectors could persist. We are seeing real estate, health care, utilities, and consumer staples lead, as tech is the primary sector contributing negative returns to the index.

Consumer staples are actually up YTD:

With companies like Philip Morris and Dollar General Leading the way:

If you don’t think Dollar General is going to collapse, this is probably a great time to buy it with stops at $63.

As I laid out in the Alpha Report, the headwinds for Mag7 mean you can’t just throw money at one of the top companies and watch it melt up. Could this change? Sure but we aren’t there yet.

We aren’t at the total collapse that perma bears expect (I am neither perma bullish or bearish, but when the index is down 20%, I buy some: Link).

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.