Alpha Report: EURUSD and The Eurozone Regime Shift

The importance of the eurozone for US equities, Bitcoin, and global fixed income markets

A Macro Shift:

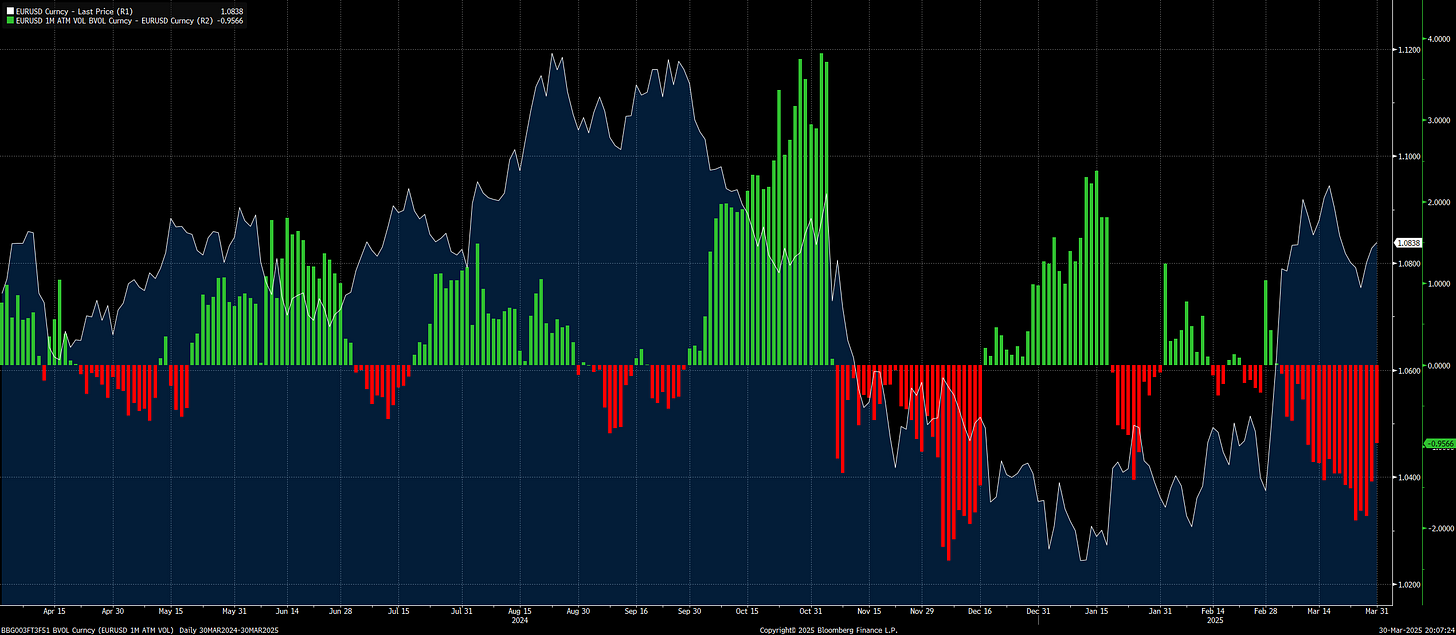

There is a shift taking place in the underlying structure of cross boarder flows that few people are taking note of, and it’s directly linked with the Eurozone and the EURUSD exchange rate. We are now seeing a significant implied volatility discount accumulate, and at the same time, we are seeing the macro begin to shift and create a higher probability of EURUSD moving out of its range.

EURUSD and especially FX volatility has drastic implications for US equities and assets on the farther end of the risk curve like Bitcoin. Many people think that a stronger dollar means lower equities and Bitcoin, but we are actually seeing the OPPOSITE and this is likely to persist.

Notice that in 2024, we saw the DXY index and US equities rally TOGETHER on the upside. Why? Because growth and inflation in the United States came in above expectations.

When we look at forward curve differentials between the US and Eurozone, you can see that the US repriced to fewer cuts at the end of 2024 as the Eurozone only repriced marginally. The charts below shows the spread between the 2-year rate and short end central bank rates. In other words, when the lines are moving down, the bond market is pricing more short-term cuts over the next two years in the respective countries. When one country prices more cuts or hikes in comparison to the other country, it has a direct impact on the exchange rate (EURUSD).

Let me show this on another chart in a more tangible manner. The chart below is the spread between the 2-year swaps in the US minus 2-year swaps in the Eurozone. It is functionally showing the difference between short-end rates of the Fed and ECB. You can see that there is a noticeable connection between the EURUSD exchange rate over the last 4 years.

However, something shifted earlier this year and understanding it is going to provide direct insight into US equities and Bitcoin.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.