Alpha Report: Inflationary Cycles and The Mistakes Of The Federal Reserve

How to contextualize the Fed and the current macro regime

Big Picture:

As we close the year 2024, we are approaching a critical juncture in markets where considerable imbalances exist in financial markets and specific tensions exist in the economic landscape. This report will provide a clear picture of WHERE we are and HOW it connects with the historical parallels that exist for inflationary cycles and the Federal reserve.

Important Logistics:

Before we jump into things, I want to make sure everyone is aware that there will be a suite of new products launched in 2025 including updates to the Macro Rates Matrix Dashboard. This entire dashboard and launch video (100% FREE) can be found here: Link. I would strongly encourage you to review it because there will be a price increase from the current rate of $ 90 per/month to $ 150 per/month. If you subscribe BEFORE then, you are able to lock in the lower rate as an early adopter. The one thing I can promise you is that the value of this Substack will be exponentially increasing over the next 12 months. There will be additional price increases in order to fund further research and product launches for you.

I can promise you that the quality AND quantity of Capital Flows will only increase. The alpha sharing won’t stop!

You can do a free trial with this link to review all of the current research across the Macro Reports, Alpha Reports, and Trades: Link

At the end of the day, the Capital Flows Research Substack is specifically meant for those individuals who want to step out of the conventional corporate mold and swing for the fences to achieve exceptional returns. It’s not for everyone.

As always, a Pepe for the culture!

Inflationary Cycles:

Inflationary cycles are one of the most important dynamics to understand in the macro mechanics of the system. At the end of the day, inflation is the revaluing of cash that is the result of nominal demand being significantly higher than the real output in the economy. This “revaluing of cash” is why inflation is a critical input into interest rates (which are the price of cash). While this is true and clear on the surface, the underlying drivers of nominal demand and real output are much more complex and highly dynamic in their contribution to the net effect.

Historically, inflationary cycles ALWAYS have unique characteristics due to the idiosyncratic tensions of the time. All of the bullet points below are part of and direct inputs into inflationary cycles:

Demand-Pull Inflation

Cost-Push Inflation

Supply Chain Disruptions

Monetary Policy

Fiscal Policy

Currency Depreciation

Commodity Prices

Wage Growth

Expectations of Inflation

Global Supply and Demand Shocks

Interest Rate Policies

Asset Price Inflation

Structural Economic Changes

Government Deficits and Debt Monetization

Velocity of Money

Understanding the drivers of an inflationary cycle is critical because it frames WHEN the inflation will come back down. This is what brings us to where we are TODAY.

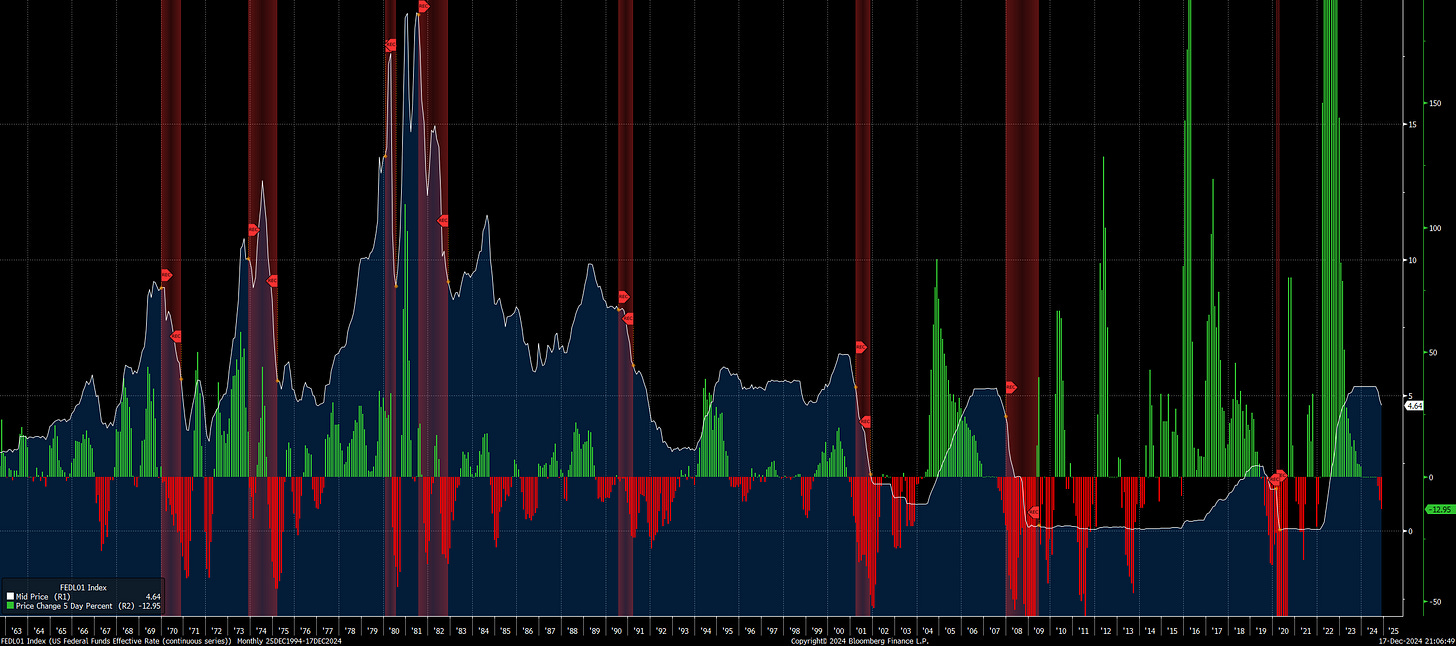

You will notice the inflationary impulse in the US has been highly out of the ordinary compared to the last 40 years:

Understanding the underlying dynamics for the historical parallels to the 1970s is critical given where we are at with inflation. Notice that during the two inflation spikes in the 70s, real output contracted in a MASSIVE way. In other words, as prices went up, people bought and sold less stuff. Growth bottomed as inflation topped.

Think about where we are today. It is a very different place. The fact that real growth is higher is WHY the Federal Reserve has been able to hold rates at a higher level. This is why a reasonable majority of the steepening we have seen YTD has been a combination of bull steepening and bear steepening. Notice this was most certainly not the case in the steepening into 2000 and 2008:

Considerable bear steepening is actually associated with the inflationary spike we saw in the 1970s (see red bars during 1979-1980):

The degree to which growth deteriorates, frames WHEN and HOW MUCH, the Fed is going to cut rates. You can review the rate of change of the Fed funds rate in the macro dashboard (link) but we have clearly entered the beginning of a cutting cycle. The key distinction to keep in mind is that consecutive large cuts by the Federal Reserve are PRIMARILY a response to real growth decelerating. This doesn’t mean the Fed can’t cut interest rates as inflation falls, it simply means that growth is a key factor for HOW FAST and HOW MUCH the Fed cuts.

All of this brings us to how the Federal Reserve is likely to come out tomorrow and into the beginning of 2025.

The Current Set Up:

The main ideas for FOMC have already been laid out in the podcast I published here:

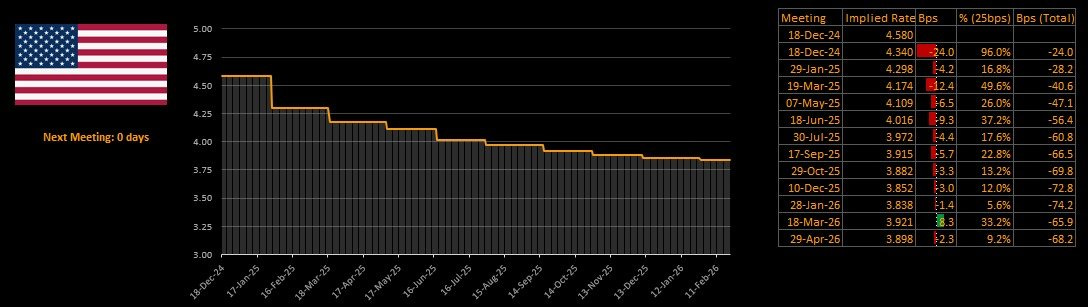

As it stands, 48bps of cuts are priced in 2025 with 23bps priced into (Jan, Mar and May) resulting in 18% in Jan, 53% in Mar and 28% in May.

What I want to cover now is how the Fed is likely to make a mistake comparable to their 50bps cut in September earlier this year.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.