Alpha Report: Interest Rate Strategy

The macro skew and positioning dynamics of rates

The Biggest Risk In Macro:

The U.S. dollar’s privileged status as the global reserve currency remains the definitive anchor for worldwide macroeconomic structures. Because it underpins trade balances, foreign exchange reserves, and cross-border capital flows, nearly all macro variables—from the U.S. trade deficit to China’s current account surplus—function as derivatives of this dollar-centric regime. If you grasp how the dollar operates in this system, you will also understand why countries adopt particular policy maneuvers to safeguard their economic interests. In turn, this insight provides a clear lens for identifying the structural drivers that shape the performance of all major asset classes. Recognizing the dollar’s outsized influence is thus essential for crafting forward-looking strategies and navigating today’s global environment.

This dynamic with the dollar’s reserve currency status directly frames ALL carry trades and flows into equity markets. The G10 carry index (which is published every day in the FX Tear Sheets here: link) and ES contract are overlayed in the chart below. The recent drawdown in US equities has moved in lockstep with the G10 carry trade.

However, notice that Chinese equities and Eurostoxx are NOT in the same drawdown as US equities. Why is this? Because the type of environment we are in is not like the 2020 sell-off where complete global liquidation occurs.

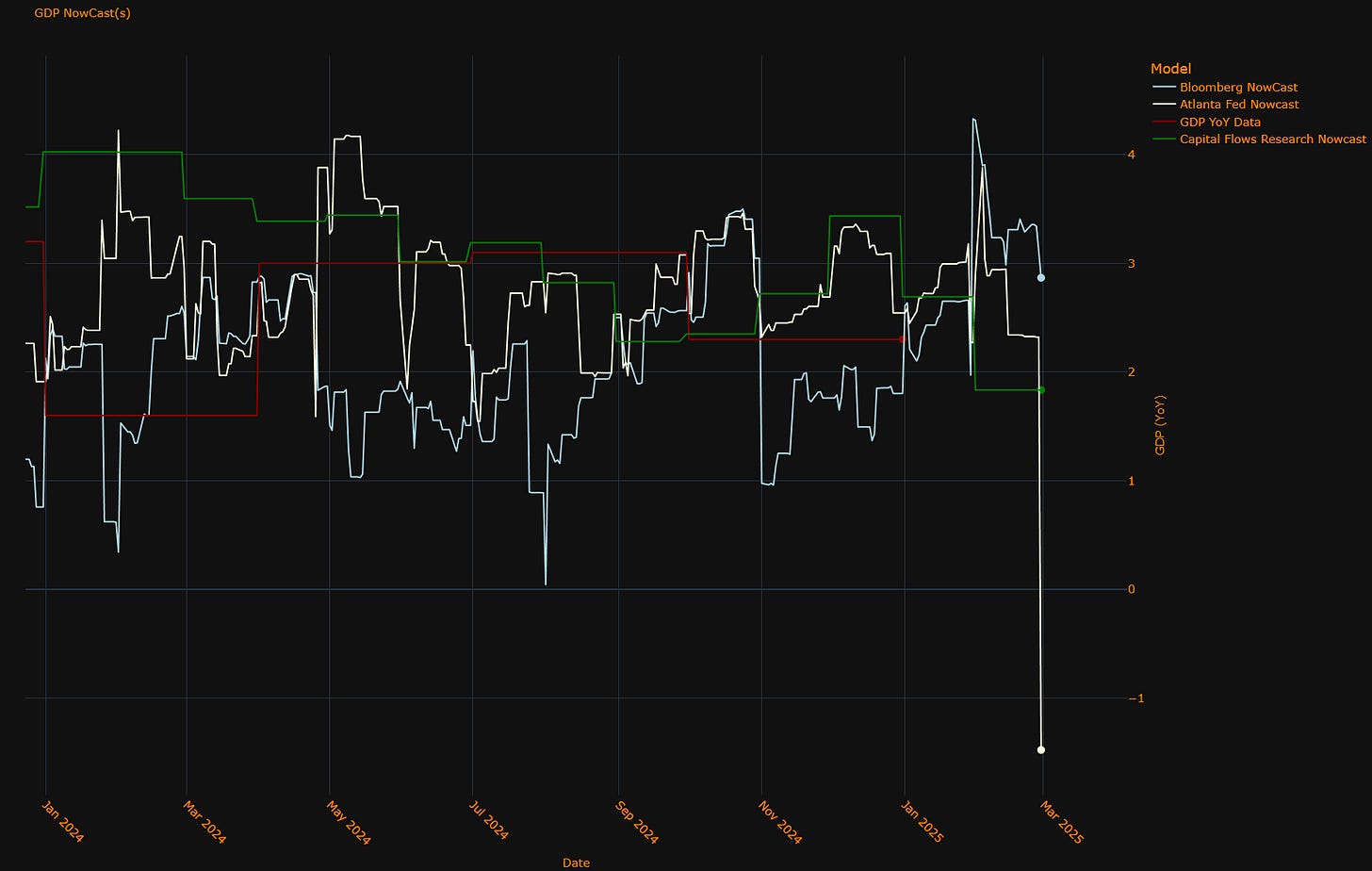

Contrary to popular narratives, we are NOT in a recession in spite of the Atlanta Fed GDPnowcast going negative:

My internal nowcast and the Bloomberg nowcast remain squarely positive:

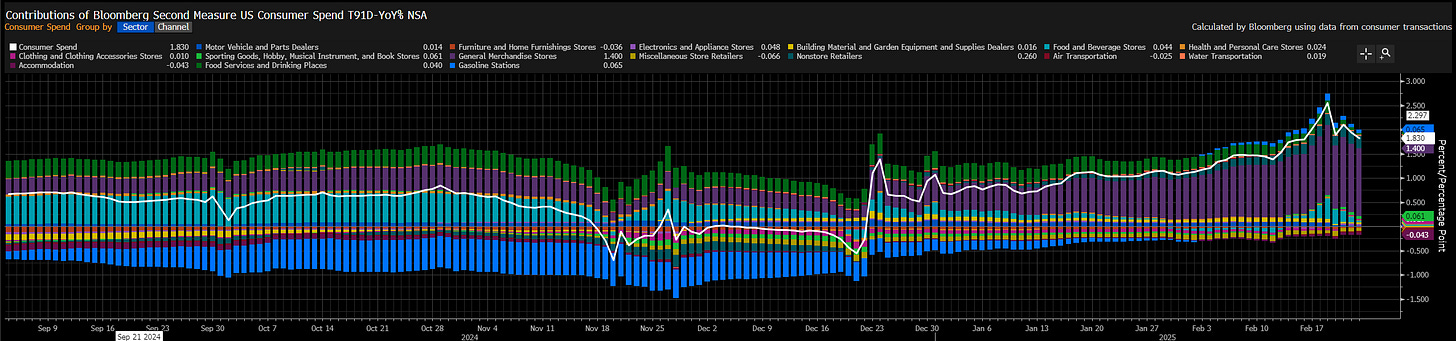

Real-time consumer spending data remains squarely positive:

When you understand the structural regime we are in with the US dollar and match this with the cyclical dynamics that are NOT indicating an imminent recession, then you can begin to understand the WHY behind interest rates and equities. The remainder of this report will break down HOW interest rates are skewed on a cyclical basis and short-term basis. Understanding the context and skew for rates is directly connected to WHERE equities are going.

Interest Rate Strategy:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.