Alpha Report: Neutral Bonds/Bullish Equities Until FOMC

Hedging pressure and positioning post CPI

Main Idea:

We continue to see elevated inflation risk in spite of today’s CPI print. However, given the hedging pressure and positioning post a weaker CPI print, as well as bonds approaching the NFP level, bonds are now neutral UNTIL FOMC. As we progress into FOMC, we are likely to have signals indicating additional downside in bonds so the thesis I have been laying out remains intact. However, in the interim, I am neutral bonds and bullish risk assets.

We are ALWAYS in a constant state of moving between macro catalysts and positioning unwinds because the signal for price is NEVER evenly distributed through time. We had the initial rally in bonds during April which I noted was highly unlikely to be sustained. In the May NFP print, I laid out the short view for bonds and we have been moving down in BOTH ZT and ZN since this time.

Being short ZT has been especially profitable:

I still think bonds are moving lower but we need to moderate our actions with how positioning is pricing the timeframe as well as new information that can take place. As a result, I am neutral duration until FOMC and bullish risk assets. After FOMC, it is possible that there is more downside in bonds but I am waiting until that time. I only take strong views when I have conviction. If I don’t have conviction, I slow down and pull leverage back. I make no apologies for this and this is how you make MORE money because you are able to limit drawdowns.

Inflation:

Let me explain WHY I am just going neutral until FOMC as opposed to flipping long or changing my fundamental view.

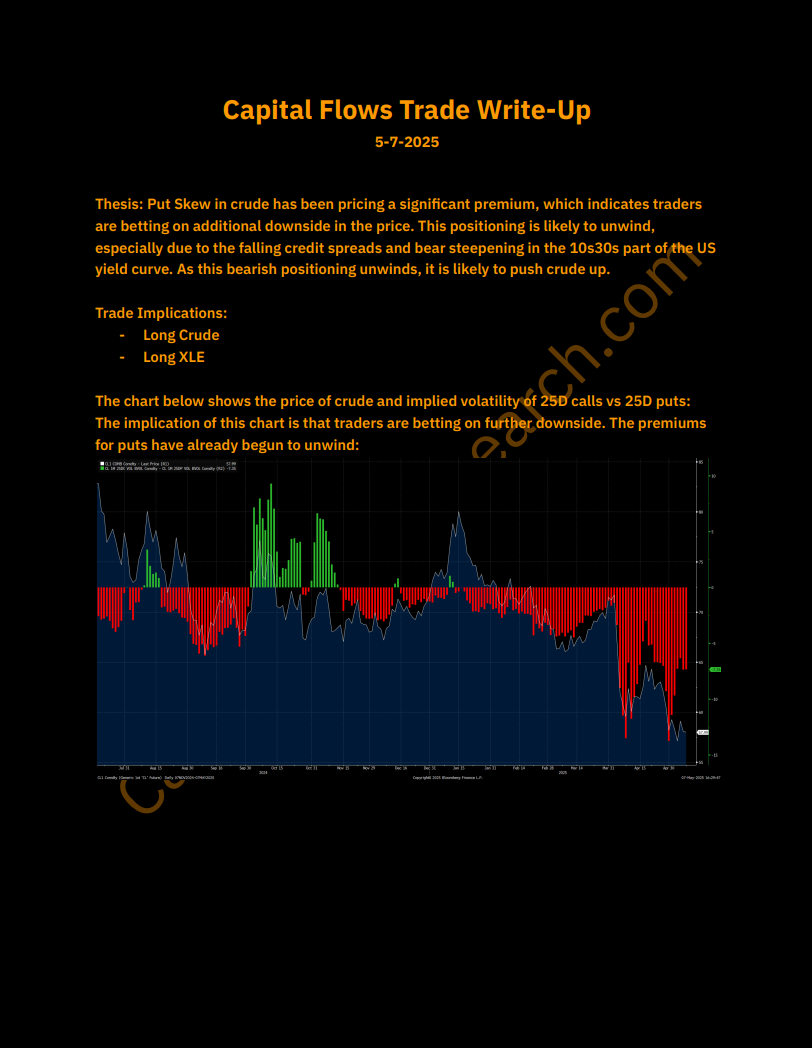

We continue to rally with incredible momentum in crude and the Russell as capital moves out the risk curve in the system.

I laid out the bullish crude case for paid subscribers on May 7th and we continue to print higher (link).

On top of this, the spread between inflation swaps remains negative. In other words, the market is pricing an inflation imbalance in the system. This spread has moved up marginally but not enough to justify a long bond view.

Part of the dynamic we are seeing in 2s10s is that we have flipped to flattening as opposed to further steepening. Through this catalyst specifically, we didn’t see as much steepening as I would like to justify holding a short bond position into FOMC.

Now how does all of this connect to equities?

Flows and Hedging:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.