Macro Review:

Main Idea: We saw an important signal in macro flows over the last two trading days with the Russell outperforming indices as 10s30s bear steepened and Z5 moved down. This overlapped with a rally in crude, copper, gold, and silver. These flows through the JOLTS print today set the stage for the NFP print on Friday.

I already laid out the breakdown of the JOLTS data here. I want to dig into this further after reviewing a few key charts.

Key Charts:

There continues to be overwhelming evidence that a recession in the US or other major economies is not on the table right now. We are in a regime where consensus expectations around economic data have normalized post the tariff shock. We are functionally “back to where we were” at the beginning of the year except long end rates are higher and short-end inflation swaps are even more elevated.

All of the companies in the S&P500 are excessively focused on tariffs which is becoming a nonissue for markets. On a side note, every major corporations has a much more sophisticated process for managing their interest rate risk and supply chain risk. As a result, they have become much more akin to market participants following consensus as opposed to a disconnected company focusing on their specialty. When companies go from a local and domestic focus to international in their operations, their actions become implicit macro bets.

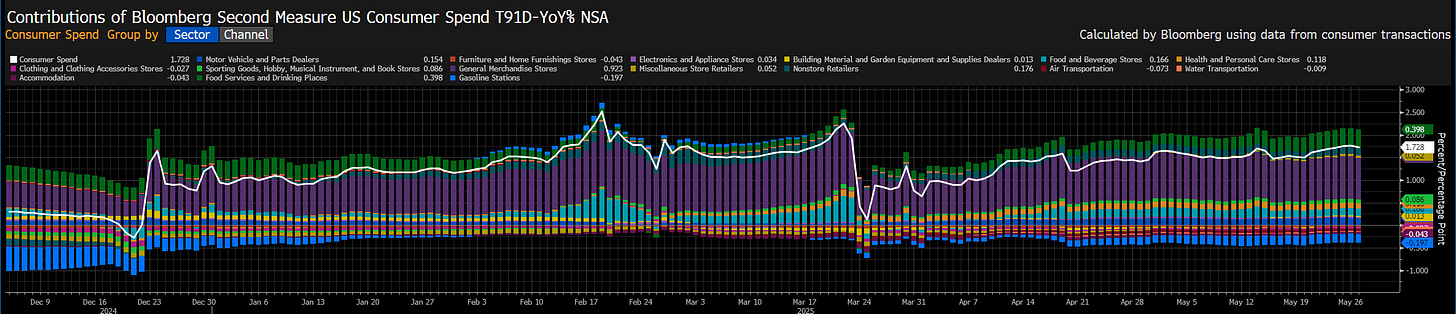

As this focus on tariffs continues, underlying growth data continues to expand:

However, we are still normalizing from Q1 which is why the economic surprise index is functionally neutral.

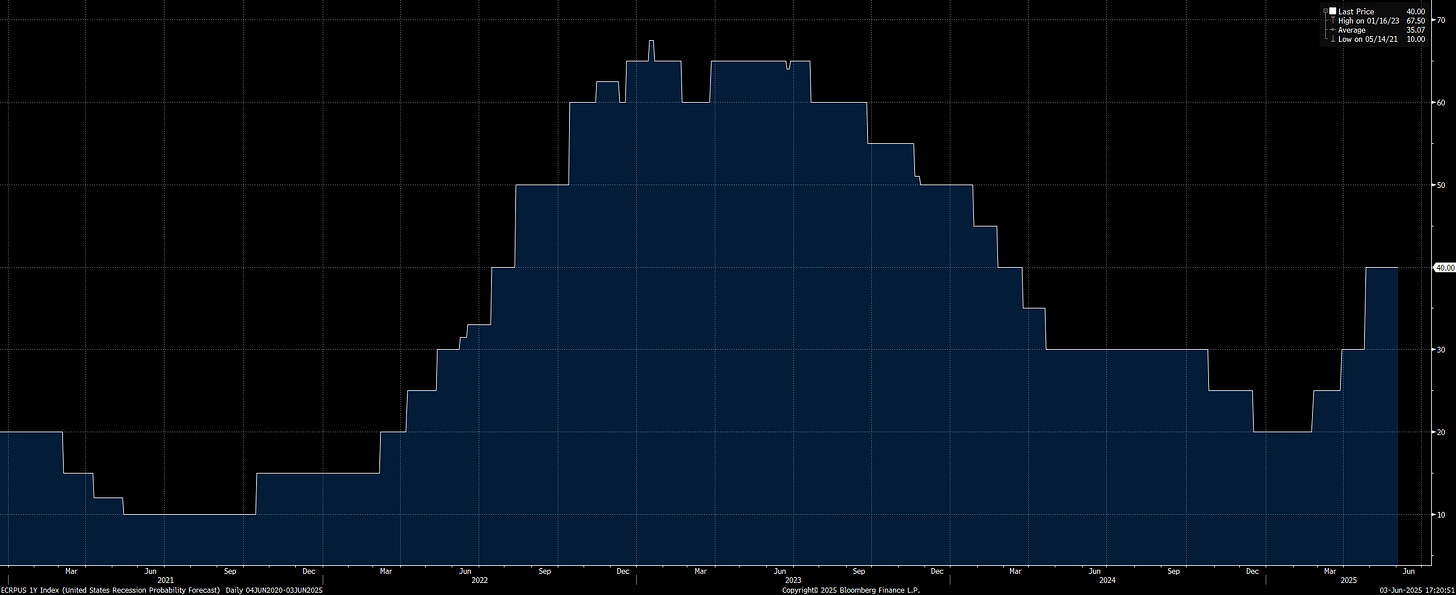

The recession probability forecast for 1 year ahead is sitting at 40%. This is completely misguided in my view and needs to move back below 20%.

This directly connects to HOW we are pricing the forward curve.

STIR:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.