Alpha Report: The Credit Cycle, Risk Curve, And Macro Inflection Point

How macro liquidity is systematically moving out the risk curve and buying junk

Main Idea:

We continue to see an increase in credit issuance and macro liquidity, which is expanding economic growth and inflation as well as causing capital to move out of the risk curve in financial markets.

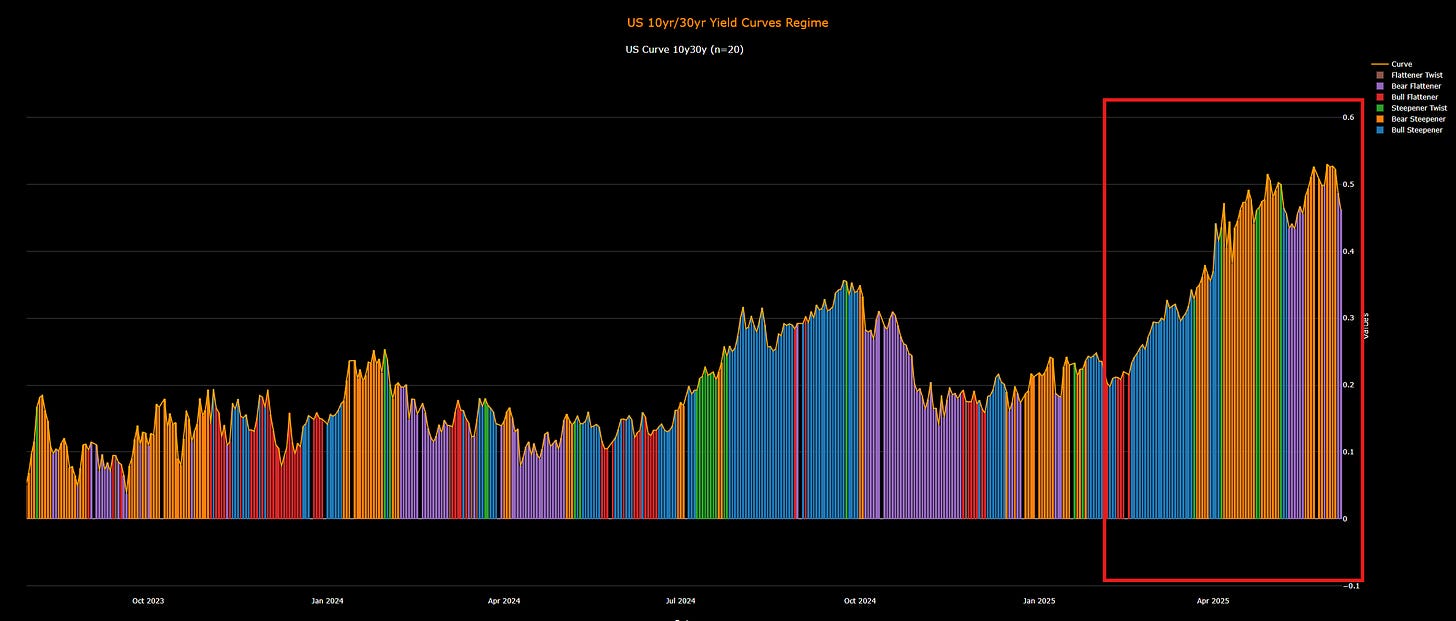

This is WHY 10s30s has been flipping back and forth between bear steepening and bear flattening. When this is happening, it is because nominal GDP is rising. In other words, the fixed-income market is screaming that growth and inflation are rising.

As I have been laying out for months now (link), long-end rates are moving higher because growth and inflation are rising:

This rise of growth and inflation in the underlying economy is occurring AT THE SAME TIME as macro liquidity in the system is expanding. The result is a systematic movement of capital out of the risk curve to buy the most risky assets.

Technical Breakdown Of The Risk Curve:

In an environment of accelerating growth and elevated inflation, nominal cash-flows rise faster than discount rates and real debt burdens fall, compressing risk premia and pushing capital outward along the risk curve—from bills and high-grade sovereigns toward high-yield credit and equity—while abundant liquidity and accommodative funding conditions reinforce this rotation. When credit issuance itself ramps up, the primary market supplies leverage that lowers spreads and lengthens effective duration, creating reflexive feedback: tighter spreads spur more issuance, which in turn attracts further risk-seeking capital. The cycle reverses when growth momentum stalls or disinflation sets in: funding costs rise relative to expected cash-flows, liquidity support wanes, issuers retreat, and investors shorten maturities and upgrade quality, crowding back toward the safest segments of the curve. Recent empirical work shows (i) that global liquidity flows become most risk-sensitive precisely when intermediaries’ balance-sheet constraints are tight, making these regime shifts abrupt and nonlinear, and (ii) that well-timed macroprudential tightening meaningfully curtails the right-tail of credit growth, dampening the pro-cyclical surge in risk exposure during expansions (papers.ssrn.com, papers.ssrn.com).

I would also encourage people to review the S&P500 Program Primer by Prometheus Research:

I would encourage everyone to follow Conks and the Conks Pro publication. The alpha he (Zee Zoltan) has been sharing in the chat function has been incredibly helpful:

The Credit Cycle:

We are seeing a continual increase in the amount of deals in corporate high-yield issuance. The chart below shows the current period compared to the same period in previous years. We are significantly above 2022 and 2023 levels.

The key thing to note is that we are only just beginning to see the early stages of this credit cycle in the IPO market. Excluding the June data in the chart (since we are only 8 days into the month and the data is showing MTD), we are seeing a significant consolidation and upward momentum in IPO deals.

The important one to note for the crypto space is the CRCL IPO which is going to have options listed to trade on it starting tomorrow. I would not be surprised to see a significant rally in CRCL driven by option flow lead the rally in BTC.

In this specific credit cycle, we are seeing a concentration of flows around all of the Trump associated securities/crypto projects. In my view, watching the names that The Last Bear Standing noted in his report will be critical because if there is a SPAC 2.0 stage of this cycle in the next 3 months, you better believe the powers at be will ensure that these names are part of the rally.

Risk Curve:

This issuance of credit coupled with the Fed falling behind the curve as growth and inflation accelerate is WHY low quality companies continue to rally from their lows. Notice that the low quality factor index for US stocks continues to show higher highs last week:

This is in lockstep with the Goldman Sachs most shorted index rallying as well:

The implication? We are not just seeing capital move out the risk curve but traders get caught offsides because they are not bullish enough.

Macro Inflection Point:

The NFP print on Friday confirmed that growth is much higher than expectations. The result was bonds moving lower as equities rallied.

ZT broke lower and we are likely to remain BELOW the NFP print level from Friday as we head into CPI this week:

CPI is likely to confirm what I have been laying out for a while, that inflation is going to accelerate when you pump credit into a system in this type of regime. Core CPI is expected to accelerate to 2.9% from its last print of 2.8%. Everyone will be floating the narrative about inflation risk this week as they are late to the table.

CPI will function as the last macro-clearing event before FOMC. Z5 is already creeping down to the 25bps level as I laid out (link):

As is Z6 creeping down to 75bps.

We are finally narrowing the spread BETWEEN the Z5Z6 contracts which is a critical signal. Previously the market was just kicking cuts down the curve. Now its realizing they need to reprice them all together. This is the next step into long-duration bonds moving toward a greater point of selling capitulation in my view.

Pulling Things Together:

We are in a period of time where the Fed is clearly falling behind the curve, credit is getting pumped into the system, and the long end isn’t even beginning to drag on equities. This is a very bullish environment for risk assets. The short squeezes over the next 1-3 months will be significant opportunities in my view. I will be publishing a report for paid subscribers on this so keep an eye out for that.

https://x.com/Globalflows/status/1931475017109528830

Buckle up fren

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Understand that you’re examining various aspects of the CPI bucket to predict an increase. From a basic standpoint, do you believe these CPI items are rising due to tariffs?

When do you think the long end rates will begin to impact equities negatively?