Big Picture:

One of the difficulties in markets and macro is that there are so many layers to the changes that are taking place. On the cyclical macro regime, growth is still positive but normalizing. The NFP print on Friday showed jobs continuing to be added to the US economy.

The current macro regime is one where the US economy isn’t collapsing. Within this regime, corporations pulled forward a lot of their imports due to the tariff risks but it was unclear how significant Trump’s changes would actually be: (chart below is US trade balance)

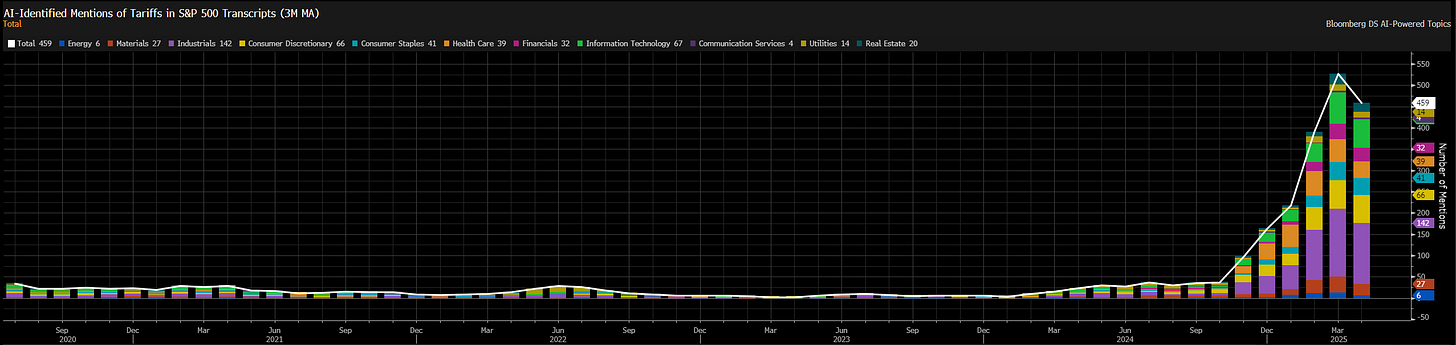

Now, we are seeing every single corporation put excessive focus on tariffs:

But there isn’t a clear translation to job cuts in corporations transcripts:

As Citrini Research recently laid out in his excellent piece, the changes could create a marginal degree of stagflation (the scenario analysis he lays out is key):

On top of this, it’s just still not clear how much of an impact tariffs are going to have on global trade. As a reminder, global trade is inherently linked with the dollars reserve currency status and, therefore, dollar liquidity in the system. This is one of the reasons we have seen such a violent shift in correlations and aggressive unwinds without the unemployment rate shooting up.

We are still seeing earnings expectations remain elevated:

And analysts’ targets are unchanged:

The wider credit spreads are beginning to impact credit markets, which will be critical to monitor:

This is beginning to feed marginally into deal flow

European markets are still faring better than US markets but if the tariff risk intensifies, then credit markets will begin to really dry up and create an actual downside for the economy.

The limitation for this is that the market is literally pricing aggressive cuts in the forward curve confluent with a recession as inflation swaps diverge from nominal rates.

Zooming In:

On the gap that took place at futures open, the June FF contract priced almost 60bps of cuts, which means the market was pricing for the Fed to cut over 50bps by June.

We have since mean reverted but are now pricing 41bps:

ES gapped down and has consolidated marginally during the low-volume Asia session, which is fairly reminiscent of the August 2024 unwind.

As a reminder, during August, we pushed down during the Asia session, rallied marginally, sold off again during the London session, and finally bottomed as we hit the US open.

The discontinuity to August 2024 is the tariff risk that is compressing right now. The biggest right tail risk is that if Trump or Bessent shift their stance at all or give the slightest indication that they will walk back the tariff risk, ES will have one of the most significant face-ripping rallies that we will see. If this takes place, we will almost certainly reprice the forward curve to LESS cuts.

We are already seeing the VIX at elevated levels as we are moving into this week.

If we move back up to the high in ZQM during the next 24 hours, I am a seller. If we did push back up to this level, I would be watching how the long end responds in connection with ES.

ZB is actually BELOW Friday’s high which is very interesting. If the underlying economy was deteriorating significantly, I would expect the longer end to be higher. So, if tariff risk decreases marginally, I expect selling pressure in the long end.

In my view, I don’t think explicit clarity will be provided on tariffs in either direction between now and the next FOMC meeting. If this is the case, then blindly buying the dip and expecting all-time highs in the next 2 months is wishful thinking.

This Week:

2 year inflation swaps are still elevated on an outright basis and above 10 year inflation swaps on a relative basis.

CPI this week will be telling in how much goods vs services inflation there is since the goods side is connected to tariff risks and the services side is likely connected to the negative MoM print in PCE a few weeks ago.

My goal for this week is to get several asymmetric trades onsides and not get shaken out by the wider ranges. Keep a close eye on the Chat because if there are any opportunities to run trades in Fed Fund futures, they will be posted there in the Tactical Trade Tracker.

I will expand on the specific trades I am looking at for paid subscribers tomorrow.

Thanks

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Amazing report!