Alpha Report: Will rate cuts reignite inflation?

Quantifying a proper framework for the developing macro set up

Main Idea:

The macro context for WHERE we are and WHY we are here has been laid out in the most recent macro report and connected podcast:

Fundamentally, we are in a Goldilocks regime where inflation is falling and growth is positive. However, within this regime, we are having some short-term dispersion that is causing the market to reprice the forward curve and shock positioning. We need to remember that all of these shorter-term fluctuations occur in a larger macro context.

Building an informational edge about a future that hasn’t even taken place is critical to extracting exceptional returns. This was laid out in the previous alpha report and we are going to build on these ideas:

Alpha Report: Disruptive Technology Is Built On Disruptive Knowledge

The world we are moving into will be dramatically different than the last 20 years. This applies to financial markets and every industry because the degree of nonlinearity and complexity is exponentially increasing at an accelerating rate every day. The most important thing you can do is correctly understand HOW to interact with the changing environment…

To answer the question posed in the title, “Will rate cuts reignite inflation?” we need to take a step back and frame the context.

The Big Picture:

We know that the hiking cycle since the beginning of 2022 and subsequent fall in inflation, hasn’t been able to shake the capital structure of the US economy enough to impact consumption. As a result, price indices have fallen as real consumption has remained positive.

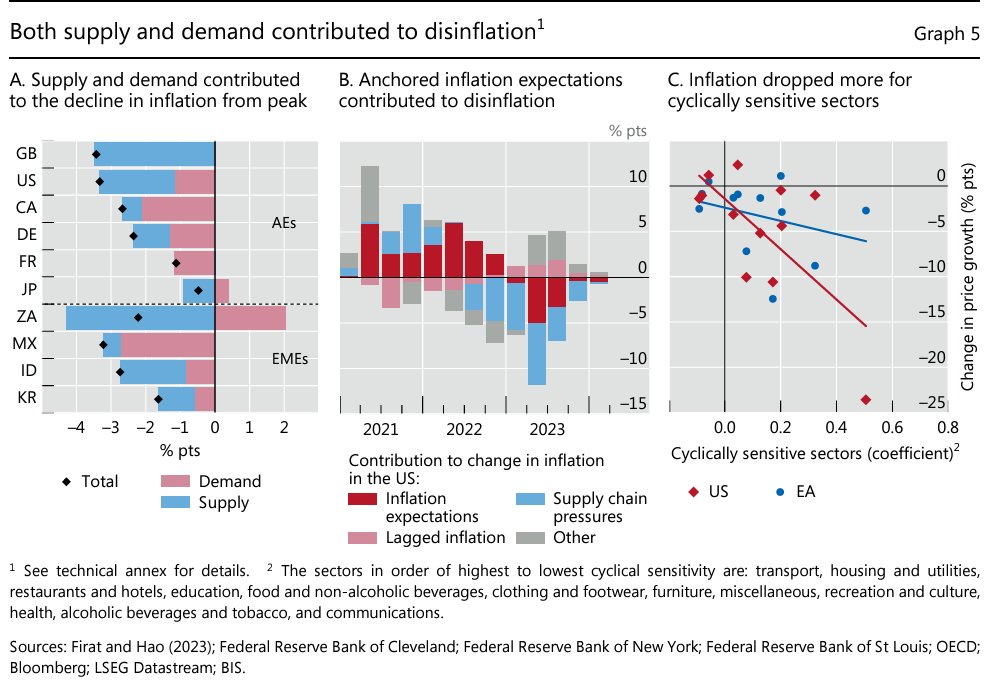

While inflation has fallen, the question is, if we haven’t had a recession, is inflation ultimately dead”? The BIS touches on these ideas: BIS Annual Report Points: Link

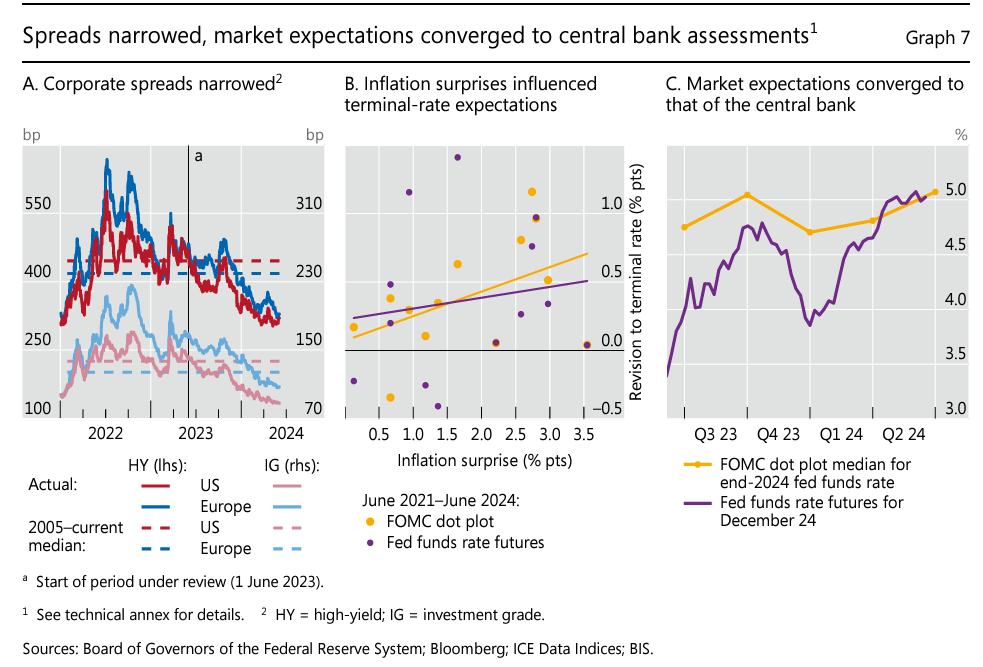

The big-picture variable coming into play now is the Fed’s credibility and forward guidance. The Fed clearly shifted its stance to a rate-cutting cycle at Jackson Hole (noted in the macro report published in Sept):

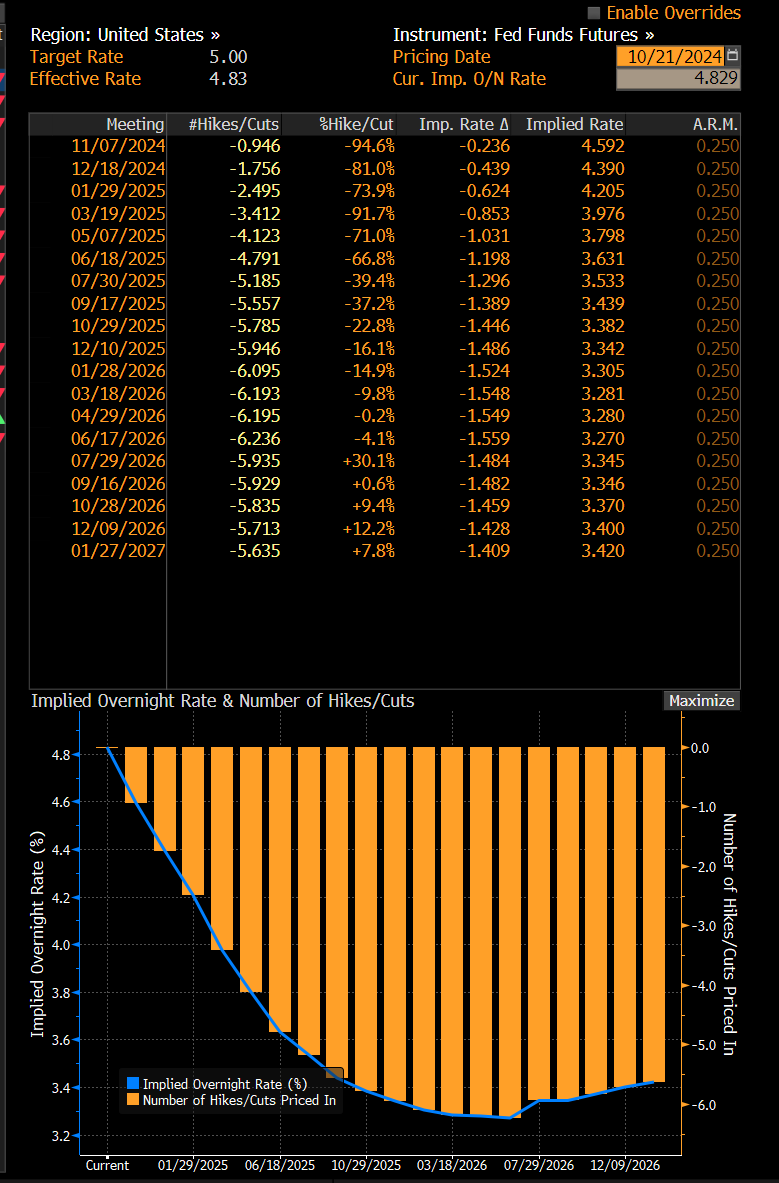

The Fed then front-loaded a 50bps rate cut just as core inflation came in above expectations and crude rallied on geopolitical risk which pushed inflation swaps UP. This is why the VIX has diverged from the MOVE Index. The market is pricing a much higher variance for bonds as we move into FOMC than equities.

Why? Because the forward curve continues to oscillate to an extreme as opposed to compressing around a median equilibrium-type expectation. Why is this? Because you have a combination of a higher R* in the economy, higher growth, and a Fed that is trying to maintain credibility. On top of this, the goods components and commodities portion of the inflation basket is going to move with a higher correlation to exogenous shocks and geopolitical risk. However, the services line item is primarily going to move with wages as they connect to supply and demand in the labor market.

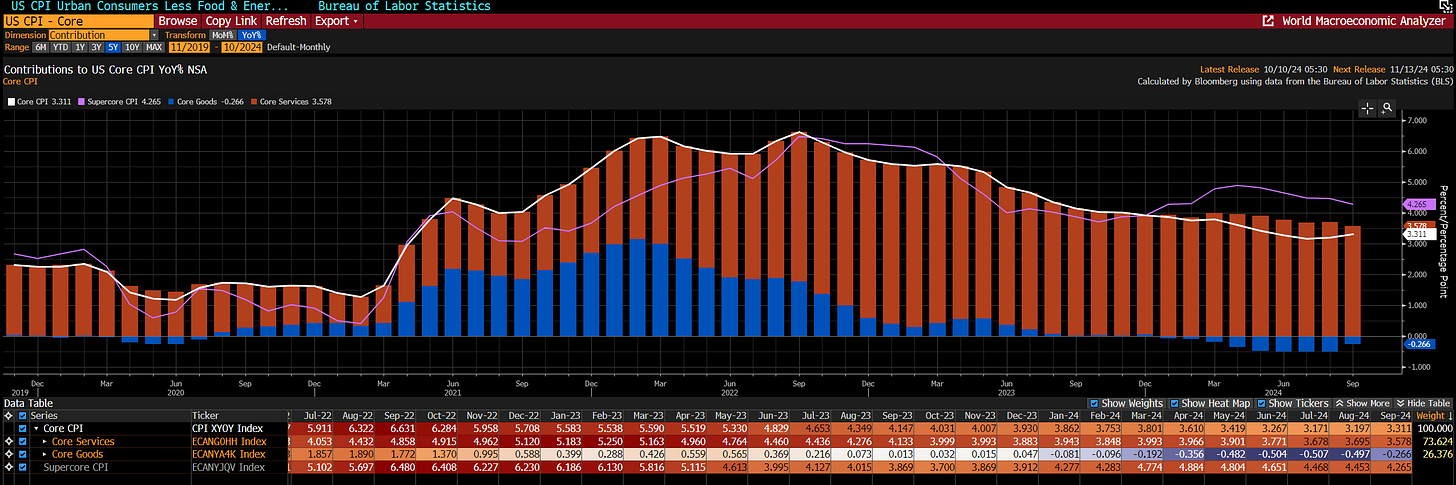

While there is most certainly feedback between goods and services, we need to remember that services spending decelerated in the most recent print in spite of the NFP print coming in way above expectations:

The other point to remember is that the services line item is still incredibly elevated above the 2% goal. It is sitting at 4.74% even though it is decelerating at a reasonably fast pace.

You will notice that the recent tick-up in goods prices in US CPI has overlapped with the rally in Chinese equities and the rise in China’s inflation rate.

This will be an important relationship to watch: Chinese CPI (blue) and US Goods CPI (white)

However, we know Mexico has become the largest trade partner with the United States.

Therefore, watching Mexico’s inflation prints is likely to provide considerable insight into how much goods prices can move up from here. (white: Mexico CPI and blue is US Goods CPI)

All of these smaller moves continue to take place in the context of positive growth and accommodative financial conditions and this is true across the board.

When you have strong growth and accommodative financial conditions, the bond volatility or FX moves have less transmission into risk assets. This will eventually change (as this is always a mean reverting relationship) but the carry trade and risk on trade continue to have positive momentum.

The Bloomberg Carry Trade index continues to rally indicating this is not an isolated event focused on the United States.

The important thing to remember in this structural regime is that any geopolitical volatility only strengthens the United States’ position. The United States has and continues to onshore production at the same time that the dollar’s reserve currency status remains preeminent. The collocation of these factors coupled with fiscal spending and the Fed’s rate cuts is WHY risk assets continue to rally.

Where are we going this week?

All of this brings us to the week ahead where the economic calendar is fairly thine again:

As we move into the election, equities are likely to push higher, especially as bonds are beginning to make a bottom in bonds.

I am still holding the ES long, Z5 long and ZN long noted in these articles:

If equities bid aggressively into the election, it might be prudent to derisk marginally or take some gains off the table/tighten your stops. This will especially be true if we can’t bull steepen further as the driver of the equity bid.

In the Goldilocks regime with bull steepening in the curve, valuation expansion is an incredibly high probability. While we have a lot more data the following week, everything in the interest rate complex is getting set up for FOMC on the 7th.

We have already moved between the extremes of a 50bps front loading that caused duration to sell off and then a rise in inflation swaps and repricing of the forward curve. The Fed is likely to cut 25bps at the November meeting and provide more certainty about the limited upside for rates. As a result, Z5 is likely to bid in order to price less downside below the previous CPI print level where we originally made a short-term low.

Z5 short term low:

More on these capital flows tomorrow. For now, stay in the shadows

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Solid!