Asset Class Report: Bonds

Bond Breakdown

We will be focusing on bonds in this asset-class report due to the current pricing on the forward curve, the shape of the yield curve, and the impact that rates are having on tech stocks.

For previous asset class reports focusing on bonds, see the following links:

Big Picture:

Bonds continue to be skewed to the upside based on the collocation of evidence from economic data, the Federal Reserve, the Treasury, and market signals.

Economic Data:

We continue to see resilience in growth data and deceleration in inflation. The implication of this is that Goldilocks is the driver of positive returns in bonds as opposed to a recessionary impulse. This distinction is important because it speaks to signals of the rally.

FED:

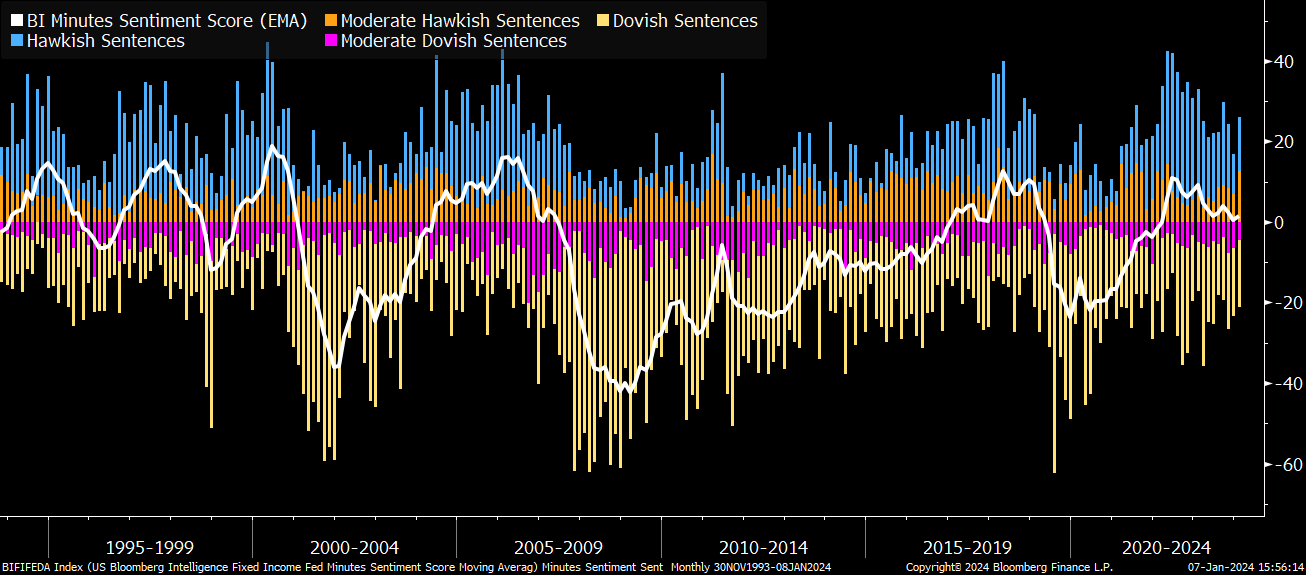

The Fed continues to hold a stance where they believe peak rates are behind us and the path forward is about the SPEED of rate cuts. FOMC minutes have confirmed this:

The FOMC minutes are not increasing the hawkishness of their rhetoric:

The market continues to price a reasonable probability of a hike in March. CPI this week and then the FOMC meeting at the end of January are likely to provide greater certainty on this market pricing. It is unlikely that the FED cuts in March but it is possible. If the FED does begin to indicate that the pricing of a March cut is reasonably correct, the market is likely to price even more aggressive cuts.

The Treasury:

The Treasury’s stance is currently neutral in terms of supply and demand. In August of 2023, they announced additional duration issuance, and then in October they shifted their stance to less than the market was expecting. As we move into QRA announcements, it is possible that they increase duration issuance again depending on how inflation prints come out. Hedging into Treasury announcements is prudent.

Market Signals:

Continue to watch sector rotations such as XLB/XLU and oil prices in connection with breakevens here:

Attribution Analysis:

The attribution analysis and quantifying the SPEED at which the market is pricing inflation and cuts is essential for trading bonds in Q1.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.