Asset Class Report: Bonds / Equities / Trade Ideas

Support in bonds and regime analysis

There is a key macro tension with interest rates right now that is causing mean reversion on a cyclical basis. Interest rates are directly impacting the environment for FX, equities, and metals. The signals and framework provided below will be critical for trading ALL assets over the next 4 weeks.

Big Picture:

We need to remember where we are on a cyclical basis with rates on BOTH the long end and short end.

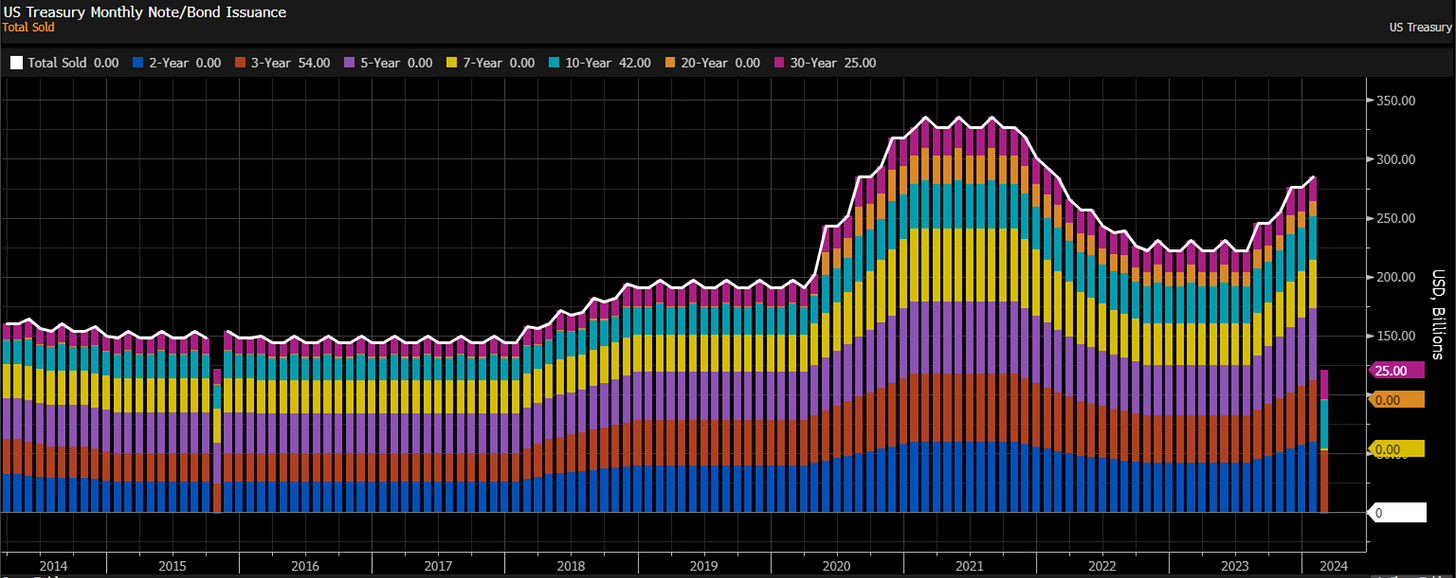

First, during 2023, it was supply that caused the long end to rally from August to October. Demand remains relatively constant but the Treasury increased issuance.

It was specifically duration issuance that caused rates to rise. This rise in rates occurred while term premia was negative and the LEVEL of inflation was still too high for the Fed to cut.

It is unlikely that we move to new highs in long-end rates this year since issuance remains neutral and inflation is decelerating. Short-end rates barely made new highs during the same time.

Key Level: While the CPI print caused the forward curve to reprice and rates to move up marginally, we are likely to remain BELOW 4.50% in the 10 year:

The next move in rates and its connection to stocks:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.