Big Picture Inflation? CPI Tomorrow

One of the least understood subjects in the market

There is a lot of discussion about the CPI print tomorrow and it will be important. However, let’s zoom out a little and talk about the preconditions surrounding specific types of moves in inflation.

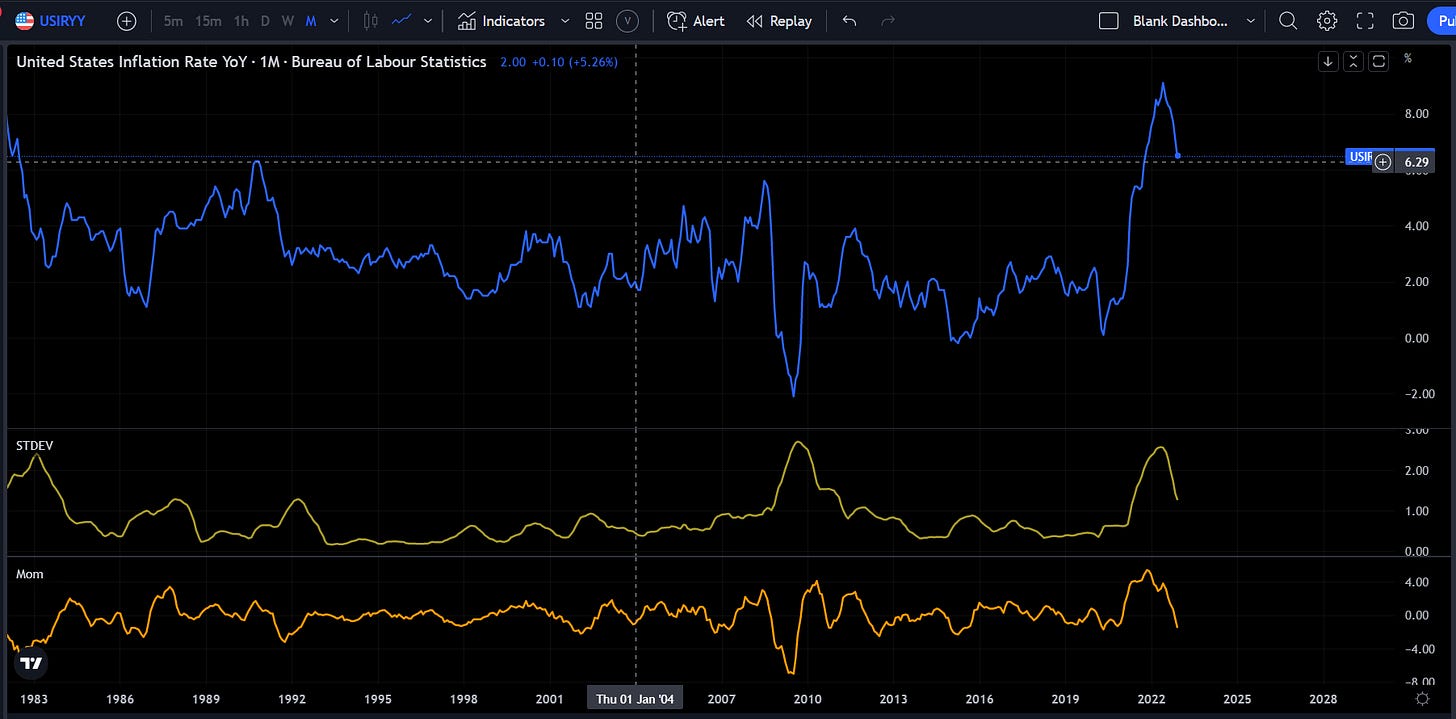

When we map any type of macro data point, we look at the level or degree of standard deviation and also the rate of change. Both of these metrics are used to map how much a data point has moved and the speed at which it’s moving.

Here is an example: the chart shows inflation, the standard deviation (stdev) and rate of change (mom).

At the danger of being reductionistic, standard deviation asks, How much? and rate of change asks, How Fast?

If you can know how fast things are changing then you can get an idea of WHEN you could potentially arrive at a specific level or degree of standard deviation. The market is in a constant state of pricing BOTH level and speed of the economy.

This way of mapping data points is pretty standard in most economic/financial market models. I run models a little more complicated than this but it’s across all economic data. Things get more complicated when you begin to map all the inputs and outputs of data points as they relate to each other. You can only do this well if you understand the mechanics of the economic system incredibly well, a skill set that is ironically fairly rare in the financial industry.

So, let’s talk about inflation……

Right now, inflation is at an elevated level but the direction is skewed to the downside. The question is, what are the inputs and preconditions that exist which would cause persistence in this move to the downside OR even cause inflation to make new highs?

Fundamentally, inflation occurs due to an imbalance between the amount of goods and money in the system. These things get out of wack when shocks occur to either the stock of goods or the stock of money in the system.

These shocks can occur from numerous variables such as invasions, lockdowns, defaults, natural disasters, and the list goes on. The KEY is measuring the degree of sensitivity the current stock of money and goods could potentially have to various events. This is what I spend a lot of my day doing. I ask questions like if x event happens, how would that impact the current setup in these parts of the economy? Big impact? Small impact? How long would it last?

We could talk about historical inflationary periods forever so let’s just stick to the current situation. The inflation shock we have experienced has occurred due to a shock in BOTH the supply of goods/services and the supply of money.

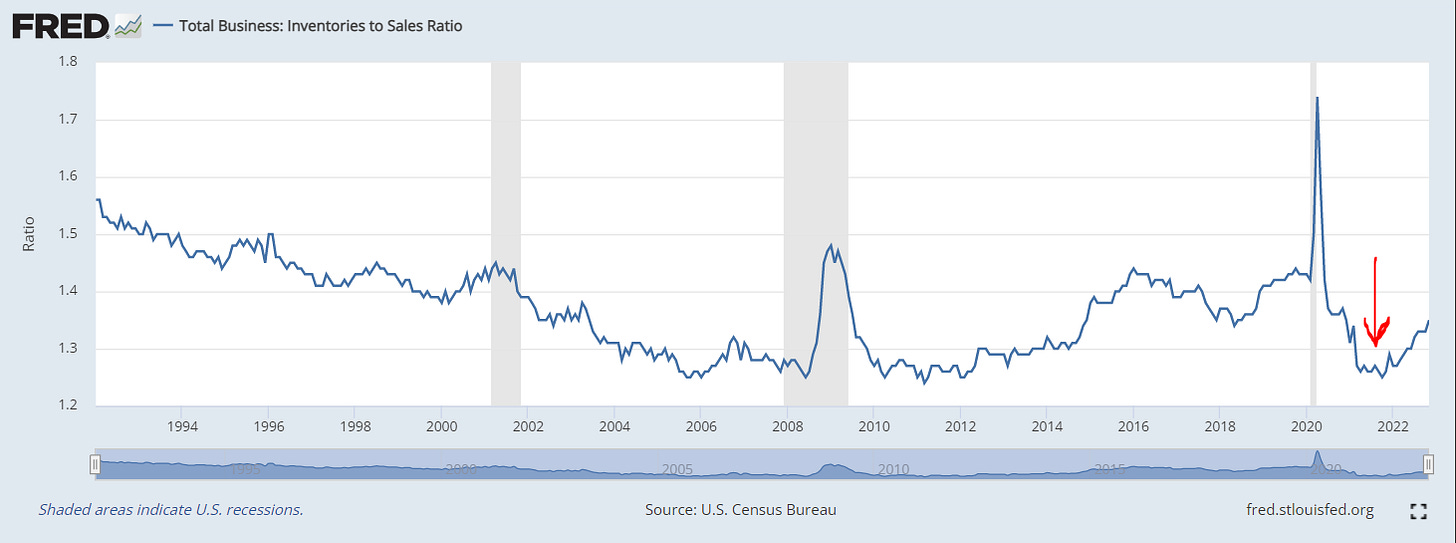

When the economy was shut down, inventories (i.e the current stock of goods) dropped dramatically. This occurred at the same time the government sent stimulus checks directly to consumers. goods down + money up = inflation up.

This initial shock was further exasperated by the invasion which put upward pressure on energy and food prices.

Now, we are seeing the reversal of all these dynamics as the system normalizes. We are currently seeing inventory-to-sales number rise which is increasing the number of available goods in the economy.

The demand for real goods is actually dropping enough for production to begin decelerating significantly. It is almost in outright contraction territory.

So what we know is the current stock of goods is increasing on a marginal basis. We are even that companies are actually taking production offline and investing less because of the decrease in demand.

What about the money side?

So we know the goods side is putting less upward pressure on inflation. The question is money? In this setup, consumers can get money from three places: their income, their savings, or by taking out liabilities.

Consumer’s income isn’t receiving further support and is actually decelerating:

Consumers' savings have been used to keep up with the higher prices from inflation:

And we know this situation has put pressure on consumer sentiment:

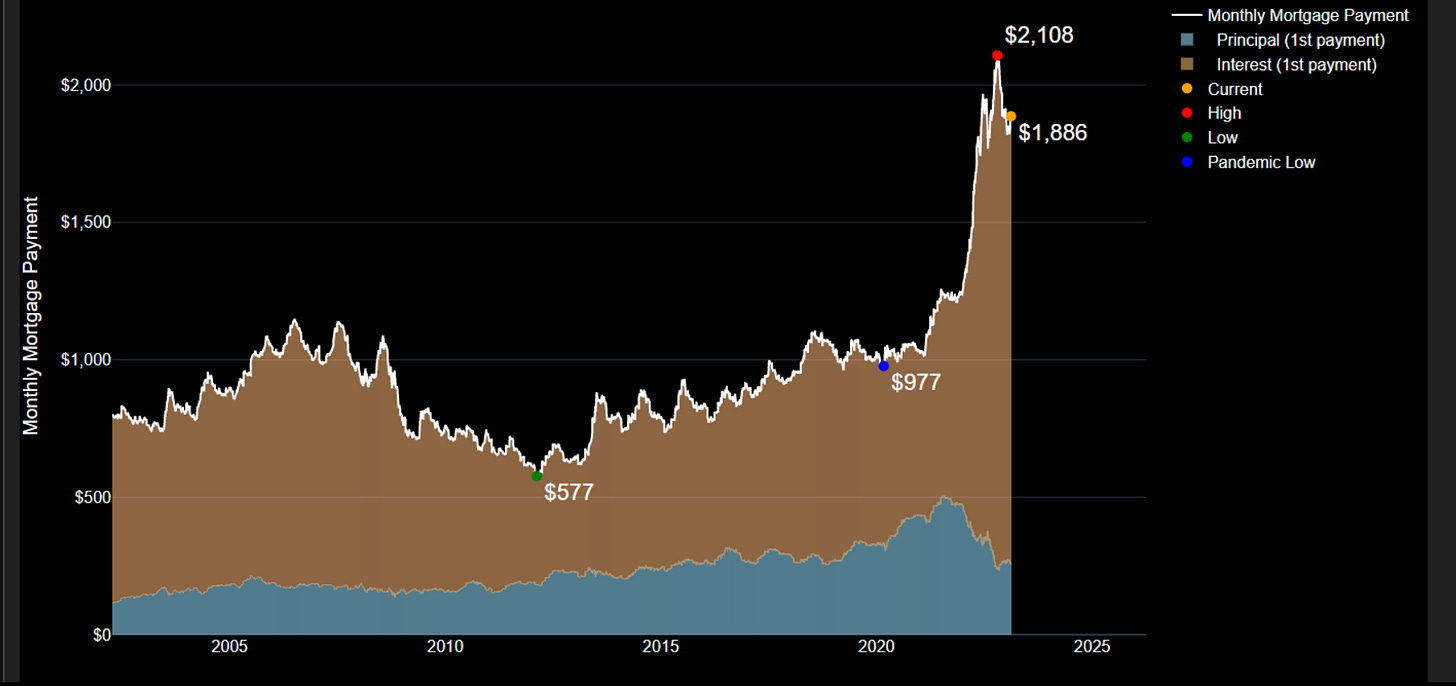

The final place consumers could get money to increase spending and thereby the amount of money chasing goods in the system is via taking out loans and increasing their liabilities. The main things consumers purchase with loans are houses and cars. The recent rate hikes by the FED have put a lot of pressure on people’s ability to finance these goods.

In sum, the setup is that the existing stock of goods is increasing and the existing stock of money is decreasing. These conditions inform our view about the persistence of inflation moving down. At this current time, the preconditions and inputs into inflation are saying that inflation is going to continue moving down. Now, this doesn’t take into account any additional shocks in the future. Inflationary or deflationary shocks could occur in the future and cause a sharp drop or spike in inflation. Therefore, we have to monitor the risks of these types of shocks moving forward. But that is the entire business of risk management. Setting up strategies and managing risks as they occur.

Final Point on CPI tomorrow:

Really exceptional breakdown of how CPI is likely to play out tomorrow relative to expectations.

If CPI comes in below expectations, stocks and bonds are likely to rally. I know I mentioned that I’m short equities in the previous publication. I’m hedging the CPI risk to the upside via short-term calls. This is how it usually goes, you take a core position and if there is a high probability of short-term moves against your position, you just hedge them out.

We shall see!

Thanks for reading!

I may be too dumb to understand this but shouldn't the shutdown of economy result in an increase in inventories / sales ratio not decrease? If goods are not sold an remain in inventory, then inventory goes up, no? I'm pretty sure I miss something but I don't know what