Brainstorm: Bond Price Action

Observations of the day

Hey everyone,

I am currently working on an article covering how I am reevaluating the risk-reward on the Yen for paid subscribers. The recent BoJ news obviously changes things marginally but not fundamentally in my opinion. Be on the lookout for that article.

In this article, I will be covering several important market observations:

First on bonds:

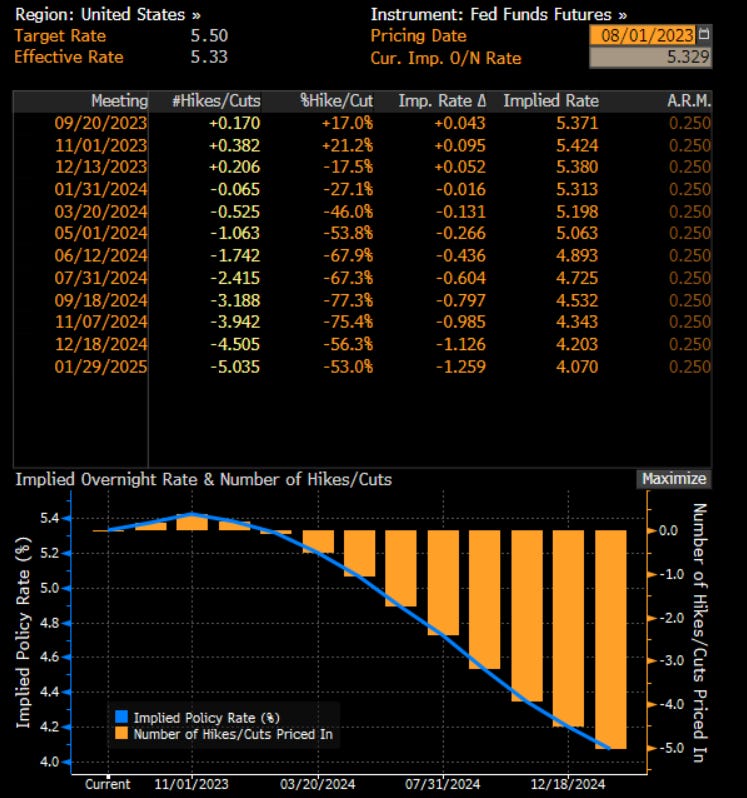

The key thing today on bonds is that September and November Fed fund futures expectations remained largely unchanged. This is why the 2 year moved less than the 30 year.

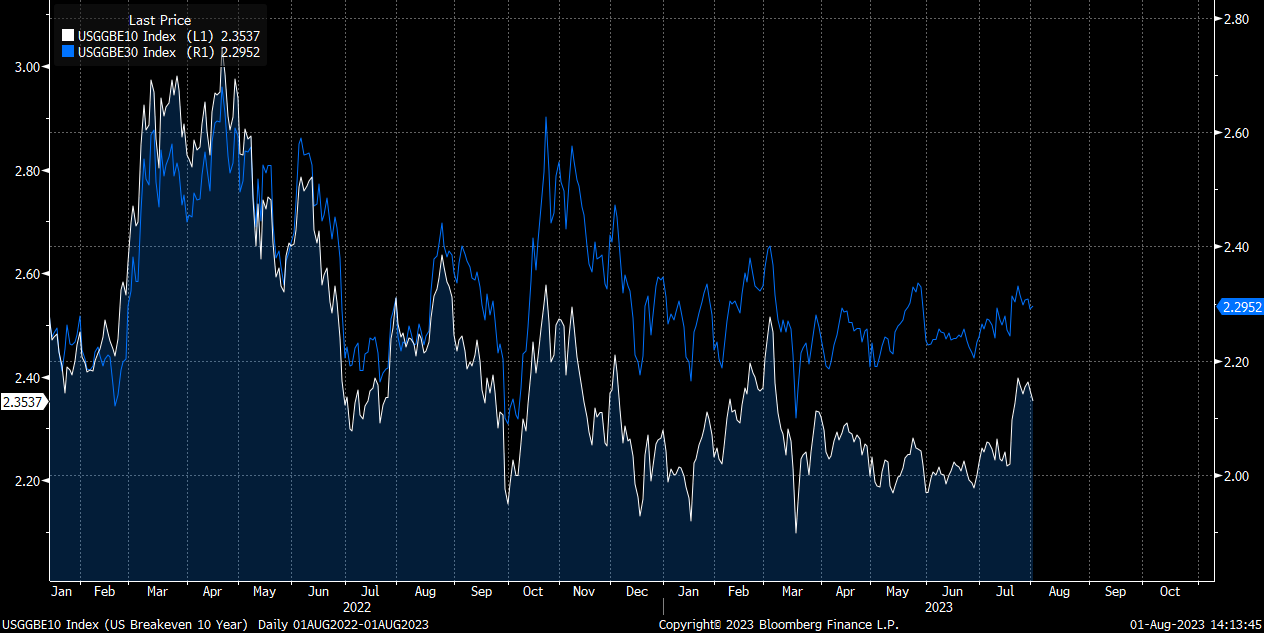

However, 10-year and 30-year breakevens have been rising marginally:

10-year and 30-year OIS swaps rose marginally:

What does all of this mean? The implication is that the market is repricing the longer end of the curve as opposed to the short end.

A lot of people are focusing on the ISM data and think bonds should be bidding. Here is the deal, if bonds are falling on a decelerating ISM print, that tells me the inflationary impulse in markets remains stronger than any negative growth prints.

Now this could change at any time which is why it’s important to watch how BOTH growth and inflation prints get priced into the market.

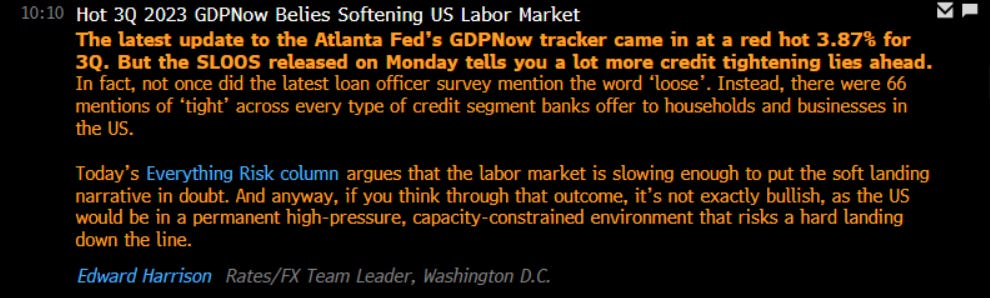

The final thing I will draw attention to is the SLOOS data and the preconditions it sets:

When SLOOS indicate this level of tightness and real rates are this high, there is likely to be some type of growth scare eventually. However, with GDP at 3.87%, it might take a little time. Also, macro always moves REALLY REALLY slow. If you’re running a global macro book, you better match your timeframe with the environment.

Timing is everything!

Thanks for reading!

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

With 10-y yields approaching 4.2%, would y97 start accumulating a long position here?

The 20-y yields are going nuts. Looks like somebody is getting killed? 🤔