Brainstorm: Inflation

What is autocorrelation?

Hey everyone,

I am traveling this week, so I'm actually writing this in the airport while I'm waiting for my flight. I thought this would be a good opportunity to touch on some bigger-picture ideas.

Inflation:

We have the inflation print Wednesday, so let's touch on some important concepts pertaining to inflation.

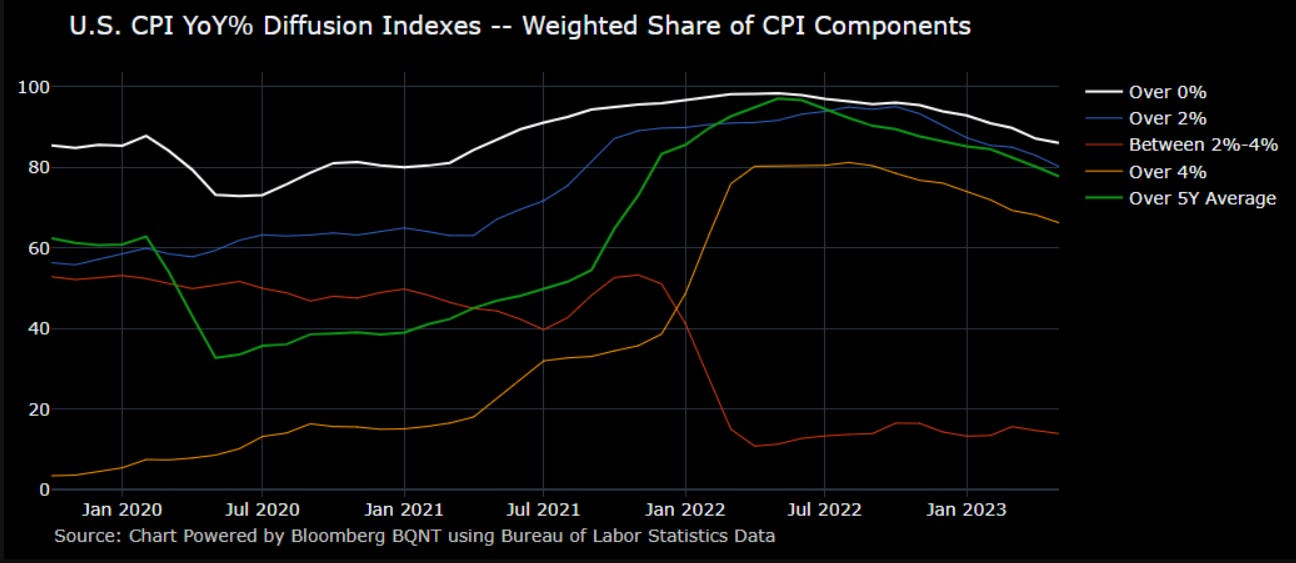

The autocorrelation of inflation components is incredibly important to monitor. What is autocorrelation? It is simply asking, how many line items of CPI are accelerating/decelerating?

For example, here are the major components of CPI:

We can break down each of these components into their subcomponents. Here is the service component:

When we look at each line items of CPI, we can begin to see HOW MANY are accelerating vs decelerating:

Most people will only watch the headline and core, which is helpful, but if you watch the underlying autocorrelation of the elements, it can begin to provide a clearer picture of CPI.

Part of the reason why "autocorrelation" is important to know is because of how inflation is transmitted through the economy. Inflation is never evenly distributed through the economy. However, once a lot of line items in CPI begin to accelerate, they begin to create a reflexive feedback loop that feeds on itself. For example, if my gas and food bill goes up, I go ask my boss for a raise. Once he increases my wages, he increases the price of his goods and services. Then the people buying his stuff go to their boss and ask for a raise. This begins to make its way through each sector and line item of the economy. Sometimes the inflation is only in a single sector because of a supply and demand imbalance, but when it begins to impact all sectors, it can begin to feed on itself.

This idea begins to frame the inflation print that will happen on Wednesday. We know that headline inflation has decelerated considerably due to the energy component. However, this is only one part of the economy. Commodities don't account for the entire distribution of prices in the economy. Core inflation is expected to fall to 5%:

The FED funds rate is at 5.25%, and the market is expecting Powell to hike another 25bps. This would put FED funds above core CPI. However, what has the FED been looking at? The labor market!

Last week we had the ADP number come in WAY above expectations:

Regardless if the FED should or shouldn't hike here, it is a significant probability that they hike again even if we end the week with core CPI below the FED funds rate. Remember, Powell has continuously used rhetoric about erring on the side of overtightening versus undertightening.

Big picture, I think we are in the process of rates making their final peak, but I still don't want to have a ton of leveraged long exposure to bonds here. Market timing is everything.

Always be intentional about the timing of your actions. Bonds will rally again one day, that’s not the question. The question is WHEN and from WHAT level.

Thanks for reading!