Brainstorms: FOMC Minutes

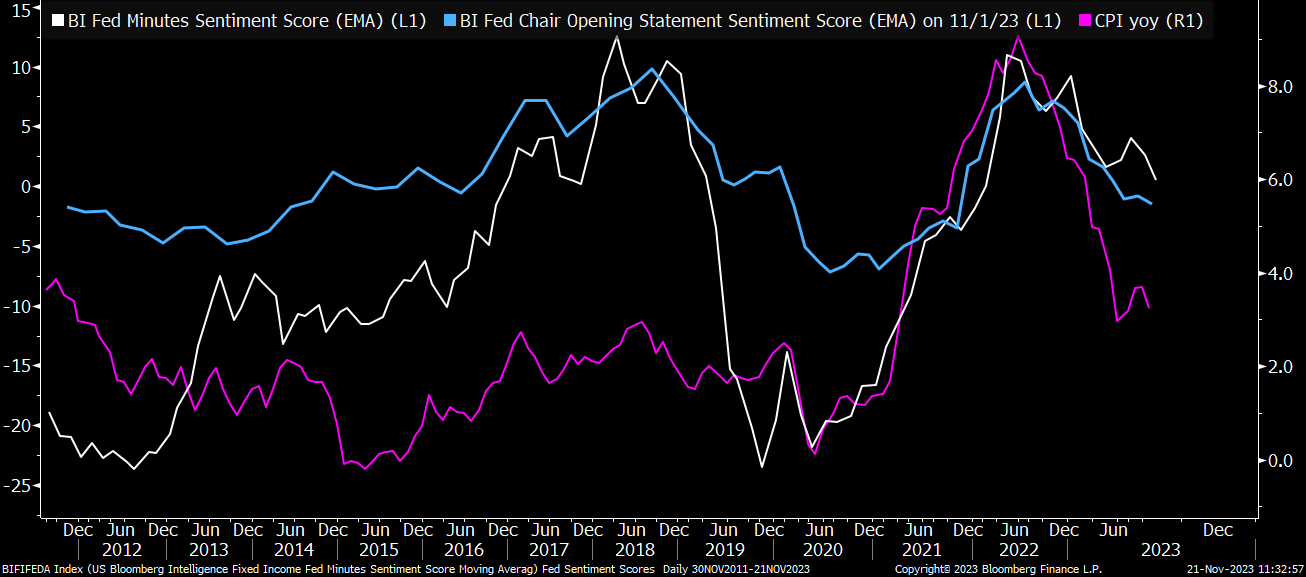

Translation of FED Rhetoric

The FOMC minutes came out today providing further clarity into the logic and mindset of the FED.

While the speakers are providing their political rhetoric, the real thing they are saying is that it’s a toss-up for inflation risks and recession risks right now.

During 2022 the rhetoric of the FED was that the “inflation risks were to the upside.” This has shifted to a toss-up between both inflation risks and growth risks.

Where are we now? The Fed’s rhetoric is marginally shifting as the economic data is shifting.

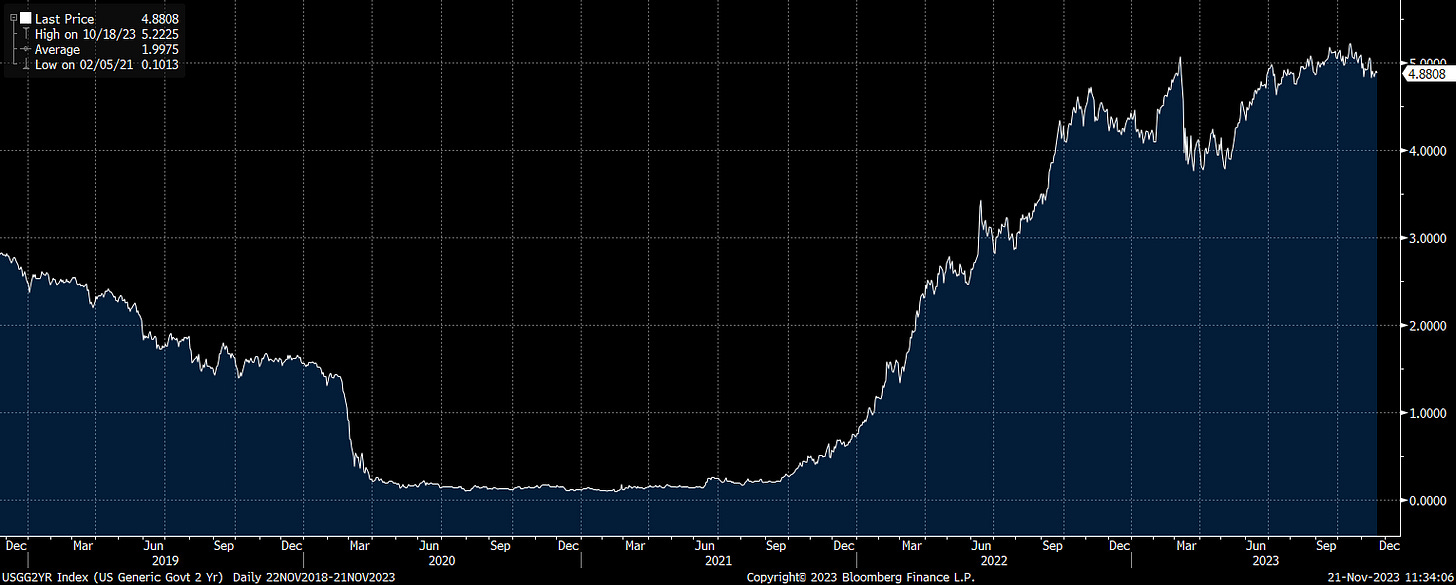

How does this impact us? It means interest rates on the short end are likely to be range-bound until we transition into the next inflection point. Timing this inflection point will be critical!

The key qualification here is that a pause by the FED doesn’t = bullish bonds. The risk might be limited but the reward might not justify a long bond trade. The question is, how much will growth decelerate and thereby increase the reward for bonds? If it’s small and inflation begins to reaccelerate in 2024, the FED has a big problem on its hands.

If inflation reaccelerates, get ready for another drawdown in 60/40 as bonds and stocks sell off together like in 2022. The risk parity ETF continues to underperform considerably.

If we move into another reacceleration of inflation, you would need to have some type of active management or allocation to a CTA to offset a drawdown in a 60/40 portfolio. (not investment advice!)

As I mentioned yesterday, it’s about having a plan as opposed to knowing the future.