Brainstorms: Genius

Markets, thinking and clarity

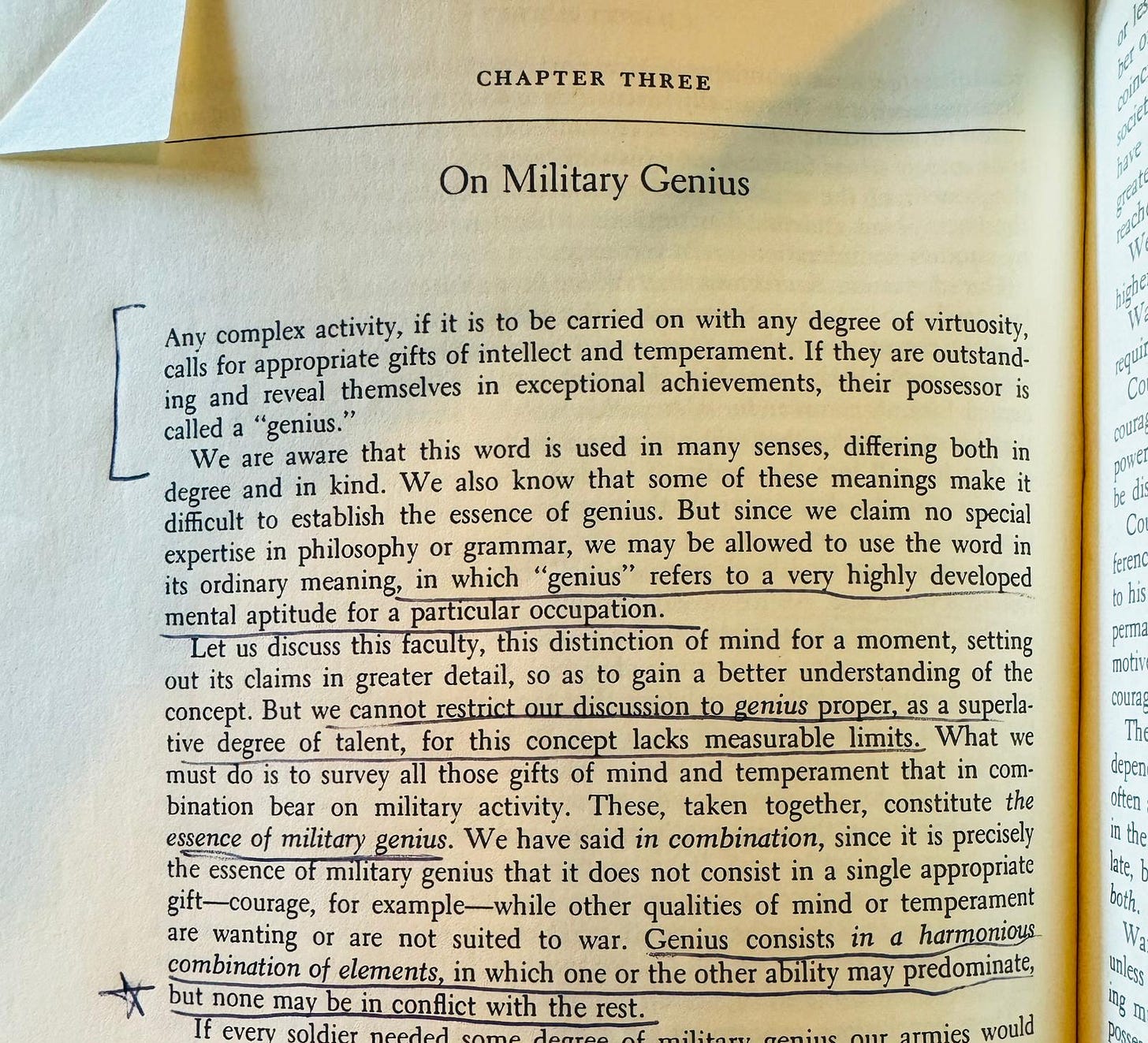

“Genius consists in a harmonious combination of elements, in which one or the other ability may predominate, but none may conflict with the rest”

On War by Carl von Clausewitz

Synthesis:

The market (and life) forces you to learn HOW to synthesize information into action in such a way that the information doesn’t contradict itself. It is the combination of elements.

While many people today have barely experienced any violence or real-life risk, Carl von Clausewitz was a practitioner who knew BOTH theory and practice in war. The educational system he was a product of (and helped improve) was one of institutionalizing excellence in such a way that there was a perfect merger between theory and practice.

But how would this type of synthesis work in financial markets? There are two things that set the foundation for this type of skill:

First, a continual intake of the information, theories, and data provided by academics that is matched with a consistent exposure to risk-taking in financial markets (see the first section of Advances in Financial Machine Learning: Link). If you have ever been in a PM role or analyst role you will recognize how the way you need to think is marginally different. Many people will go to either the research side or the trading side of financial markets to provide value. It is a rare breed that can do both. Why? Because a PM is ALWAYS thinking about their risk that it can be difficult to allow your brain the space to be creative. Inversely, the analyst is always trying to come up with ideas but is sometimes disconnected from the intuition you develop as a risk taker. Similar to any field, participants will try to pit these roles against each other as if one is “better.” When you begin to play status games like this, it will be the only lens by which you view the world and it will ultimately cloud your ability to think clearly.

Second, while the world we live in is chaotic and complex, there is a place for quantifying flows of capital via the accounting mechanism we use in both economic data and financial market flows. Fundamentally, there are two sections of the system: the economic side and the financial market side. These parts always net out in their capital flows because all money that is anywhere comes from somewhere. Any action in financial markets is a relative bet. If I am purchasing SPY, I am shorting dollars and going long SPY. If I am holding a money market fund or cash then I am functionally shorting every asset and being long cash. This has implications for purchasing power because if I hold cash forever, it will inevitably lose purchasing power against financial assets and goods/services in the economy (assuming deflation doesn’t occur and assets go up over the long term). Under the presupposition of this accounting mechanism, we are always trying to get an idea of where we are in BOTH parts of the system through holistically accounting for each variable and identifying its contribution and causal impact on the whole. Understanding how to synthesize these variables is what gives you clarity for making decisions in financial markets.

“Clear thinker” is a better compliment than smart

-Naval

The beautiful thing about the world we live in today is that it functions very differently than it did historically:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

In the past, even if you were a clear thinker, you needed a preexisting structure for leveraging your decisions. In today’s world, everyone has the infrastructure if they have an internet connection. On top of this, education is functionally free in today’s world with online resources. This is why I always share this quote:

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

- Good Will Hunting

In my experience, it is the people around you or lack of self-discipline that are the greatest hindrances. I remember when I first decided I was going to learn about financial markets, there were shiny sales jobs or other ways to hustle and work more hours in order to make a couple extra thousand bucks a month. I said no to all of these and spent all my time learning. I knew the shiny objects were short term and sitting in a room alone to read and think would be more valuable in the long term.

So far, it has paid out