Brainstorms: Have a playbook and be exceptional

Are you asking the right questions?

Let’s take a step back for a moment...

I know that I've shared a lot of technical things on this Substack over the past month, but in reality, we all operate with the same principles. The principles I use in trading the bond market are the same principles a small business owner uses to run their bagel shop. The language is different, but the ideas are the same. Everyone in finance tries to overcomplicate all this stuff, but in practice, it’s all pretty straightforward.

Let’s talk about a very simple concept of “playbooks” for various environments. Anytime you go to a major hedge fund or even a corporation, they usually have different “playbooks” for different market environments. All this means is that you have redundancy plans of action depending on the environment you are in. You always want to match your action with the environment you are in.

This is all straightforward. If you were invited to a BBQ, you would wear your casual clothes. If you were invited to a corporate office meeting, it would be business casual. If you were invited to a gala, it would be formal attire. Depending on the people you interact with, you intuitively know that you need to moderate your communications and the things you say.

The same is true in the market with a portfolio. You might ask, how do I know my environment? Well, it's very simple. At any time, you need to know what is happening with three things: growth, inflation, and liquidity.

Here is a great chart by Prometheus Research on these different regimes:

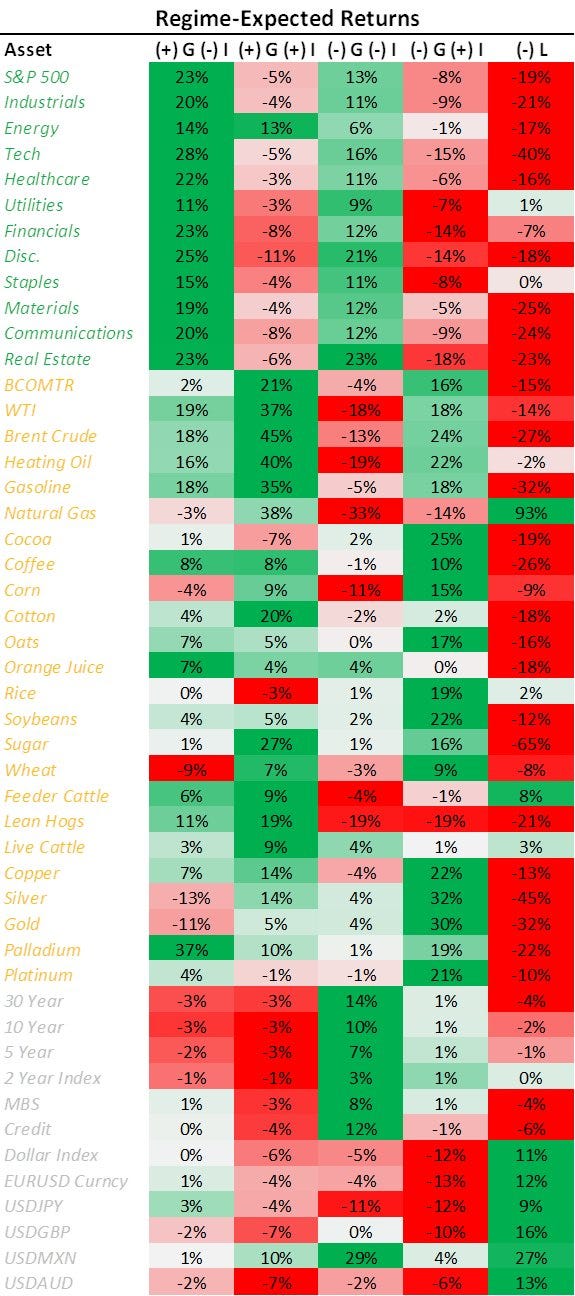

Here are the historical returns of assets in these regimes:

Now you might say, "Hey man, I just have a 401k and I really don’t understand any of this stuff, what should I do?"

First, I don’t give financial advice. Everyone should strategize with their financial advisor about these regimes and how to allocate.

Second, all you need to do is be able to ask the right questions of the right people. If you have a good financial advisor, they have a wealth of experience managing risk through all of these regimes.

The danger of not knowing a lot about the market (or any field for that matter) is one of two extremes:

Don’t think about it, let someone else execute for you without question, and just hope for the best.

Try to do it all yourself even though you have minimal experience.

In the first extreme, what ends up happening is an individual entrusts themselves to a financial advisor who doesn't have much competence. The individual just thinks, "Well, I don’t know much about it so I would rather not deal with the stress. I will just give it to this guy who seems to know more than me and hope for the best." This can result in massive drawdowns or underperformance during market cycles. The consequences can be not being able to retire on schedule OR even worse, losing large portions of money. I can’t tell you how many times I have seen the negative consequences of this.

In the second extreme, an individual tries to actively manage their portfolio through the market cycle even though they have no expertise. They might have a little overconfidence in themselves or excessive pessimism about the financial industry. This can result in losing A LOT of money.

What is the answer then?

Well, to start, I actually wrote an entire article on how to think about wealth management. It was my first article because at the end of the day, I have a lot of respect for people who just want to work hard and provide for the important people in their lives:

There are a couple of additional things you could think about:

Ask a lot of questions before entrusting your wealth to someone. In many ways, wealth is irreplaceable because it represents your hard work and time. We don’t take money to the grave, but our wealth is directly connected to our time, which is one of our most valuable commodities. If you want to watch the best interview in the world on this topic, check out this video. It was instrumental in my learning journey:

There's nothing wrong with managing your own capital; just be smart about it. I know a lot of exceptional traders who actually allocate capital to advisors or hedge funds. There's no rule that says you need to do it all yourself. The good thing about managing wealth is that if you can do it with $10,000, then you can probably do it with a lot more. If you can’t successfully manage a small portion of money, then it's probably wise to entrust it to someone who can.

Regardless of your involvement in financial markets, have a playbook for the market cycle. You can go over this individually if you're managing your own money or with a financial advisor. Preparation now saves you from a lot of pain later.

Be exceptional in your domain. There's no rule that says the only way to make money is in markets. Just look at the billionaires index. If another opportunity came along, I wouldn't have a problem leaving financial markets to build and run a business. I would simply allocate my capital to a number of funds and go make a lot of money in a different domain. It might be a different domain, but it's the same principles. I truly believe that I can succeed in any domain if I put my mind to it.

Conclusion:

I will say it over and over:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

You could be running a small business, the CEO of a major corporation, or a PM at a hedge fund. This principle applies across all domains. This means you need to curate exceptional conduits of information and an extraordinary network of smart individuals.

If you had a playbook for every market cycle, 3-4 exceptional conduits of information, and a network of people smarter than you, the amount of success you would have in a year would shock you!

Be exceptional in your domain!

Thanks for reading!