Brainstorms: Nonlinear Learning

We are going all over the place today

Learning is never linear because our knowledge and acquisition of knowledge are imperfect. I start with this because there will be a number of very important things I will touch on in this article, but we are going all over the place.

The Lost Decade:

2022 marked the beginning of a regime shift, but the world has not fully priced in this risk yet.

Let me explain something to you: the entire financial industry is built on the expectation that “over the long run” you will get a 9-12% return on your money by investing in a combination of stocks, bonds, and maybe real estate.

This idea is based on the past 40-year trend of stocks and bonds. Let me ask you a very simple question, what happens to your plans for the future if your 401k is flat or negative in real terms for the next 5-7 years? How does that change your plans? How does that change consumption, retirement, and the workforce?

Most people will ignore this risk because they don’t like feeling uncomfortable.

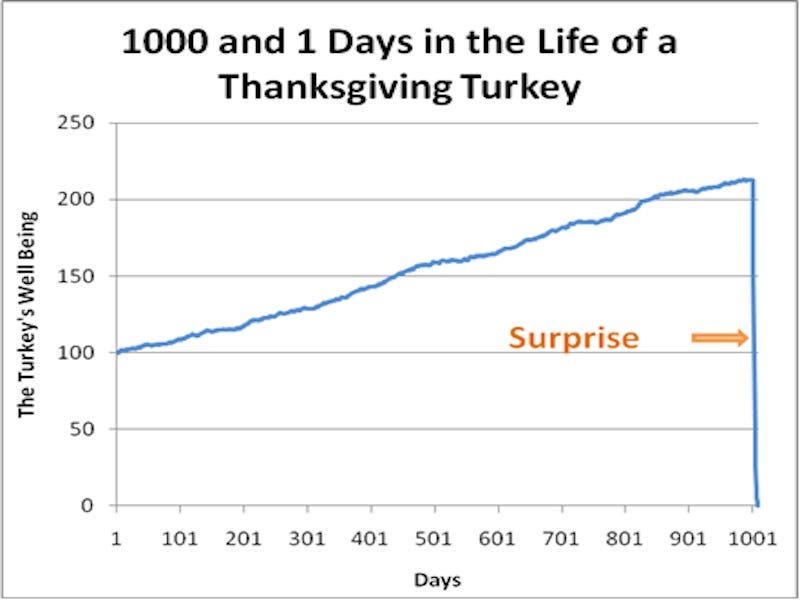

A very simple idea you study when building strategies is the “Don't be a turkey” investment. Basically, think about the life of a turkey just like an investment. It keeps going up and up. The turkey gets fatter and fatter. Growth is surprisingly on the upside, earnings are coming out positive, margins are expanding! But then, in a single day, your entire investment goes to 0!

Most people find some semblance of safety looking at the past trend, but when you are a risk taker, you are always thinking, “Am I being a turkey right now?”

Do you begin to see how this relates to the 60/40 portfolio and the regime shift we are in? I am not saying that I expect 60/40 to go to zero, but I am saying it is very probable that the typical “9-12% annual returns” are off the table for the next 5-7 years. Could I be wrong? Sure. But that doesn't matter. The impact of such an event is so large that you can’t afford to be wrong in this scenario.

Don’t forget, it wasn’t long ago that stocks were in a range for more than a decade:

Strategies:

"When you have a problem such as passive instruments generating flat to negative returns for an extended period of time, the solution is creating an alternative strategy to accomplish your goal. Optimally, you want a strategy that would do well in MULTIPLE scenarios that occur in the future, not only the bearish one I am drawing attention to.

This is a key thing for strategy development and risk management: You don’t ever want your success dependent on a single outcome. This is where most bears lose their way. They talk about the risks of the financial system and say you should just sit in cash or take a wild bet. In reality, a truly exceptional risk manager or trader will approach any situation with a very level head and strive to thrive in any environment.

With this being said, I am going to go over a couple of ideas that will refine your understanding of this realm. If you don’t work in financial markets, all you need to do is change the language and implement the same principles of risk management into your domain. Like I say over and over, this is how life works:

Regimes:

Any time you approach a domain, you need to aggregate all the causal mechanics of the system and systematize them into regimes for making decisions. I shared this paper which shows a basic regime model: https://twitter.com/Globalflows/status/1655744053265285120. As regimes change, you need to moderate your decision-making.

This isn’t rocket science. Just like you moderate your behavior depending on the people you are with or your work environment, you need to moderate your decision-making during different market regimes.

Signals:

Signals sometimes overlap with regimes but the main idea is building models that provide you signals about HOW to act in various regimes. In order to determine regimes correctly, you will use some type of signal though. For example, the two most basic tools in markets are Bollinger bands and moving averages.

Key qualifications for signals and regimes: these do not mean you should immediately make a trade. For example, let’s say your regime signal for a bear market is for the price to be under the 200-day moving average. If you immediately shorted, you would get squeezed out of your position many times.

When building systematic models, you basically spend the majority of your time coming up with sophisticated ways of generating signals.

Strategies:

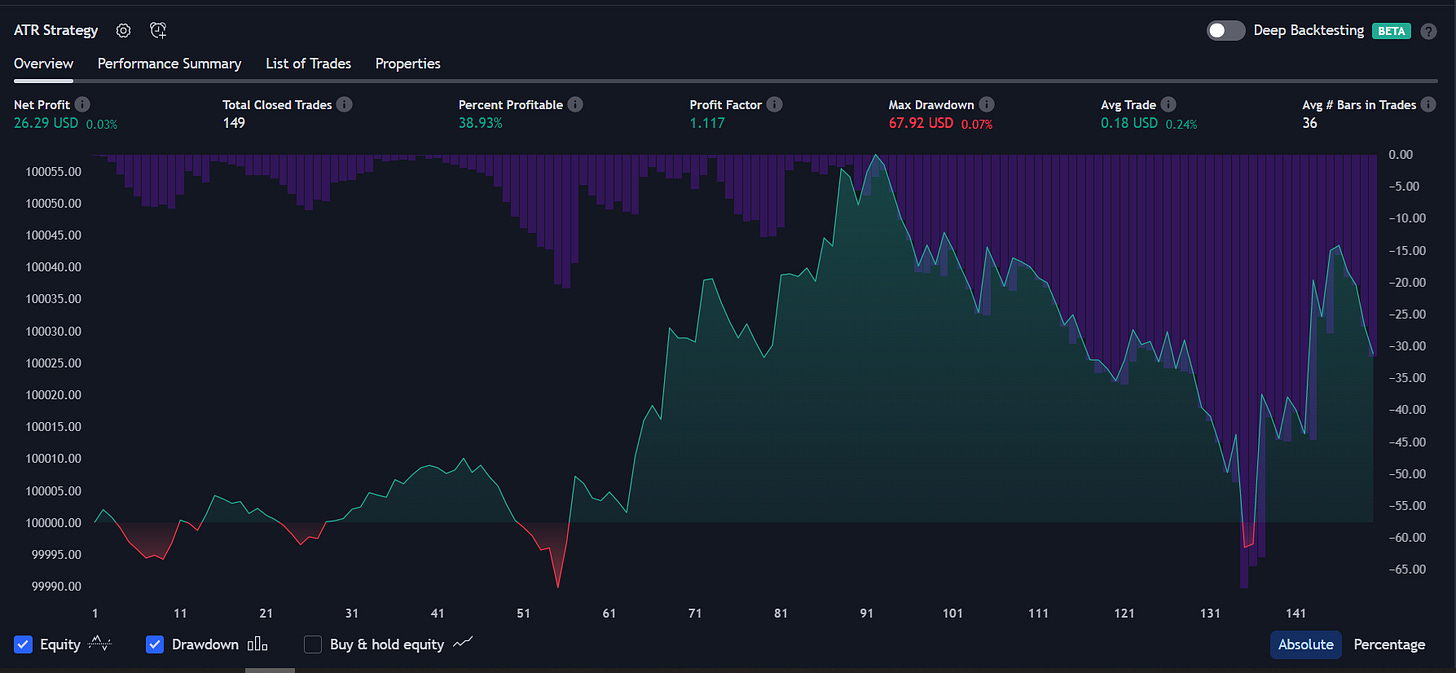

A strategy is where you take all the signals you have created, generate buy/sell signals, and then backtest them. Why do we do this? Because you want to test your idea against history in order to see when and why it works or doesn't work. This goes back to understanding how to align your actions with the continuity and discontinuity a situation has with history.

For example, you can go into Tradingview and see a basic ATR strategy:

Portfolio:

After you create a suite of strategies that can function in every market regime, you build a portfolio which is the aggregation of strategies resulting in a whole that is greater than the sum of the parts.

If you want to look at examples of how to build portfolios, I would point you to four sources: 1) Prometheus Research, Mythic’s Substack , Resolve Asset Management (see link in my first Substack) and the Wifeyalpha account on Twitter has done a great job showing this process.

The main idea to take away is that a strategy is the implementation of action that is tailored to a specific regime or environment. A portfolio is the aggregation of strategies resulting in the whole being greater than the sum of the parts.

All of this is very intuitive when you begin to think about it. We intuitively moderate our actions to different environments in every domain of life. We know that when we have success, it is never due to a single variable but a combination of actions.

I share this process with you because this is how to navigate the 60/40 “problem” mentioned above.

Do you begin to see why I have a research section of this Substack (see “About” Section)? Do you see why I have a macro report section? The research is meant to refine your regime identification and strategy development. It all CONNECTS! I share these educational points because I am getting a lot of DMs asking how to think about this. I am sharing a very VERY simplified version of this.

Here is the deal, most people are only going to talk about one aspect of this process. They will talk about their single signal, a single book, or a single research paper, instead of creating a businesslike process where you continually innovate, systematize, and run strategies that extract returns from the market.

Where are we right now?

Where are we in terms of the macro regime right now?

Several things:

First, the EURUSD trade continues to pay. I wrote an article on this: link

Second, it is my view that the probability of recession is increasing exponentially from here. Prometheus Research has done a great job of showing this in their most recent macro report.

"What are the implications of this? It means that I will be looking for longs in bonds and shorts in equities. However, you have to know how to analyze the positioning and risk-reward of these (see this article). A lot of the long bond positioning is getting shaken out since FOMC because people got bullish too early. I have brought attention to this in many MANY tweets. The duration positioning I drew attention to in these tweets had a high probability of getting shaken out before we move into recession:

Third, Eurozone growth is currently surprising to the downside. The Chinese reopening narrative was clearly crushed yesterday with the data prints that caused the dollar to rally against the Yuan.

The implication of these data points is that Europe, China and the US are heading toward slower growth.

I truly believe we are in the last innings of equities maintaining their bear market rally. All my models indicate this and I am simply waiting for my strategies to execute the short. Last year everyone was panicking because their portfolio was down A LOT. This sentiment has eased into 2023. This sentiment will get shaken again as we move into the next leg of the bear market.

Here is the deal, you don’t need to know exactly how the future will play out to make the right decision now. Very simple, cash! If you are like me and generate alpha, then you are looking for opportunities to benefit from the volatility. However, you need to have the foundation I laid out above. I have A TON of regime models, signals, and strategies running at all times. I am not going into this off-the-cuff or blind.

I don’t care if you have been through a bear market or not. You can do research on optimal decision-making during periods of higher variance. Like any market environment, if you are new, trading very small size is the solution. You can always hedge your ignorance and inexperience if you acknowledge it!

Conclusion:

I started this article by saying learning is never linear. I hope you can see that the thoughts I laid out in this article go all over the place but they all connect. I am here to show you my learning and trading process. I am trying to focus on the things that most people don’t talk about on Twitter. The goal is to build an exceptional foundation and a skillset that you can consistently monetize.

Final note, you will realize, I share everything pretty openly. There are some things that I can’t share because of IP constraints but for the most part, I will explain how things work. Most people won’t do this because it would mean they need to continue learning in the future. I try to maintain a high capacity for constant learning so if I’m losing edge because I’m sharing ideas with you then to me that just means I am not working hard enough. Again, there are always qualifications but I think you understand what I mean. Work harder!

I appreciate all of the pledges that have come through thus far. If you have benefited from my writing and want to pledge, you can do so in the Subscription section:

Thanks for reading!

*************None of the above is investment advice!!!!!

Thank you for the mention!

great take as always, thank you!