Capitulation: Equities and Rates

Forced selling

Today is a clear example of what forced unwind and blood in the streets look like.

We opened with the VIX above 60 on an intraday basis:

Both the standard deviation and speed of the move clearly indicate capitulation in the equity space:

Every equity index is in the red:

In addition to this, the yield curve uninverted on an intraday basis:

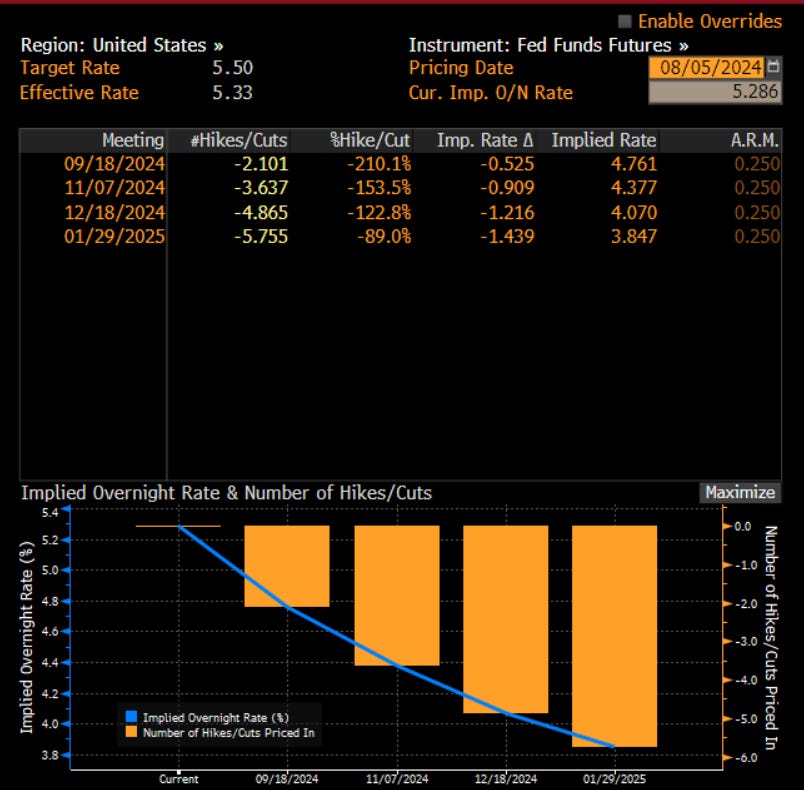

This was as the forward curve priced a 100% probability of a 50bps cut at the next FOMC meeting.

The question you should be asking is if this current move is reflective of the economic tensions in the economy or simply a positioning unwind? If this is simply a positioning unwind then we are likely to mean revert. If it is driven by the macro regime, then it can have persistence. This is exactly what I covered in the macro report and the views remain the same:

Stocks are already rallying off their lows as bonds turn red on the day. This is a key signal for what comes next. Please also review my comments in the chat function of the Substack:

As a reminder, there will be a price increase today!

Everyone who is currently a Paid Subscriber has access to all of the in-depth macro research and trades at the current price ($60/month or $720/year). This price will never change for you. In order to continue future innovation and the quality of research, the price for new subscribers will be increasing.

This price will be increasing to $70/month or $840/year on Monday, August 5th. If you subscribe BEFORE then, you will lock in the lower price ($60/month or $720/year) and never pay more than this. If you are here early and long the Capital Flows Substack, then you get to lock in the lower price for all the future upside.

Trades:

Let’s breakdown some specifics:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.