Checklist For a Trade

Quick Thought Today

Hello everyone, I am going over two things in this article:

Housekeeping/Structure for the Substack

How to filter your thinking for a trade idea

Housekeeping/Structure for the Substack

First, I want to say we just got a ton of subscribers with a number of pretty high-level individuals/traders. I like this because people who are way smarter than me can provide feedback or critiques of my work. I assure you, you want as many smart people providing feedback on your work as possible when you are managing risk.

Every successful risk-taker I have ever met will ALWAYS listen to the feedback of other people because they don't care about being wrong; they are just trying to win. It takes a second to change your mind and even completely flip your position (obviously depending on your size).

Here is how I am going to structure publications moving forward. Every article I publish will have one of the following subjects in the title.

“The Research HUB”: These articles are on books, academic papers, or strategy development. The focus is on education.

“Week ahead Strategy”: These articles will be brief thoughts on how the week ahead is likely to play out.

“Macro Report/Insights”: These articles will be macro research focused on the current cyclical dynamics or insights into what is likely to occur.

“Trades”: These articles will purely be various trades I am running.

“Brainstorms”: These articles will be various thoughts connecting things together and a catch-all category.

How to filter your thinking for a trade idea:

A quick overview of how I think about generating a trade: This is highly simplistic and most certainly not a comprehensive view into all the algos and ideas I am running.

Also, if you are not actively involved in financial markets, you should have a clear process for execution and taking risks in your domain. You could be running a trash truck company; you are still taking risks.

These ideas go back to the fundamentals of how the world operates as opposed to how financial markets operate.

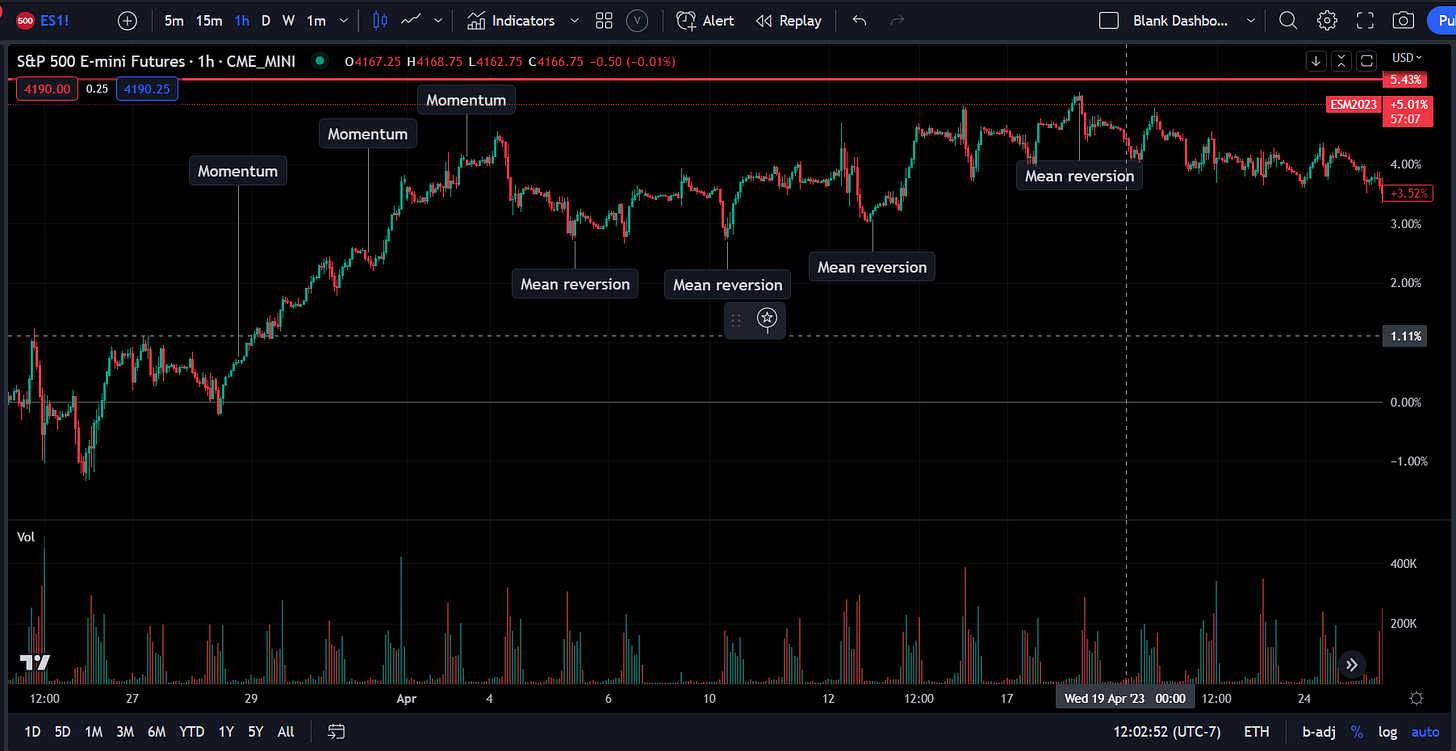

Momentum and mean reversion:

Momentum and mean reversion exist on every timeframe on both the left and right tails. In my mind, it is a way to think about antithetical presuppositions. Momentum says that positive returns follow positive returns and negative returns follow negative returns. Basically, as the price goes up, this increases the probability of the price continuing to go up. The same goes for negative price action. This could also be true for any system in the real economy as well. As a city increases in wealth, it is likely to continue increasing in wealth.

Mean reversion says the opposite. It states that the price will continually revert to the mean. This implies that as the price goes up, there is a higher and higher probability that it comes back down to the mean. The same applies to negative price action.

I have no doubt that the Quants on here are pulling their hair out (if they have any left ;) ) with my explanation but I am trying to keep it big picture.

When you think about having a specific view, you always want to think about momentum and mean reversion occurring on both the left and right tails. Remember, momentum and mean reversion are not about bullish or bearish price action, they are about the TYPE of price action.

Information: Information is some type of interpretation of flows or fundamentals. This goes back to having a top-down and bottom up understanding of the world. Here is the Twitter thread with the articles on this:

Order Imbalance: order imbalance is directly connected to the ideas I explained in this article. Functionally, you are trying to connect the microstructure and positioning of the market to imbalances that occur. This obviously connects to momentum and mean reversion.

Ok let’s bring it together:

These ideas overlap A LOT, so don't try to be too stringent. What you want to do is have a consistent feed of information to know the WHY behind things and take a view on specific TYPES of price action in the future. You then want to align yourself correctly with momentum or mean reversion price action. Finally, you want to take into account and execute in confluence with order imbalances that take place during a Globex trading session.

You want to have a clear understanding of all of these when executing a trade. Never leave any margin for error.

All of these ideas apply to any domain of life. If I left my current firm and went to work in another field completely unrelated to markets, I would rebuild my frameworks using the same presuppositions. Once you figure out how the world works, you can do anything.

Conclusion:

Be sure to check out the last article I wrote. Really key thoughts for 0dte and FOMC this week:

The Story, 0DTE Research, FOMC

Hello everyone, we have a ton of interesting topics to go through in this edition: Some stories about this Substack and trading Options research How to think about this week Let’s get right into it!

Thanks for reading!