Comprehensive Macro Report

Tariff risks and their implications for equities and interest rates

Comprehensive Macro Report

Below is the comprehensive macro report covering the following:

The Macro Regime:

Tariffs Through the Lens of the Balance of Payments:

The Macro Regime and Tariffs:

Implications For Financial Markets: Interest Rates and Risk Assets

Introduction

As 2025 unfolds, the Federal Reserve has solidified its decision to pause further policy adjustments, drawing attention to a new political administration that has become a focal point for market narratives. Tariff news has led to short-term positioning shifts, but many discussions lack proper context within the broader macroeconomic environment.

This report offers a clearer understanding of the current macroeconomic landscape, focusing on how the Fed’s policy stance and the new administration’s decisions may influence both the economy and financial assets. Additionally, it will demonstrate how changes in tariffs are transmitted through the balance of payments, directly affecting the overall economy. This will contextualize the drivers behind the market and WHERE we are likely going given the current market positioning and pricing of future expectations.

The Macro Regime:

The current macro regime is characterized by positive economic growth, with inflation remaining above the 2% threshold. While there are some marginal indicators of potential concern, there isn’t an imminent deterioration in growth. Inflation has declined significantly over the past two years but remains elevated, with a neutral three-month trend. The interaction between economic growth and persistent inflation is closely tied to risks and developments in the ongoing tariff situation.

We are seeing core CPI remain functionally flat over the last 3-4 prints because the good line item has been moving less negative: This dynamic with the goods line item is at a marginal degree of risk from tariffs because the majority of US imports are in the goods line item:

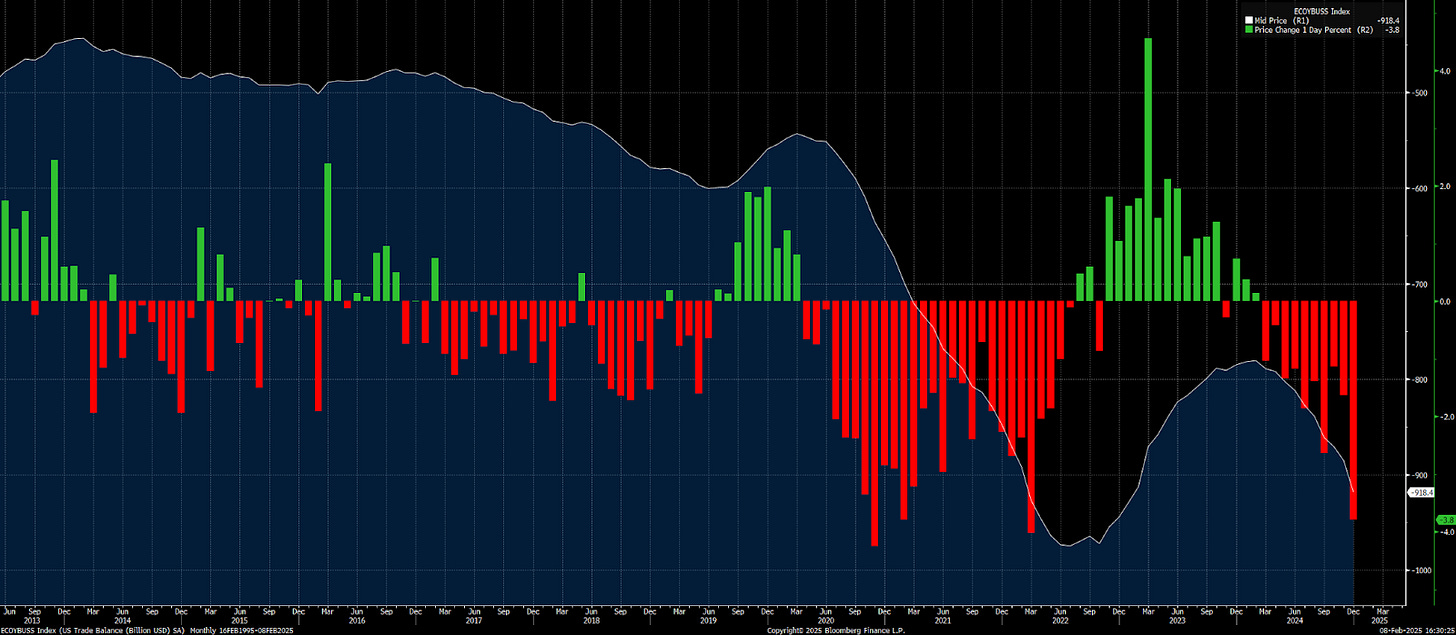

And the trade balance continues to move sharply negative:

Since the trend in inflation has turned neutral after the initial rate cuts in 2024, the Fed has shifted its stance to pausing again which has caused the 2 year rate to have an incredibly narrow spread between Fed Funds.

As the Fed paused, the curve bear steepened due pent up demand after the election and because the rate cuts in 2024 helped growth to surprise to the upside:

We are now seeing the higher rates begin to put downward pressure on specific parts of growth since the economy is now more sensitive to interest rates than it was during 2022-2023. Construction spending (chart below) in the US has come down considerably as the onshoring impulse from COVID-19 is normalizing. As rates are at these higher levels, we are likely to see more downward pressure on the investment line item of GDP:

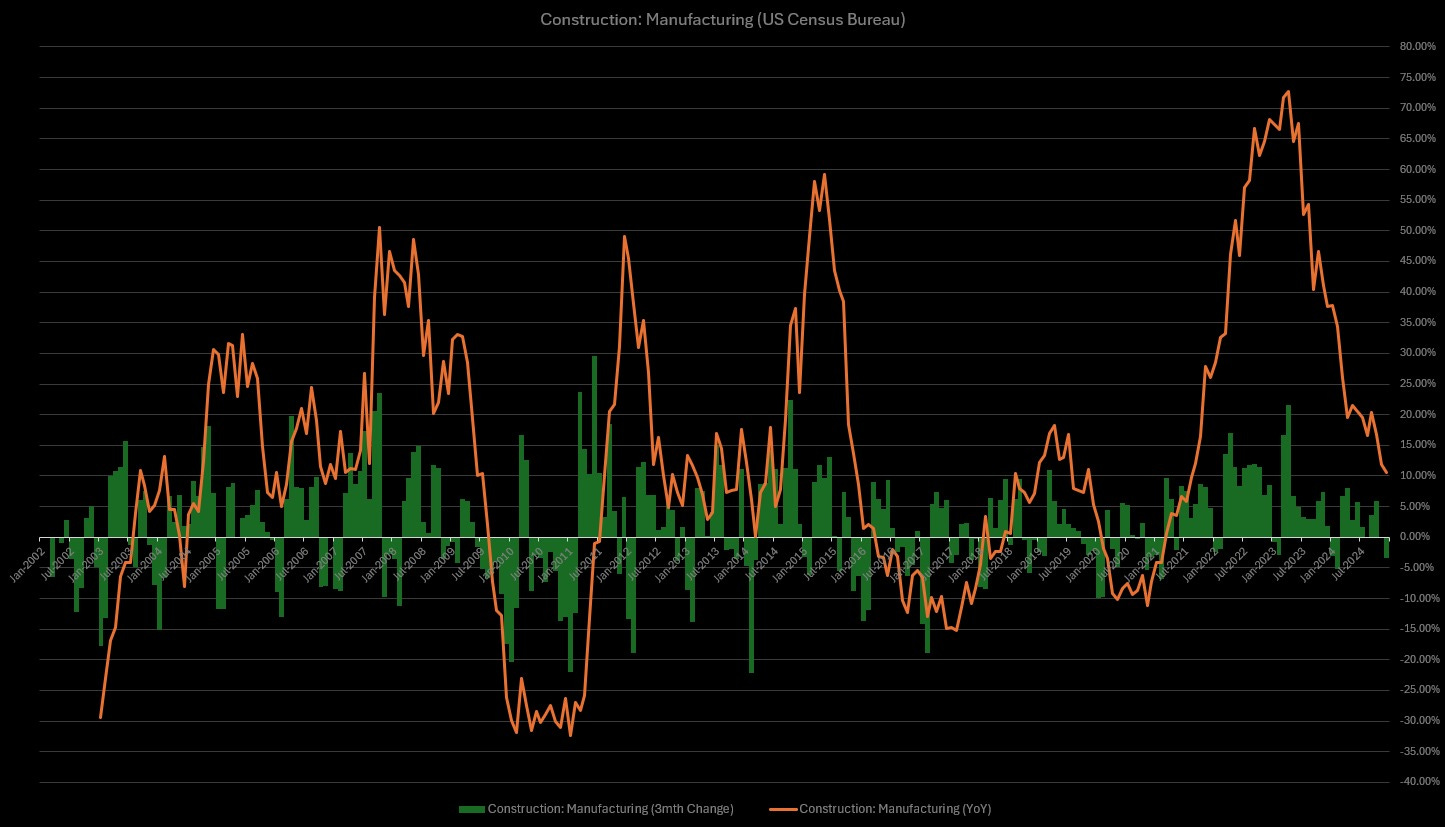

Manufacturing construction is also trending down with considerable momentum:

The implication of this is that the higher rates are putting more downward pressure on economic activity but we are not seeing a pervasive enough effect to impact the labor market and personal consumption. We are not even seeing the construction or manufacturing payrolls numbers turn negative yet:

We are likely to see credit spreads rise marginally since bankruptcies are elevated and interest rates remain at highs but we are not at the point yet for a durable move to take place.

This cyclical weakness is reflected in homebuilders diverging from the index and moving to the downside:

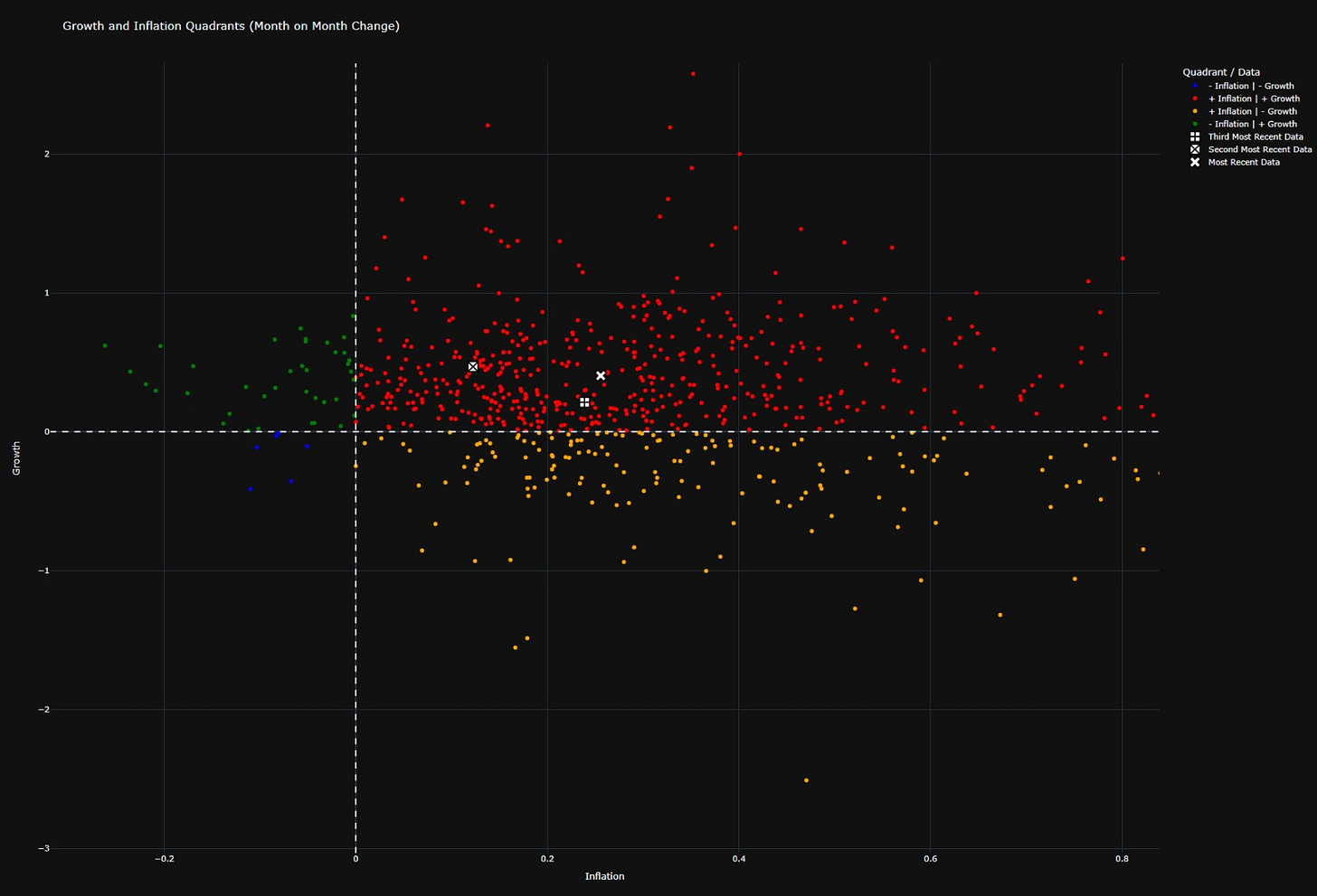

The net result of the current regime is one where growth is expanding and inflation is expanding on a month-on-month basis:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.