Comprehensive Macro Report

How a pause in the beginning of 2025 sets the final stage for equities and bonds

Hello everyone,

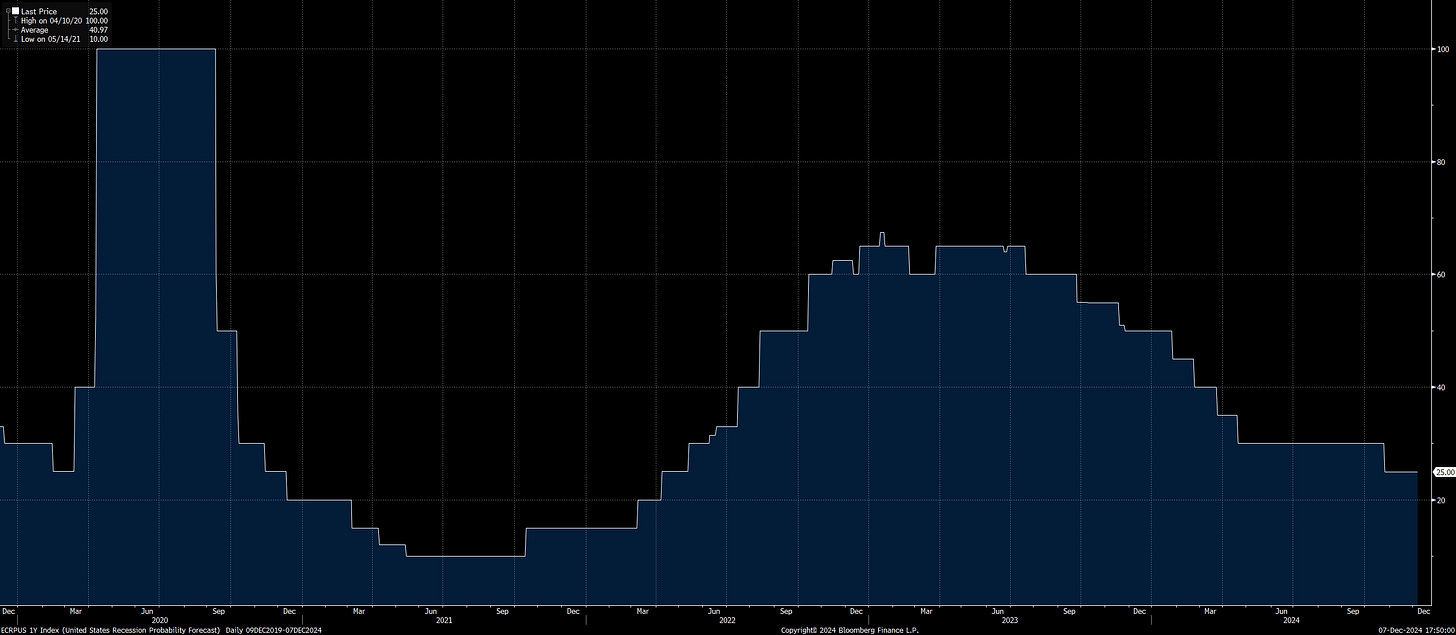

When we look back on 2024, it is very clear that Wall Street has such a low-quality understanding of HOW macro flows function and WHY assets move the way they do. Coming into the year, economists were expecting a 50% chance of a recession and we were told that as soon as the yield curve uninverts, a recession will take place. Both of these things failed to take place and equities are now up 29% on a YTD basis:

This entire year, all of the macro reports have laid out that a recession in 2024 is an incredibly low probability. Why does this matter? Because all year, my equity strategy was correctly timing dip buying in risk assets and long crypto (all of this is documented in the research which can be found in the Substack). The macro situation and its connection with risk assets now have additional tensions that need to be incorporated in order to properly run trades across all financial assets.

I had an exceptional discussion with the guys from Blockworks touching on the macro tensions that currently exist. You can find the interview here:

In order to further explain and map the tensions and risks, I just published the next comprehensive macro report which can be found below. If you are not a paid subscriber yet, I would encourage you to start a free trial this week so you can read the macro report and receive the additional alpha reports that will be coming out over the next week.

You can do a free trial with this link: Here

Comprehensive Macro Report:

Enjoy!

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.