Country Analysis

Starting Right

We are expanding on the previous article and will be starting with approaching a country correctly.

Here are the bullet points from the original article.

Country:

- Country Profile/History

- Demographics

- Investment/Output Capacity

- Geography

- Natural Resources, Weather, Transportation Networks, Technological Abilities

- Political Structure/Political Regime/Geopolitics

- Currency Regime/Monetary Regime/Fiscal Regime

Let me provide examples of what each of these looks like:

- Country Profile/History

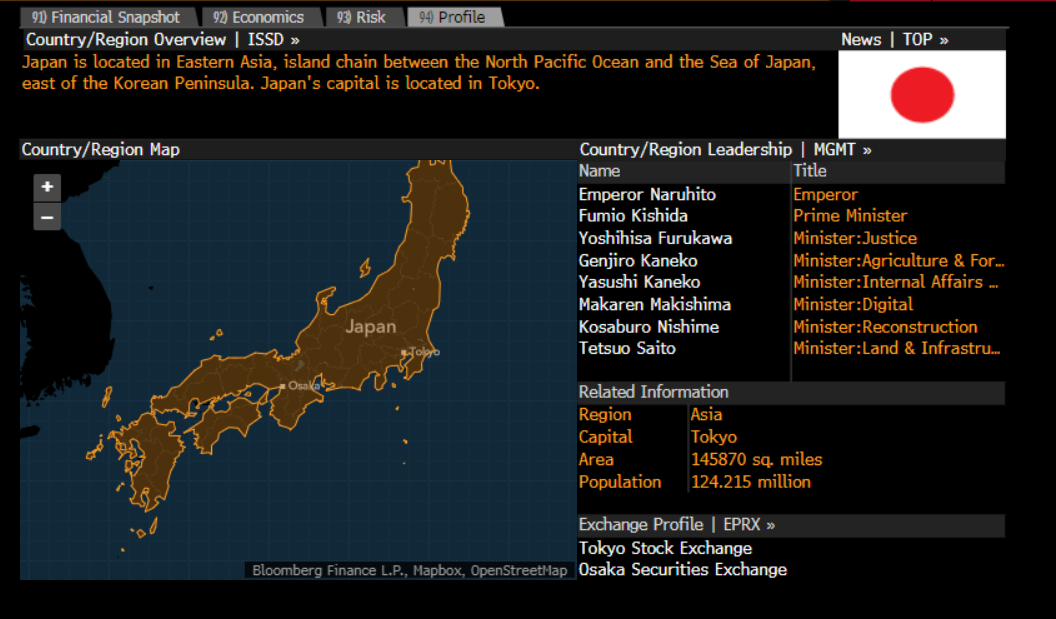

You just want a simple breakdown of the country. You can find decent breakdowns on the IMF website or CIA World Factbook:

https://www.imf.org/en/Home

https://www.cia.gov/the-world-factbook/

The way that I think about a “country profile” is I want to know how the various power/political structures work because they function as mechanisms to transmit capital flows, volatility and risk.

If you want really good books on how to think about this I would recommend these:

https://www.amazon.com/Why-Nations-Fail-Origins-Prosperity/dp/0307719227

https://www.amazon.com/Volatility-Machine-Emerging-Economics-Financial/dp/0195143302/ref=sr_1_3?crid=1V0M6061370C9&keywords=volatility+machine&qid=1680116893&s=books&sprefix=volatility+machin%2Cstripbooks%2C146&sr=1-3

If you want a classic work on thinking about this, read Politics by Aristotle.

- Demographics

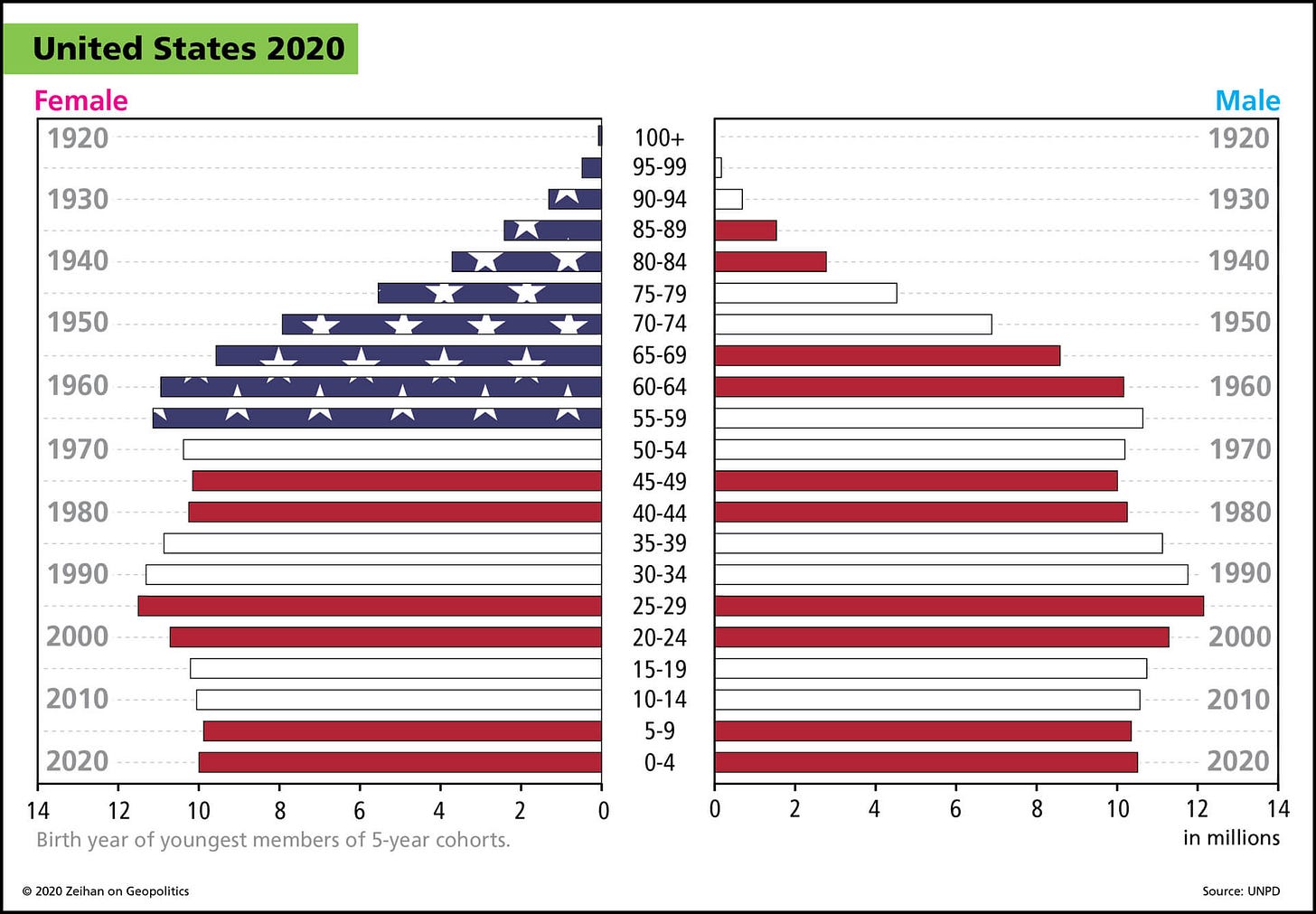

Peter Zeihan explains demographics really well.

Here is the demographic structure of the United States:

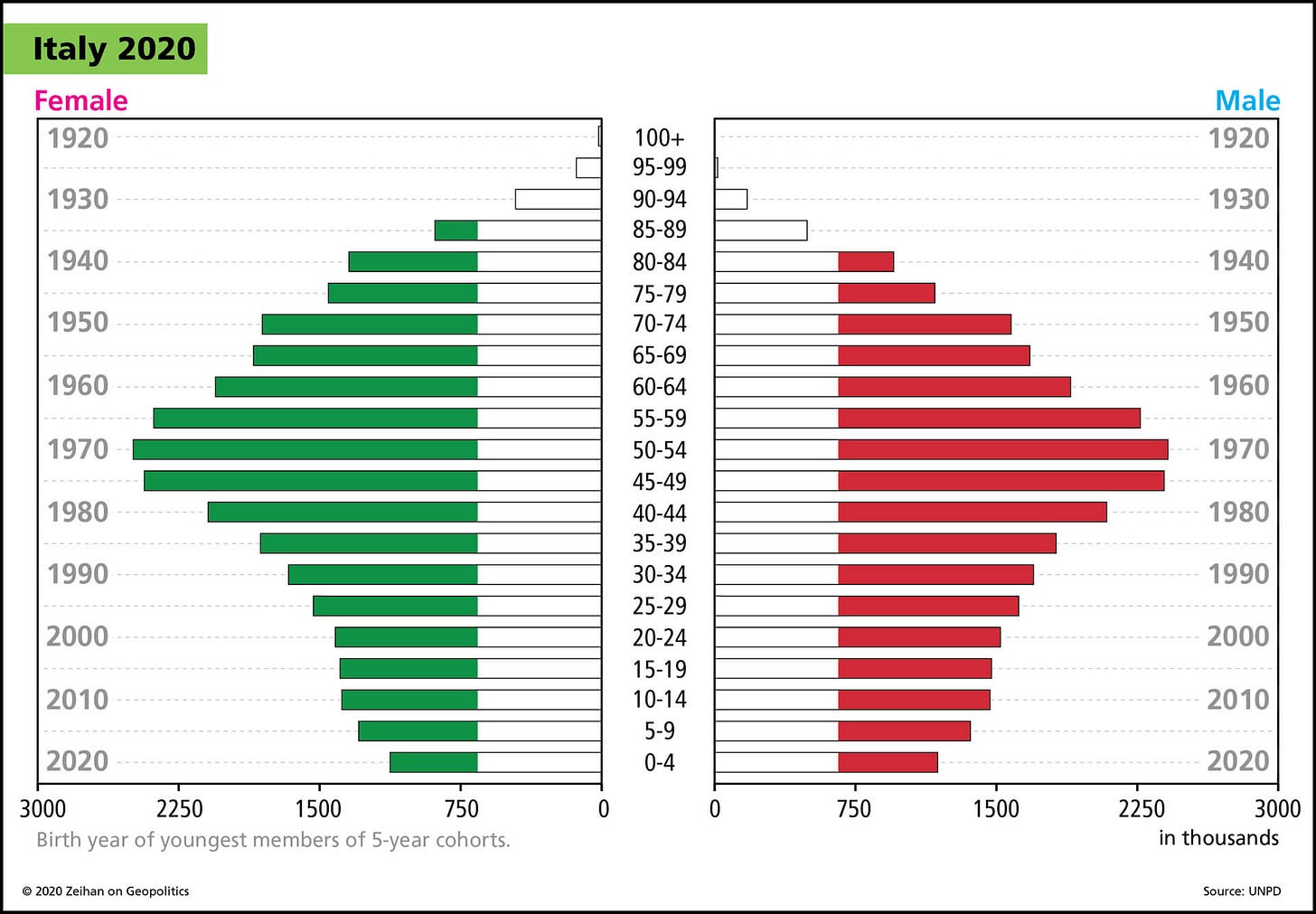

Here is Italy:

Here is a great keynote by Zeihan:

Why do demographics matter? Several reasons. First, it will connect with the labor market and the labor force participation rate which impacts wages (which impacts inflation). Second, the consumption profile of a young person is very different from the consumption profile of an older person. You can compare this with the breakdown of personal consumption expenditures to see if there is a large enough impact. For example, you can look at first-time home buyers (usually younger people) and the supply of houses available.

- Investment/Output Capacity

Technically investment and output capacity is part of economic data but all of these things overlap a lot. I put this here because I like to know how much capacity a country has to produce goods, services, and natural resources. If a demand shock occurs with minimal capacity due to low investment, inflation is likely to occur. The opposite is true as well.

- Geography

Geography is very interesting because it’s one of the most implicit things that always gets overlooked.

Peter Zeihan does a great job of explaining the significance of geography in his talks and books.

Another good book on it is Prisoners of Geography:

A phrase in geopolitics is “geography is destiny.” While there are some qualifications, it’s a great point. We take for granted how the geography of countries plays into their destiny. The United States is a great example of this. A lot of the success in the US was due to the geographic advantage of having water surrounding the continent, plentiful natural resources, and waterways for easy transportation.

So when you approach a country just read some brief summaries of its geographic characteristics, advantages, and disadvantages. These become really important when things like invasions and wars happen.

- Natural Resources, Weather, Transportation Networks, Technological Abilities

All of these points are becoming increasingly important as deglobalization increases its presence.

When I think about natural resources and broad commodities, all I want to do is see how much a country is long or short each commodity through their current account. For example, Japan is predominately short oil while Canada is long oil.

This is why many times CADJPY moves with the price of crude.

Weather connects with the seasonality in both demand and natural resource production/consumption. This can be important for commodities such as nat gas during the winter. It can also impact travel and various countries attracting tourism. There are data points for all of this but we will go into them later.

The transportation network is really important. If a country has a ton of goods it needs to export but can’t transport them (or vice versa), the impact can ripple across the world.

Here is the vessel tracker on Bloomberg. Every time I look at this I think, wow the world is really complex and there is so much opportunity.

We see this a lot with the headlines of “supply chain issues.” You can get a lot of good signals on the actual supply chain as opposed to subscribing to a narrative. Remember, our entire job is betting on things changing. A data point is important for monitoring how things are changing.

Technological abilities are a longer-term variable in my mind but can make a big difference. Technology is fundamentally about increasing the productivity of the inputs and outputs of a system. If a country has very minimal technological abilities, it can really drag on its ability to produce goods and services even if they have amazing demographics and natural resources.

You have to be a little creative in researching technological abilities but the world bank database is a good start: https://data.worldbank.org/

- Political Structure/Political Regime/Geopolitics

The book I mentioned above “Why nations fail” is basically about how the political structure of a government and the incentive structure determines the success of a country.

In terms of political regime, I would look at how much populism and inequality there is in the country, the bias of spending for the country and what the dominant parties are trying to accomplish.

Geopolitics in my mind brings together all of these ideas and asks, what are the constraints that exist and what are the likely outcomes based on this analysis.

- Currency Regime/Monetary Regime/Fiscal Regime

I did a breakdown of the various currency regimes in this article

In terms of the monetary and fiscal regime, the main thing you want to identify is how decisions surrounding these things occur. Knowing if the central bank is independent or politically motivated can be really important.

A great example of how this actually impacts markets is the change in the BoJ governors. You can watch Weston’s video on it

Summary: I want you to remember several things

First, all of these are intricately connected. They overlap A LOT. This is the entire point though. Knowing the facts about a country is easy. Connecting them accurately to correctly determine probable outcomes is difficult.

Second, you want to aggregate resources on each of these topics and systemize your process as much as possible.

Third, always do source research. So often I see people using secondhand research which eventually creates limitations on the conclusions you are able to make. The farther you get away from the source the more noisy things get.

Fourth, always connect things to markets. The knowledge silo that exists is that people who know a lot about the things I mentioned above usually know very little about markets.

Finally, remember I am just laying out broad thoughts here. It is by no means a comprehensive list. I am hoping this helps people who are newer to markets.

Thanks for reading!