Distribution Of Knowledge And Secrets In The Industry

What most people don't know

Like any industry in the economy, knowledge in markets is never evenly distributed. Some people have higher degrees of knowledge which create the potential for a considerable advantage. As long as you are aware when you are at a disadvantage then its ok but you’ll need to offset this disadvantage somehow.

For example, a financial advisor helping someone manage their net worth might not know the intricacies of liquidity in the system. However, they might have a different edge in terms of time preference, maneuverability, or preferred tax treatment that can help offset this lack of knowledge.

Ultimately, you want to align yourself with every knowledge edge as possible instead of just letting things offset each other.

Insider Knowledge On Global Liquidity:

While people won’t admit it, there is most certainly a high degree of insider knowledge in the financial industry. Back-door meetings with CEOs, world leaders and central bank chairs take place all the time. For example, the Treasury is one of the main contributors to the increase or decrease of liquidity in the system. One of the main reasons we have seen this bear market rally is because of an increase in liquidity due to the Treasury's actions. The Treasury very tangibly impacts your portfolio on a consistent basis (if you want to know the technical reason for this, as the maturity distribution of government debt changes, it increases or decreases liquidity in the system. So if the Treasury issues more short-term debt vs long-term debt, it provides liquidity since shorter-term debt is more money-like than longer-term debt).

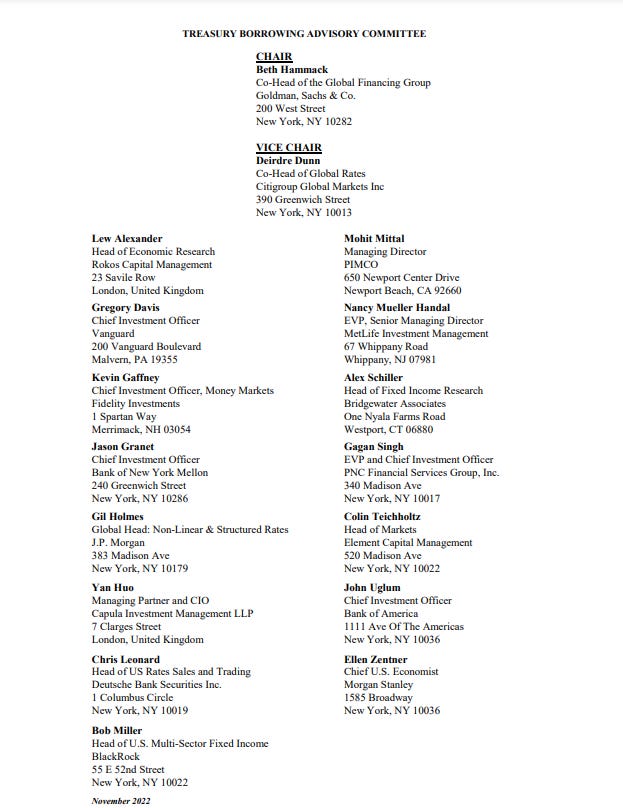

Who do you think advises the Treasury? They state it very clearly in their TBAC report: https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding/treasury-borrowing-advisory-committee-tbac/treasury-borrowing-advisory-committee-members

It’s literally all the major people who manage hundreds of billions of dollars in the industry. Executives at Goldman, Citi, Blackrock, Vanguard, Morgan Stanely and even hedge funds like Bridgewater are on the advisory committee.

This isn’t some conspiracy or secret but what it shows you is that these people not only have insider knowledge of how liquidity will unfold but actively exert influence to change its outcome!

These types of relationships take place across every sector of financial markets. Another example is that “insider knowledge” takes place in the commodity space all the time because it’s legal to trade on it whereas it isn’t with stocks.

Do I even have a chance?

Now the implication of all of this isn’t to despair. It is actually an opportunity for several reasons:

You can watch what these individuals do and say.

The constraints that large banks and hedge funds are under are very different from the average person.

Executives at large banks are managing huge portfolios that move markets when they transact so they can’t always take advantage of their knowledge. Plus, if you know what constrains these players to buy and sell regardless of insider knowledge, then you can front-run them.

A simple parallel would be if you know that a large player is going to build a large shopping center in a rural area. You could begin buying up smaller homes in the area that will benefit from the development.

In sum, identify the distribution of knowledge and the constraints of the players with that knowledge. This is true in markets and any domain of life.

Curate Sources of Information:

I would say that THE main thing I do is curate sources of information that most people don’t know about. This is essential for having an edge in markets. I quite literally have a spreadsheet that I run with different informational edges. Some are from talking with people, some are from reading sources most people aren’t aware of and some are simply knowing how to interpret specific signals most people don’t understand.

This is part of the reason I enjoy talking with people about the problems they face because it is very possible I have a piece of information that could be helpful. In the information age, you simply need to be at the right place at the right time with the right information to be successful.

Side Thoughts on Markets:

CPI came out in line with expectations so the hedge didn’t payoff. See the previous article.

While growth is skewed to the downside on a cyclical basis, we are currently in a short-term period of time where economic data is surprising to the upside. It is still decelerating on an overall basis though.

This has allowed some more hawkishness to get priced into the market. Here is the implied rate hike for July of this year. As you can see they have rallied a little over the past month as the economic data has surprised to the upside.

This dynamic has caused a short-term move to the downside in bonds. I am still bullish on bonds at these levels. My strategies signals haven’t triggered another buy signal yet but they are close, perhaps next week.

In a previous article, I noted that I was getting signals to short equities. We are still waiting for this view to come to fruition. It doesn’t appear options expiration is having as big of an impact as expected. Next week will provide a clearer signal if the short equities view is correct or will take longer than expected to play out.

Thanks for reading!

Side logistic note: this is the 8th publication within the first month of this substack. All of the previous publications are available if you log into Substack with the email you are receiving this at. As I have noted in the “About” section, the substack will remain private for now and any additional subscribers will be based on referrals. If there are specific things you would like me to share then feel free to contact me. What I have shared thus far is probably 1-2% of everything I am currently running so there’s no lack of things to talk about.

Be well!

Are there public metrics to look at liquidity or a fred chart that illustrates treasury issuance?

Thanks in advance!