Equities View/Charts

Take Risk Like A Profressional

Hey everyone,

I hope you are having a good weekend. I have a few thoughts to share, a couple of charts, and some analysis on risk-taking. Let’s get right into it.

Thoughts:

First, everything I laid out in the macro report remains the primary view. I am bearish on equities. We tried shorting it once and got stopped out because my models were indicating a short-term squeeze. We got this short-term squeeze and have since then come back to the range where we originally shorted. This is basic drawdown control.

We could have another squeeze or we could dump. The key is to manage the risk around these types of trades and know the overall skew.

One thing I have learned in markets and communicating with people about markets is everything needs to be repeated OVER AND OVER. I don’t mean this just for you. I also mean it for me. On a daily basis, we all hear so many views and it is essential that we clear our minds and come back to the view I laid out in the macro report. The skew for equities is to the downside.

I use systematic strategies to execute and manage the risk. I will let you know when the strategy trades and shorts SPX. Be ready for it. While none of this is financial advice, I believe this is the last stop to go into cash before we have new lows in equities during the second half of 2023. We shall see. Remember, strategy and redundancy planning is more important than a deterministic view.

Charts:

Here is how I view the risk/reward and levels of SPX right now:

Here is the high-yield CDX. My view is that sometime in the second half of 2023 we go back to the October highs or possibly make new highs:

When we look at the financial conditions index, we have hit a high. At the very least, the risk-reward is skewed to the downside.

When we look at the dollar index, we have come back to the previous low. Positioning is very short the dollar against the other major currencies here.

Net positioning (blue line) is short bonds right now. While getting long bonds is a little trickier than the equity short, it will come in time.

When we look at the VIX, it almost broke below 16 this past week. However, you will notice that spikes in VVIX (the volatility for the VIX) helped set a bottom in the VIX this week. This is a key signal and relationship to watch. Volatility is incredibly cheap here and positioning is extremely complacent.

When we look at sector lead/lags, we can see tech and communications have been leading the market to the upside over the past 2 months.

The favorites of the market are almost back to all-time highs. NVDA has been fueled by this “AI narrative” which I believe will fall apart in short order. I might even buy some puts on NVDA when the time is right.

The tech sector is pricing in a near-perfect scenario in terms of valuations and earnings estimates. It only takes a little shock for these types of unrealistic situations to unravel.

Risk Taking:

One thing I have learned from trading and taking risks is that you need to be intentional and take extreme ownership of your results. Be a professional at whatever you are doing. Take it seriously and leave no margin for error. People who don’t have a plan and consistent execution won’t succeed in the long run. If you go up to a jacked guy at the gym and ask him how he is in such great shape, he NEVER says it was an accident! He didn’t just accidentally get into amazing shape. It takes intentionality, planning, and consistent execution. The same is true in any domain.

Thoughts On Tweets:

Great chart by Andy here: https://twitter.com/dampedspring

I am very much in line with the view.

The low vol has allowed funds to increase their exposure which has added to the complacency in the market:

https://twitter.com/t1alpha/status/1649119510497198081

I’ll end by pointing everyone over to Credit from Macro to Micro

His most recent piece was exceptional. Be sure to follow his work:

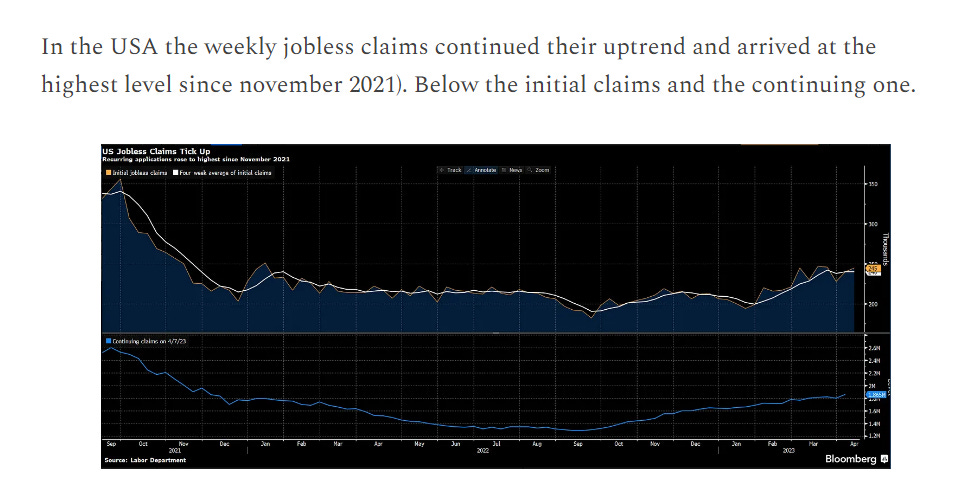

I like these two insights he shared about the labor market:

Thanks for reading!