How does macro impact real estate and small businesses?

Connecting the BIG Picture with small details

I just had a great conversation with a friend (who is a subscriber here) about life, business, and the projects we are working on. These are really instructive for me because it helps me understand what type of information people can actually use. So, please! If you have specific questions or insights, just call or email me and I’d be more than happy to write an article about it.

I am going to provide a quick breakdown of how big-picture ideas like growth, inflation, liquidity, interest rates, the FED, etc impact tangible things such as real estate or small businesses.

The “Problem”

I hear a lot of people say things like, I run a small business or invest in private deals because they aren’t impacted by the public markets or macroeconomic dynamics. While sometimes there might be some truth to this, there are much better ways to frame these types of decisions.

I also hear people say that owning businesses in the real economy is a great way to diversify a portfolio because you don’t have to experience the volatility of public markets. Again, there is a partial element of truth to this but not really the right way to think about it. Plus, as more and more capital flows into private equity, the correlation between private and public markets is increasing considerably.

So I will break this relationship down, provide a conceptual framework and give you some principles for applying macro insights to idiosyncratic scenarios.

How Important is Macro?

Macroeconomic forces are the primary causal factor for asset class returns and businesses in the economy. Why is this? It is because the entire economy is a very interconnected system and nothing operates in a silo.

When we talk about things like growth, it is the amount of stuff that is being bought or sold in the economy at any one time. This directly connects with every person because every person’s consumption is another person’s income. When a person buys a ton of stuff at their local shopping center, some of the money goes to the business profit margins but a portion of it goes to the employees of that business which allows them to go and buy stuff for themselves. These transactions take place over and over as we move through the business cycle. The key thing to know is that when one person stops consuming, by default, that impacts someone else’s income. These cycles operate in self-reinforcing feedback loops where more consumption fuels more income which fuels more consumption. The opposite can occur as well.

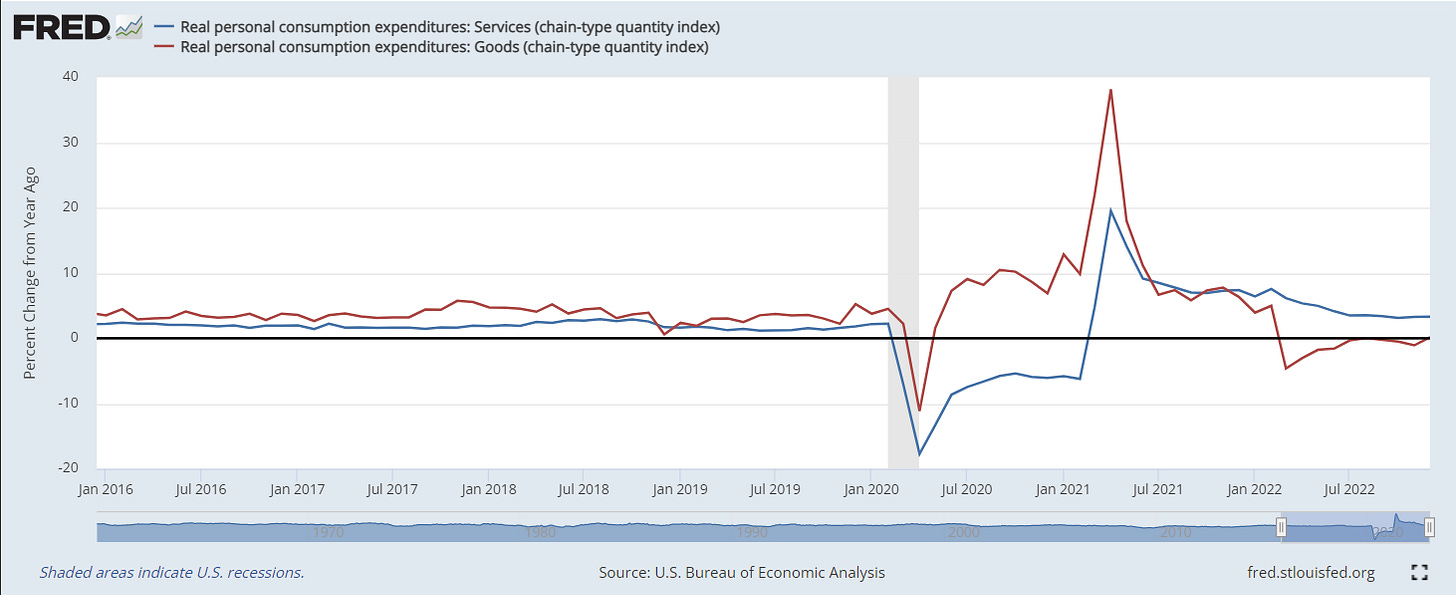

When we think about inflation, it can be a little more complicated because inflation is never evenly distributed throughout the economy. COVID provided a really clear example of this because, during the lockdowns, people primarily bought durable goods. Just think, gym equipment, bikes, and Amazon delivery. This means the majority of consumption was pushed into one section of the economy for a short period of time. The chart below shows this dynamic where goods (red line) rebounded almost immediately. The service sector didn’t reopen considerably until the vaccine was released.

This situation caused a bit more inflation in the durable goods portion of the economy vs the service side of the economy. We all heard the stories of restaurants going under while at the same time, some businesses were doing incredibly well. This confused a lot of people because they didn’t know if the economy was doing really well or if we were going into a great depression 2.0.

In sum, basic supply and demand dynamics can influence the distribution of inflation through the economy. The other thing that impacts inflation is when there is simply a surplus of money to the amount of overall goods in the system. So monitoring the supply of money can dramatically influence how long you think inflation can persist.

Both growth and inflation dynamically impact all businesses. Some businesses can transmit this inflation incredibly well and others end up getting hurt on their bottom line. For example, gas stations have a high sensitivity to inflation because as soon as the price of oil changes, it’s reflected at the pump and the bottom line margins expand or contract.

Businesses across the economy have varying levels of sensitivity to growth, inflation and liquidity. Another intuitive example is how banks, insurance companies or mortgage brokers are all highly sensitive to changes in interest rates. Their margins are directly connected to interest rates and credit spreads.

A business is a portfolio and a portfolio is a business:

Any portfolio has implicit exposure to growth, inflation and liquidity in the overall economy. In the same way, real estate or small businesses have implicit exposure to these dynamics.

I add in real estate because it’s a very tangible example. Specific types of real estate have varying sensitivity to growth, inflation, and liquidity in the system. For example, if we are talking about inflation, there is a spectrum in real estate that has the ability to benefit or be hurt by rising/falling inflation. Hotels have a high degree of turnover and can pass through inflation much easier to tenets than leases with longer duration. Similarly, multifamily properties with leases ranging from 6-18 months usually benefit from inflation because leases are expiring every month and you can update the rates in real-time. It won’t be as fast as hotels but it’s still reasonable.

You can begin to imagine that if you have a property with a long-term lease, it’s very possible that the lease doesn’t roll over for years on end. If you are the owner of the building, you have to increase your operating expenses with inflation because the cost of goods and labor are going up. In real terms, your margins will get squeezed. Many times these long term leases will be structured to increase rental rates at a certain percentage to track with inflation but it really depends. Generally speaking though, net lease or contracts with less frequent turnover don’t do as well during inflationary environments.

You can see in the real estate example that the capital structure of the real estate deal/portfolio transmits growth and inflation differently. The ability to manage these moves through the cycle can be the determining factor for maintaining positive margins.

Tthe real estate example is the same as any small business. A business has a series of implicit assumptions about growth, inflation, and liquidity. This is why major corporations actively hedge their exposure to these dynamics and monitor the business cycle.

Let me give you another example, say a business wants to take market share from a competitor or acquire another business. When would the best time to do this be? Generally speaking, it will be when the competitor is under some type of constraint that is forcing them to liquidate assets or lay off employees. When would a scenario like this take place? In a growth cycle downturn or some type of recession.

Tangible example: just think about Zillow having to liquidate a large portion of their real estate holdings last year because they overleveraged when we hit peak growth.

Attribution Analysis and Scenario Analysis:

So let’s say you are a very specific business that is operating in a single market with a very specific consumer base? Does any of this even matter? Well, it depends. This is where we build some type of strategy breaking down how much of the fundamentals of the business have sensitivity to broad macro factors. For example, a business that is primarily based on discretionary income would likely do incredibly well during a growth cycle upturn. However, if savings aren’t set aside for when the probability of a recession is increasing then your overall risk of default or closing down will increase exponentially.

The same is true for inflation shocks or changes in liquidity. If your business can only operate when you have access to a short-term credit facility at 2-3%, then once interest rates rise, this could dramatically impact the business.

Any good business or portfolio will have an understanding of its exposure and then plan according for various scenarios that could take place. As many of you know, running a business or portfolio means you need to constantly be aware of all the risks. Most business operators are so busy managing the issues and risks from vendors, employees, and their bottom line that it’s difficult for them to be mindful of business cycle risk.

The key thing to remember is that any business or portfolio is implicitly long or short some type of growth, inflation, and liquidity dynamics in the market. Now is it possible that a company is just growing so much that a recession doesn’t impact them at all? Of course and that would be amazing for the company. However, they should still try to time strategic decisions around the business cycle if they can. Raising equity, taking out credit, employment contracts, and vendor agreements can be impacted by our position in the business cycle.

Ideally, you want to align your individual business decisions with the macro environments so that you can have higher margins or higher ROI.

Portfolio Management and Trades:

I will give you a practical example in public markets.

When I think about all the trades I have in my portfolio at any one time, ideally, I want them all to align with the macro regime. However, sometimes trades won’t be aligned. This is ok as long as I have a reason for it. For example, let’s say I think we are moving into a disinflationary recession. This would mean that broad prices are likely to drop and I would want to be short commodities in some manner. However, if I have a very specific fundamental view on wheat or soybeans, I might decide to go long. BUT! I need to do an attribution analysis that says, even though the macro headwinds are putting downward pressure on the price of wheat, the specific fundamentals are so great that they will offset the macro headwinds.

It would be the same for a business decision. Would your specific fundamentals offset any negative pressure you might encounter from the broad economy? There is nothing wrong with going against the headwinds if you have a really powerful boat pushing you forward.

Do private investment provide uncorrelated returns because they are “removed” from the volatility of public markets?

It really depends. Most private equity funds don’t have active liquidity like the S&P500. However, just because there isn’t active liquidity doesn’t mean there isn’t volatility. Many times in private equity deals, it gets marked down a large amount all at once instead of a consistent trend down you might see in stocks. So liquidity and price discovery are important factors to take into account when trying to evaluate if private deals are “uncorrelated.”

An example of this dynamic is the private equity valuations we are currently seeing. The S&P500 is down considerably from its high but a lot of private equity deals haven’t been marked down. This isn’t because they are doing better, it’s because there isn’t an active market to price the risk!

The question of a private deal being a source of uncorrelated returns really comes back to the degree of sensitivity a business has to the same variables moving public markets. This is a better principle to think about than just saying private markets are uncorrelated.

I mentioned a book in the last article called Beyond Diversification and there is another book called the Allocators Edge. Both of these books provide a great breakdown of how true diversification works. Beyond diversification provides some great studies on why private equity has a high correlation to public markets due to the flows and players in the space. While managing money is incredibly difficult, I will say that most portfolios don’t have true diversification. Perhaps I will write a future article on this.

Perhaps the most frequent thing I hear about private markets is that people don’t care about the price of their asset as long as it’s producing cash flow. An investor might say they don’t care about the real estate value as long as it’s producing cash flow. There is nothing wrong with this except you will be confined to a specific time horizon and won’t be able to take advantage of any additional opportunities in the future with the capital you have previously allocated. Again, this goes back to the specific goals and constraints that each individual and business faces. When you take this type of view though, it does limit your optionality, and optionality in markets is your greatest asset.

Conclusion:

Ok so let’s bring together these thoughts:

Macro matters for all asset classes and the economy

All businesses exist on a spectrum of sensitivity to growth, inflation, and liquidity

You want to evaluate the sensitivity of a business or portfolio to these variables with attribution analysis and scenario analysis to strategize correctly.

Ideally, you want the fundamentals and macro environment to align to make maximum returns/profits.

True diversification is about having various businesses/trades/assets that have varying sensitivities to the macro regime and don’t all fall apart at the same time.

If you or someone you know is trying to build a specific strategy around these ideas, I am more than happy to chat about it. Always feel free to send thoughts or questions my way because that will help me write more pieces like this.

Thanks for taking the time to read.

Nice read

excellent piece, I greatly appreciate you