Inflation and Wages

Always stay ahead of the curve

Part of actively trading money in markets or managing risk in any domain of society is staying up-to-date with all literature and published insights. This article will be an example of me doing this and demonstrating how I think through it.

A paper was released by the FED on the role of wages in trend inflation during the 1980s: https://www.federalreserve.gov/econres/feds/the-role-of-wages-in-trend-inflation-back-to-the-1980s.htm

If you are new to reading these types of papers, skip the technical stuff, read the conclusion, and take it with a grain of salt, as it would be difficult to verify the more complicated concepts they are using.

Several things to note before diving into this paper:

First, for those who don't know, many people use the 1970s and 80s as a parallel for the current inflationary environment. There is a bit of debate around the actual driver of inflation in the 1970s-1980s, since there was a demographic boom during that time.

Second, the wages component of inflation is different than other aspects of inflation. For example, the food and energy portions of inflation have a higher degree of volatility compared to wages. However, if wages begin to take off, it takes much longer for them to come back down. Why does it work this way? I'll save that for a future article if you guys are interested :).

Third, most of the time in the research process, people focus on what they know for sure. What is really important in research and risk management is specifically identifying what you DO NOT KNOW, whether that is due to your own lack of knowledge or a variable being a known unknown. This process isn't glamorous, but identifying exactly what you don't know is incredibly important when you calculate how you take risks. This is true in any domain. Normally, people focus on what they know and ignore what they don't know. This is dangerous because it's always what you don't know that gets you in the most trouble.

Alright, let's go through a couple of major points from the paper and think about their implications:

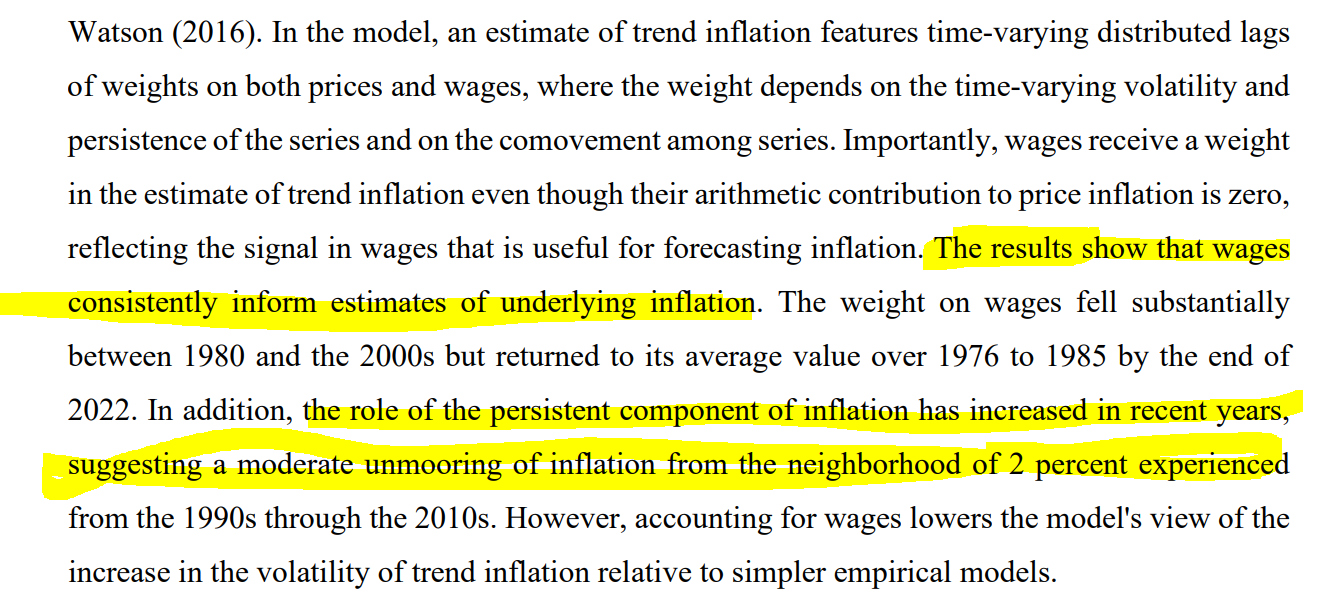

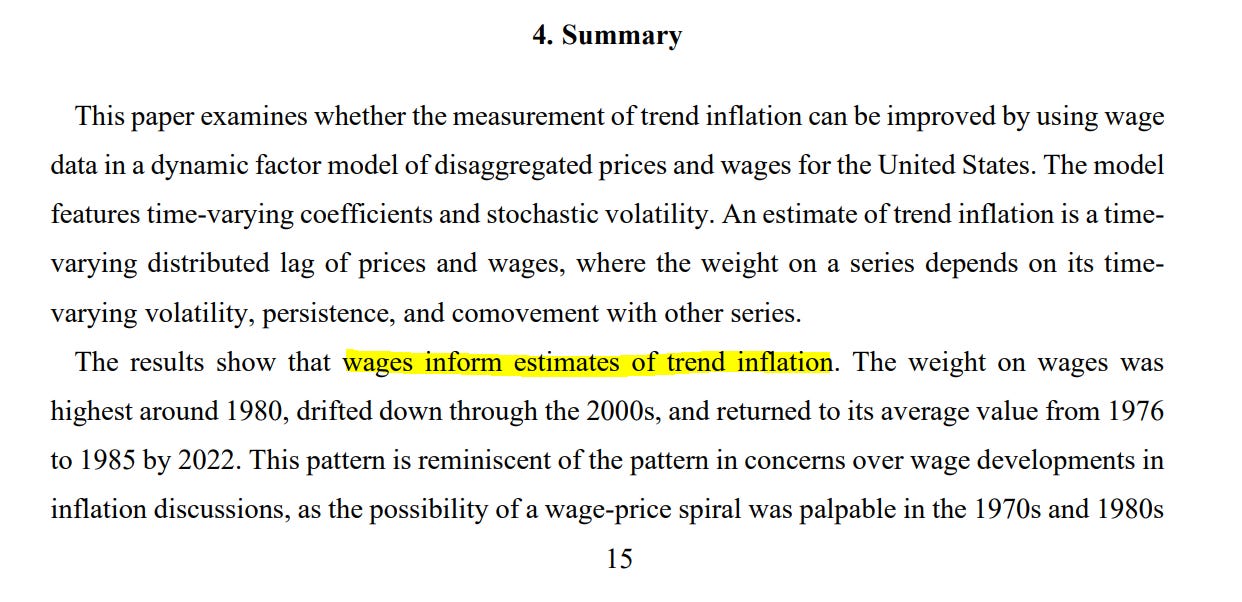

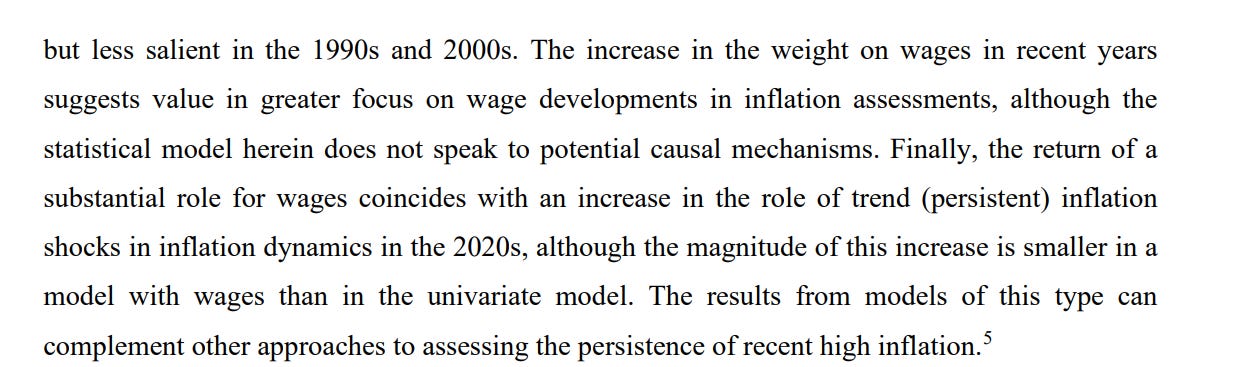

What does the above statement mean? Simply put, when wages begin rising, it's much harder to keep inflation at the 2% target the Fed has set.

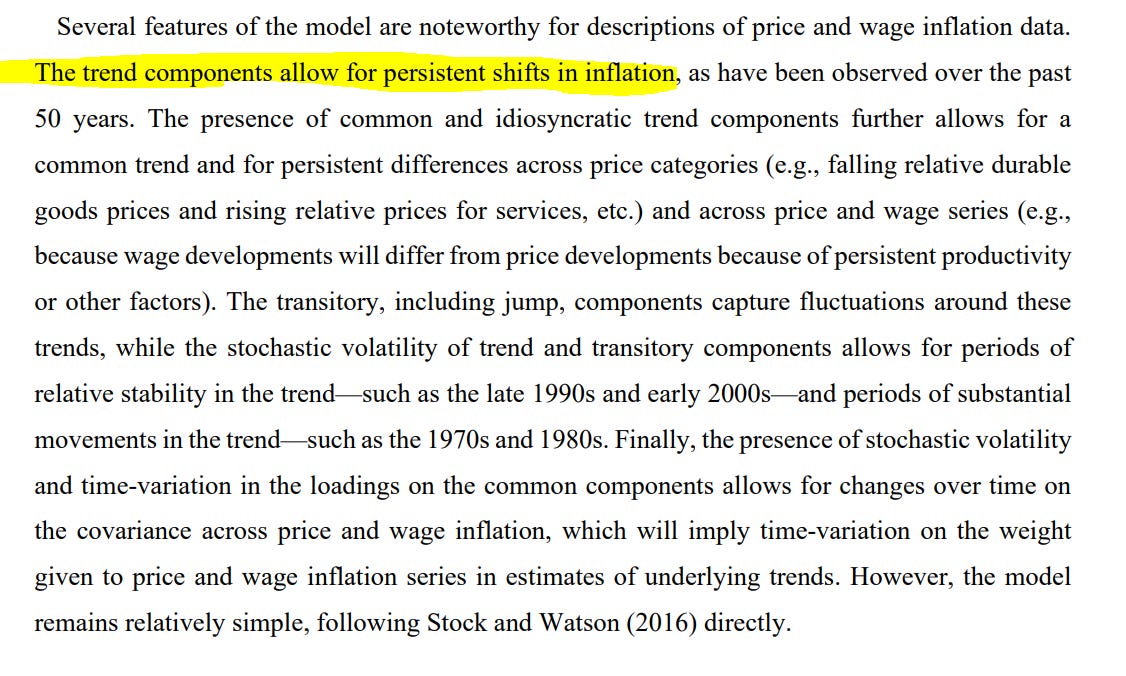

What does the above statement mean? Simply put, specific components of inflation have the ability to be more transitory or persistent than others. Both "transitory" and "persistent" are descriptions of periods of time and therefore need a specific timeframe associated with them.

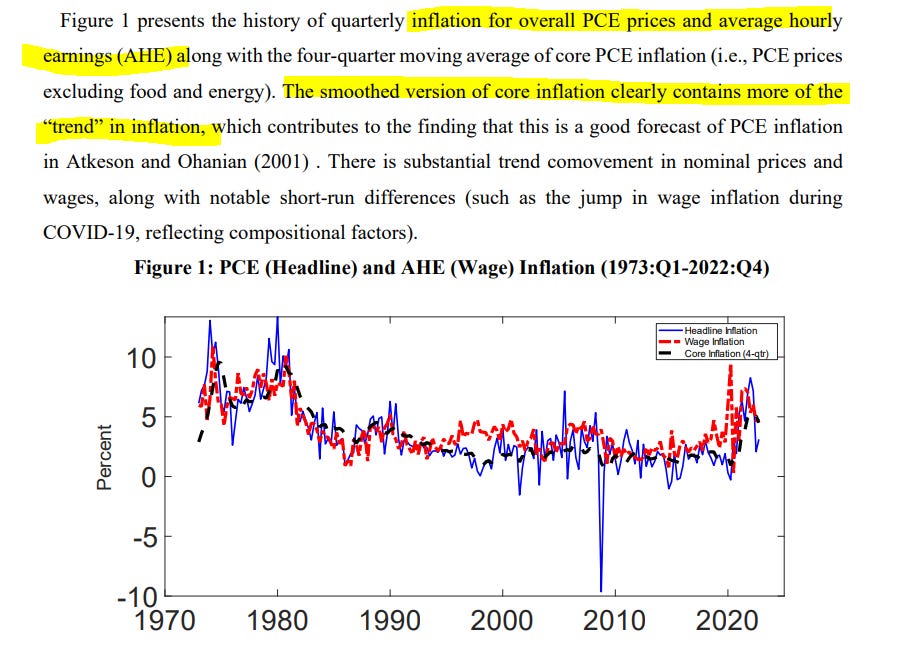

What does the above statement mean? Simply put, we can establish an "underlying trend" of inflation by smoothing specific components. This is key for understanding the Fed because they aren't looking for a single inflation print to change their policy. They are looking for persistent and pervasive moves across the inflation complex. This is why having a CPI model is really helpful.

What does the above statement mean? Simply put, understanding wages and the labor market is important for determining the overall trend of inflation. This might seem simple, but you would be surprised how often it is overlooked.

What does the above statement mean? Knowing wage inflation is important for determining trend inflation, BUT it does not indicate causality. This is a key distinction because there is discontinuity with the 1970s due to demographics. More people entered the labor force during the 1970s. However, just because we don't have the same causal driver of inflation, doesn't mean we can't have a comparable situation.

Pulling Thoughts Together:

How does this connect to markets and redundancy planning?

First, we can see that core inflation is remaining elevated. This is the key thing to watch in this regime. I provided some charts of this in the macro report (link). This means that we need to see a persistent trend in core inflation, which has not occurred yet.

Second, if the core measures of trend inflation are not making a strong move down, we are likely to have two competing forces affecting bonds toward the end of the year: duration risk and credit risk. What does this mean? Basically, bonds are unlikely to rally significantly unless credit risk increases (i.e., the world is falling apart). This is why it's so important to watch flows connected to duration and credit risk.

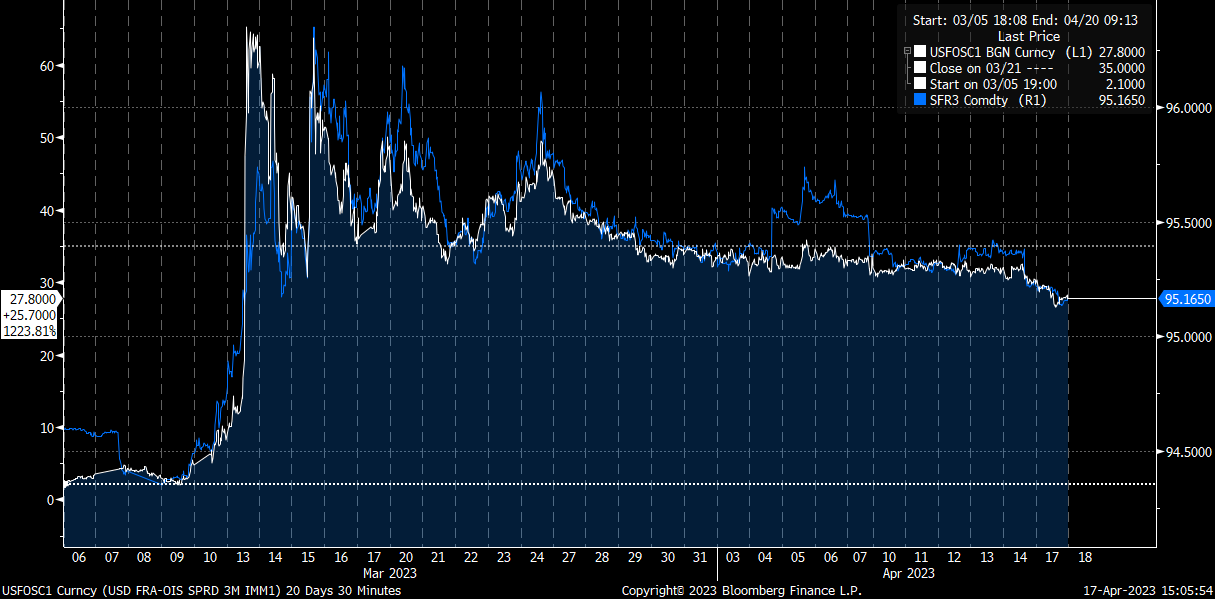

Here is a chart of the FRA-OIS spread overlaid with the 3rd SOFR contract. If that's too complicated, then just think about it like this: White line going up = credit risk increasing, which is bad. Blue line going up = market pricing more rate cuts in the future, which indicates a dovish Fed pivot. The big spike is the SVB blow-up. We are now waiting for the next one.

What would bring down core inflation? A recession and the labor market falling apart. This appears to be the next thing on the timeline. Prometheus Research has done some great work on this that I noted in my macro report. Just spend some time familiarizing yourself with it.

If you want the layman's version: I think we might see some type of recession in the second half of this year, with some sort of credit event that causes a bid in bonds. This will likely set up another top in bonds and bottom in equities. However, things can always change, which is why it's important to know how these mechanics work and adapt accordingly.

Final Thought:

Depending on the context, both of these statements can be true:

Nothing ever truly changes.

Nothing lasts forever.

A lot of times, I see people taking views on inflation or assets with a bias from one of the statements above. The paradox of markets is that you don't know which one is true at the current moment. The implication is that you should strive to align your mindset and actions with the market process instead of a deterministic view of the future.

I'll conclude with a great quote from this Twitter account:

Thanks for reading!

Another great piece. Thank you Pump!

Great take ... rarely online I see scientific/relevant literature references and inferences from there ... too many takes are based on 'sentiment' and 'recency bias' or 'confirmation bias' ... or even worse, show like the guy throwing pigs and bulls and bears in a studio and screaming buy buy buy or sell sell sell lol ... great that somebody does it ... kudos to you! Thank you!