Innovating: The Dollar and Global Financial System

How to frame the dollar discussion in trading

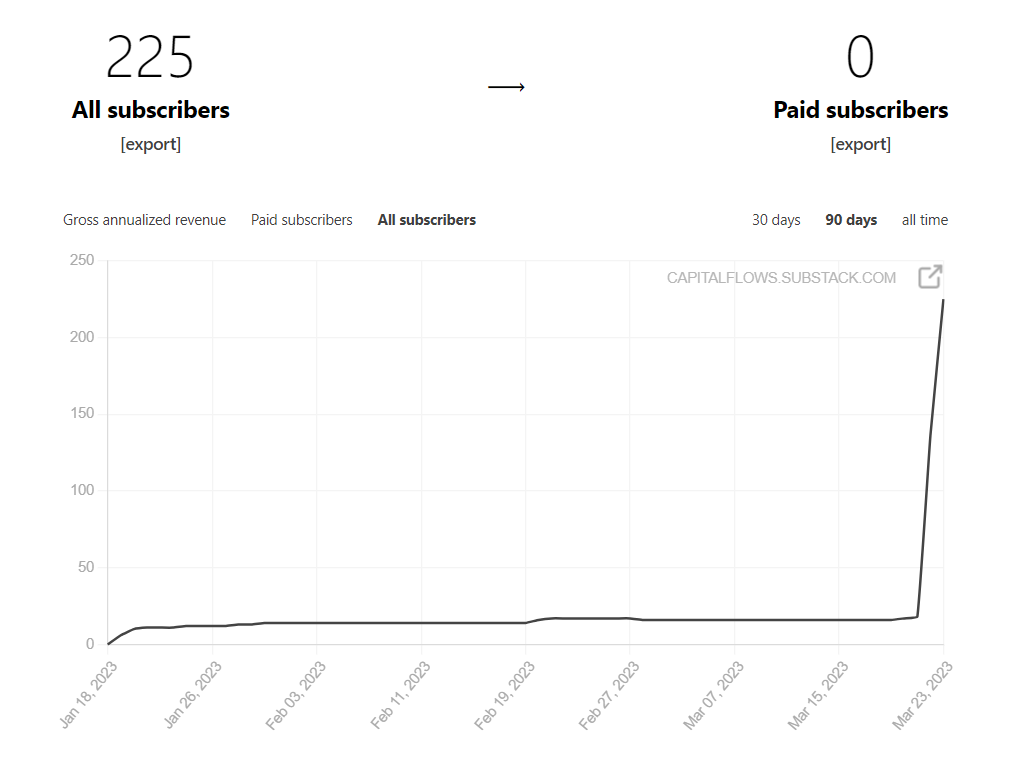

First of all, thank you to all the new subscribers!

Literally overnight, we went to 225 subscribers which is pretty cool.

Let’s talk research and the dollar:

In the first article, I talked about the process of researching and trading:

In today’s article, we are going to do the “innovating” portion which requires research. Also, side note, I got this whole idea of “innovate, systematize and run” from Prometheus Research . Their founder Aahan is one of the best macro minds I know. You should subscribe to them!

For today, I want to bring two resources to your attention and then will explain how it relates to trading. The first is this Twitter thread which provides an exceptional overview of a new book by Daniel Mcdowell on financial sanctions. I ordered the book but the Twitter thread is an excellent summary.

The second resource I have found incredibly helpful on the dollar’s reserve status is the West Point Paper by Michael Kao

How does this relate to trading and tangible decisions though?

First, anytime you approach a country, you need to know the current currency regime:

Here are some of the most common currency regimes:

Fixed (or pegged) exchange rate regime: Under this regime, a country's central bank commits to maintaining a specific exchange rate between its currency and a foreign currency, or a basket of currencies. The central bank buys or sells its currency on the foreign exchange market to maintain the peg. This regime can help provide stability and predictability in trade and investment, but it can also limit a country's monetary policy flexibility.

Floating (or flexible) exchange rate regime: In this regime, a country's currency is allowed to fluctuate freely against other currencies based on market forces of supply and demand. Central banks may still intervene occasionally to stabilize the currency or achieve other economic goals, but the general principle is that market forces determine the exchange rate. Floating exchange rates can provide more monetary policy flexibility and better absorb economic shocks but may be more volatile and susceptible to speculation.

Managed float (or dirty float) regime: This regime is a hybrid of fixed and floating exchange rates. The central bank allows the currency to float within a certain range or band, and intervenes in the foreign exchange market when the exchange rate approaches the limits of the range. This allows for some flexibility and stability but requires active management by the central bank.

Currency board arrangement: Under a currency board system, the central bank commits to exchanging its currency for a specified foreign currency at a fixed exchange rate. The domestic currency is fully backed by foreign currency reserves, which ensures that the peg can be maintained. This system provides exchange rate stability but severely limits a country's ability to conduct independent monetary policy.

Dollarization (or currency substitution): In this regime, a country officially adopts a foreign currency (usually a strong and stable currency like the US dollar or the euro) as its legal tender. This can help stabilize the economy by eliminating exchange rate risk and lowering inflation, but it also means that the country effectively loses control over its monetary policy.

Currency union: A currency union involves two or more countries adopting a single currency, such as the euro in the European Union. Members of a currency union share a central bank and a common monetary policy. This arrangement can help promote economic integration and stability among member countries, but it also requires them to coordinate their fiscal policies and can limit their individual monetary policy flexibility.

Each of these currency regimes has implications for geopolitics and how you interpret capital flows. For example, I would interpret the flows and price action of SARUSD (Saudi currency vs USD) and EURUSD very differently because one is pegged (SARUSD) and the other (EURUSD) isn’t.

Secondly, in the context of currency markets and the concept of the dollar's reserve status, it's important to differentiate between long-term structural dynamics and short-term cyclical fluctuations, as the latter may serve as an indicator of potential shifts in the underlying structure.

A simple example is the most recent monetary policy divergence where Legarde at the hiked 50bps last week and then Powell only hiked 25bps yesterday. This caused a bit of a rally in the Euro against the dollar. This was a shorter-term move that you would need to take into account or position for regardless of your structural view about the dollar.

So when I think about doing research on the dollar’s reserve status in the resources above, I want to make sure I connect that to the short-term catalysts and then my trading decisions.

Even if you think the dollar is losing its reserve status, it doesn’t mean you immediately go out and short the dollar. There are always short-term catalysts connected to cyclical dynamics.

In my opinion, I don’t see an imminent risk of the dollar losing its reserve status. There is anecdotal evidence that is usually extrapolated to the global system but if you want to see a currency being devalued, just look at the Turkish Lira:

That is what a currency collapse looks like, it’s not the DXY being down 3% on the week!

How do I think about currencies moving into the end of the year?

In my mind, we are beginning to see a much clearer trade-off between credit risk and inflation risk. So I will be watching the inflation risk and credit risk of each major country. As central banks begin responding to these risks, we are likely to see currencies express these monetary policy differentials.

Watching gold is important as well. There is a reason gold is rallying this week. Powell has dereased his hawkish stance which has caused real rates and the dollar to fall. This dynamic has pushed up gold to the 2k level. I think a breakout in gold to all time highs is on the horizon, we shall see though.

How do we keep track of all this stuff?

I am in the process of builing a lot of structured frameworks in Obsidian (2nd brain note takeing program). If you want an example of it, check out this guy’s blog, its truly amazing. My goal is to provide a structure of all the majory things to monitor in the market AND show how they relate to one another. I will share as much as possible with you guys so stay tunned.

Thanks for reading!