Interest Rate Strategy: POST FOMC Breakdown

How the comments by Powell are impacting interest rates

Interest Rate Strategy: POST FOMC Breakdown

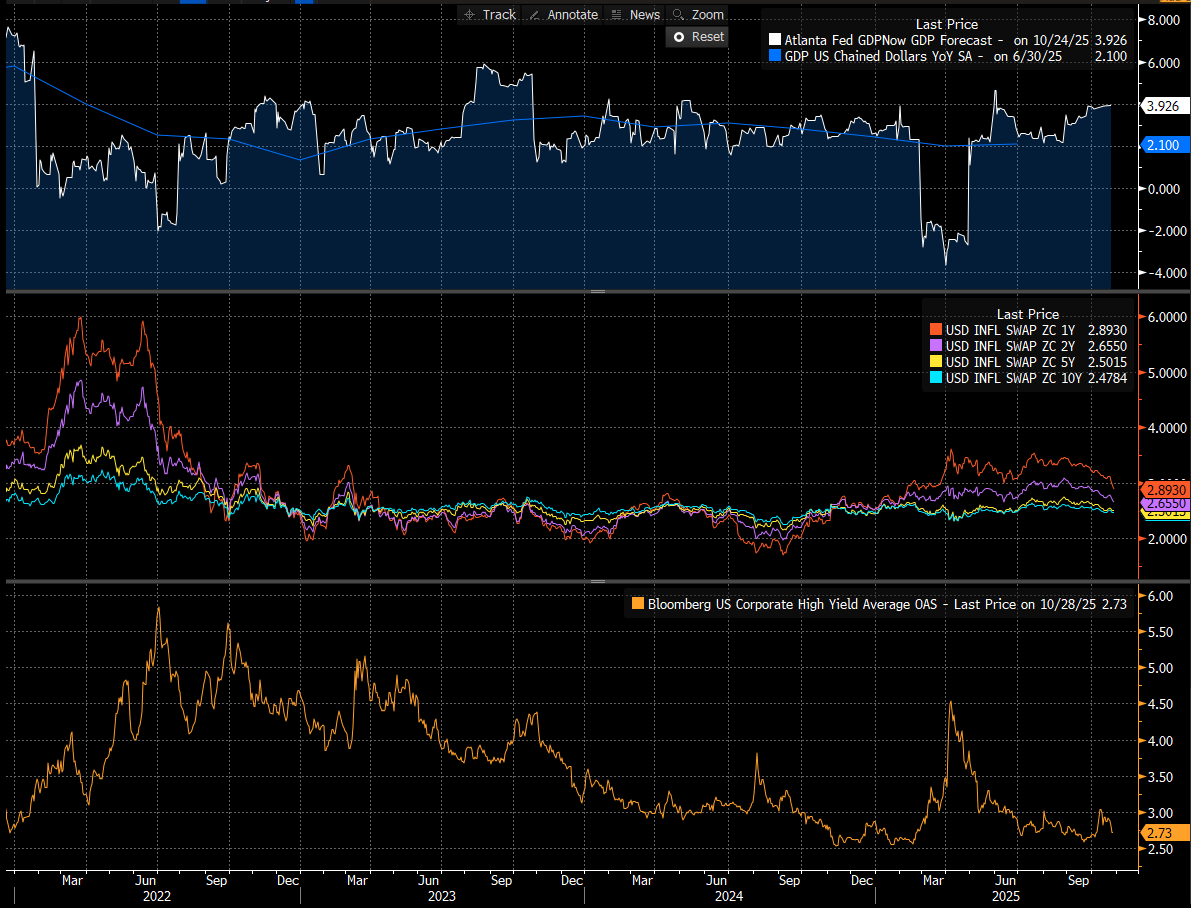

The global backdrop continues to sit firmly in a Goldilocks configuration, growth remains positive (panel 1), inflation continues to slow (panel 2), and financial conditions (panel 3) remain at cycle lows.

It’s a combination that markets have grown comfortable with, even as the rate-cutting cycle remains sticky and forward pricing has barely shifted over recent weeks.

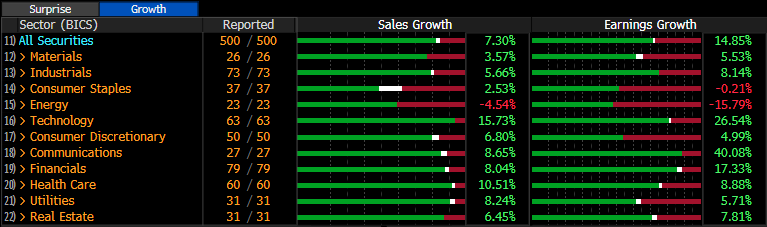

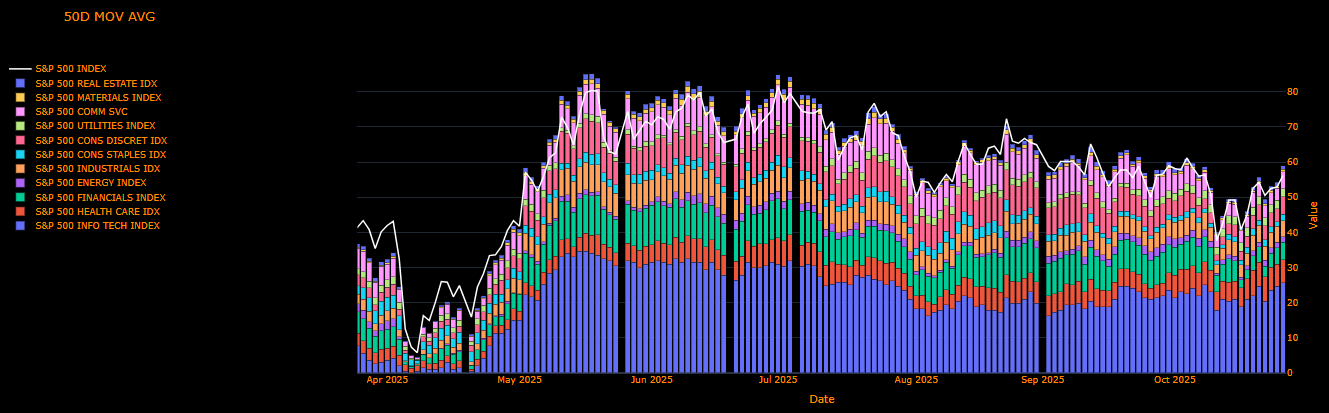

Growth has proven resilient. Activity data, earnings, all point to an economy that continues to expand without overheating. There’s little evidence yet of a loss in momentum seen in the breadth below. In other words, growth is positive and holding its ground.

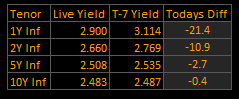

Inflation swaps have slowed materially and continue to decelerate at an accelerating pace. With both headline and core measures recently printing softer than expected numbers. These market-based gauges like the below inflation swaps (or breakevens) confirm that disinflation is broad and, importantly, expectations are anchored (see 5yr and 10yr measures. The market’s conviction that the inflation fight is largely won has strengthened.

Liquidity remains ample. Credit conditions are easy, high-yield spreads are exceptionally tight, and issuance flows remain healthy. Spreads continue to grind tighter relative to the past four years, clear evidence that the current easing impulse is still being transmitted through financial channels.

KEY IDEA: Policy has not been restrictive enough to impair credit creation or demand. Liquidity is circulating through the system rather than being trapped in the banking sector or the very front end of the risk curve. As a result, growth momentum remains positive (across the risk curve), supported by resilient credit transmission and strong buying pressure for risk assets.

Reflexivity is reinforcing the cycle. Easier financial conditions are feeding back into stronger growth and tighter spreads, which in turn validates the macro mix between growth, inflation and liquidity.

Trading Implications:

Inflation remains under pressure, and recent progress in trade negotiations with China reinforces the disinflation trend. Over the past week, 1-year inflation swaps have fallen 21 bps while 10-year swaps are down just 0.4 bps, near-term inflation expectations continue to ease, but long-term anchors remain stable.

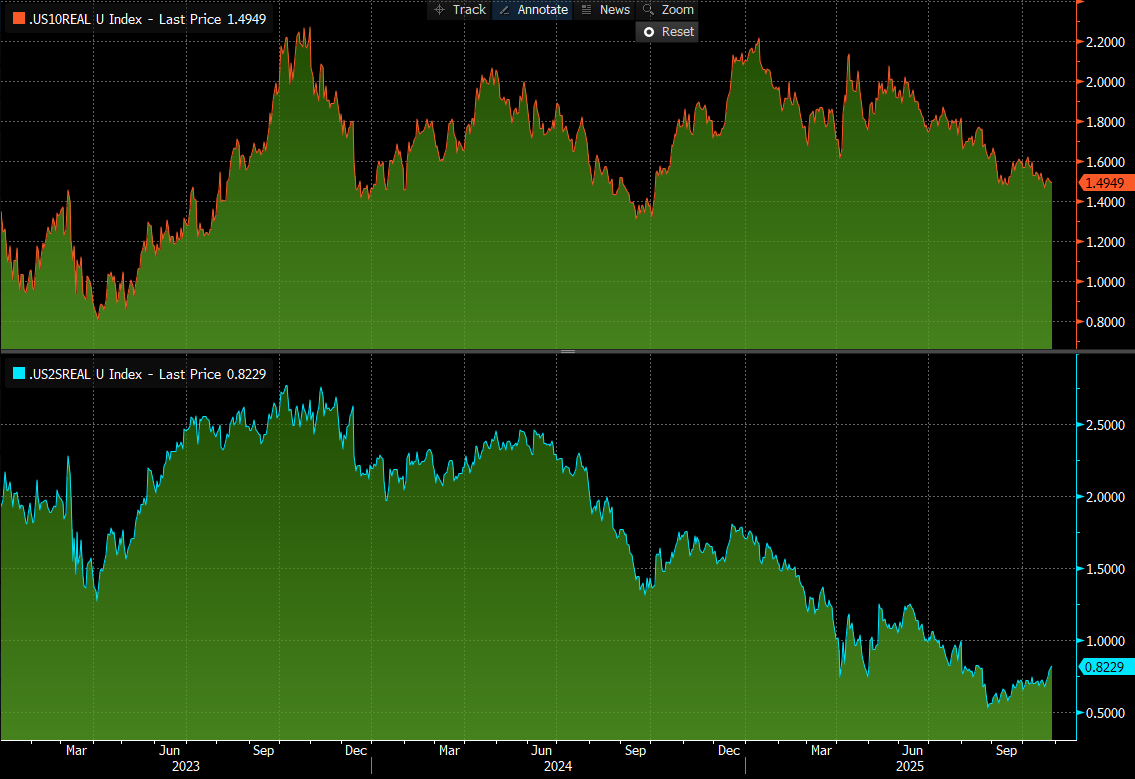

Markets, however, have likely priced excessive policy support for labor weakness that has yet to appear. With growth still resilient and inflation rolling over, the Fed can cut, but without the urgency. This keeps 2-year real yields rising while 10-year reals stay flat to slightly lower, producing a bear-flattening bias, liquidity tightening even as nominal activity remains solid.

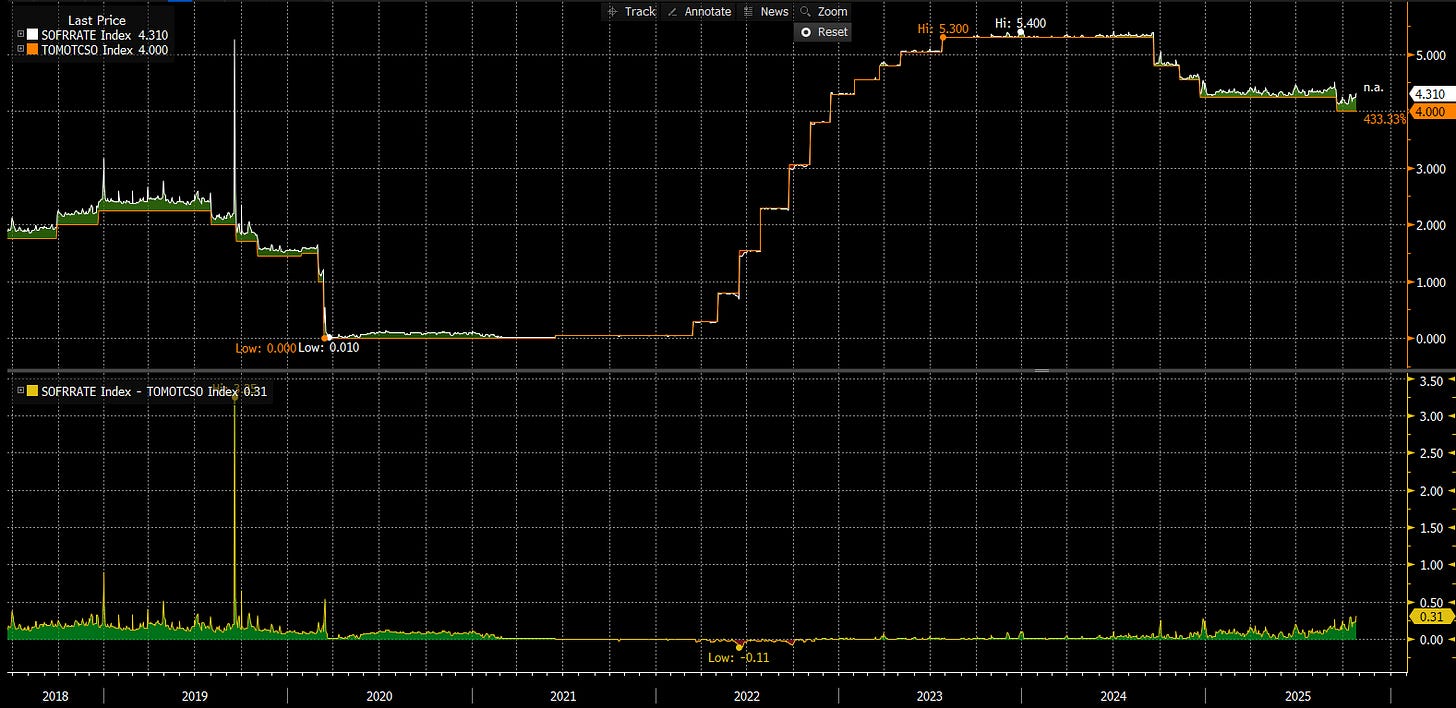

Institutional funding costs are creeping higher via the repo market, and reserves are edging lower. In the below we can see we are at the highest SOFR fixing in 5 years, but a far cry from ‘stress’ as seen in 2019. Liquidity remains ample but the marginal impulse is fading, suggesting a transition from the current regime to the next.

As all the above continue to play out while growth holds firm and policy remains cautious. My view is a bear-flattening bias as liquidity tightens at the margin.

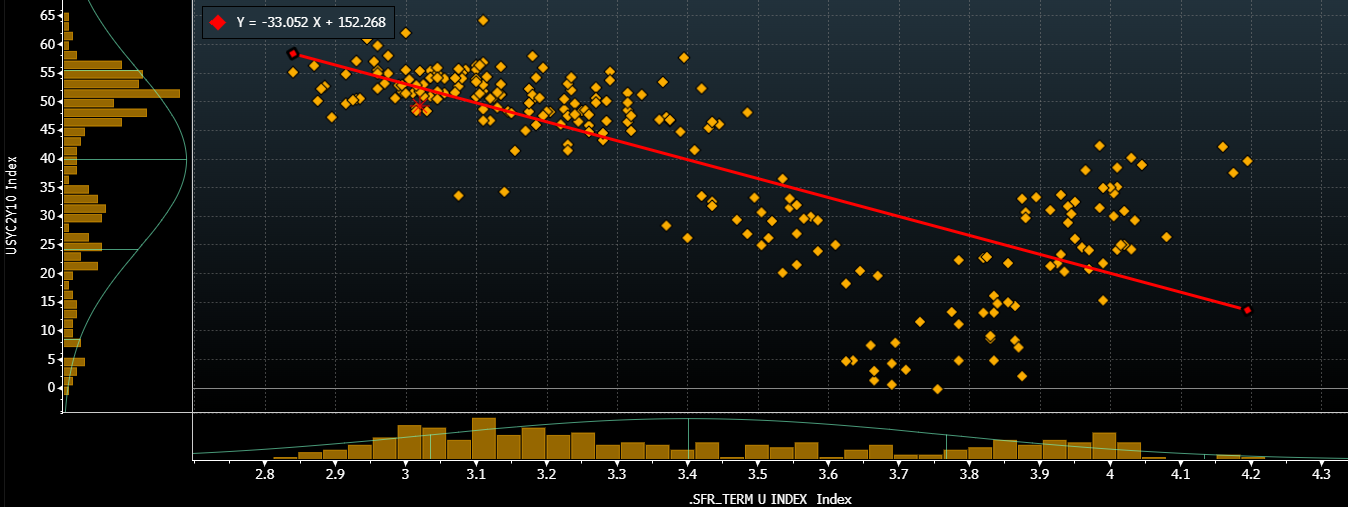

The core trade bias is to short 2yr and be long the 10yr, best expressed as 2s10s flattener. The move from the FOMC has confirmed the flattening. As a result, I will scale into a flattener throughout a pullback.

Continued flattening depends on the terminal rate holding above ~3.05%; if it reprices lower, the curve will re-steepen.

Pulling Things Together:

The comments by Powell today caused a marginal repricing in the probability of a cut in December, but the broader macro regime and constraints of the credit cycle remain intact. My view is that there is going to be a moment to get short equities and long bonds as the liquidity in the financial system becomes unsustainable. We are NOT at this point yet, and my view is equities remain skewed to the upside on a cyclical basis.

As I have told paid subscribers, when the regime shift occurs, I will be covering how my strategy is dynamically updating to in real time. Until then, short-term pullbacks remain buying opportunities in equities, and there are opportunities to trade bonds tactically.

Thanks

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.