Interest Rate Strategy: SOFR and Bonds

The pricing of the forward curve and why it matters for markets

Interest Rate Strategy: Macro

At the beginning of last week BEFORE we had the pullback in US equities, I made a very simple and clear point (link): ES was entering a short period of time where a pullback could occur, and IF it did, 6820 would be an excellent place to get long as we moved into the London session after any type of cash equity sell-off.

This happened almost perfectly as AMZN earnings came out Thursday and sold off after hours (see original report here: LINK):

It doesn’t matter if you caught the low last week or not; what matters is WHY it happened because that will determine HOW you should think about the drivers of markets this week.

MACRO DRIVERS:

There are three major drivers you need to understand to frame the risk-reward in markets this week. None of them exists in isolation. Each one is interacting with the other two, either amplifying or muffling the moves you are seeing across equities, rates, and global flows. If you understand these three drivers and how they connect, you will have a much clearer picture of what the market is actually pricing and where the asymmetry sits.

The AI Rotation Is Still the Primary Driver of U.S. Equity Price Action

The software-to-hardware rotation I laid out last week (Software: The Trade That’s Fooling Everyone) is still developing. The market is not in a risk-off environment. It is repricing who captures the economics of AI, and that repricing is mechanically dragging the S&P 500 because of tech’s outsized index weighting. We are roughly one-third of the way through S&P 500 earnings season, and many of the highest-impact reports are behind us, but the single most important catalyst for this rotation sits at the end of the month: Nvidia reports on February 26th. Until the market gets that print, the tension between hardware strength and software weakness will continue to define the trading range. Every earnings report between now and then is either going to confirm or challenge the dispersion framework. (see video where I explained this below)

AI Investment Is Keeping Long-End Rates Elevated

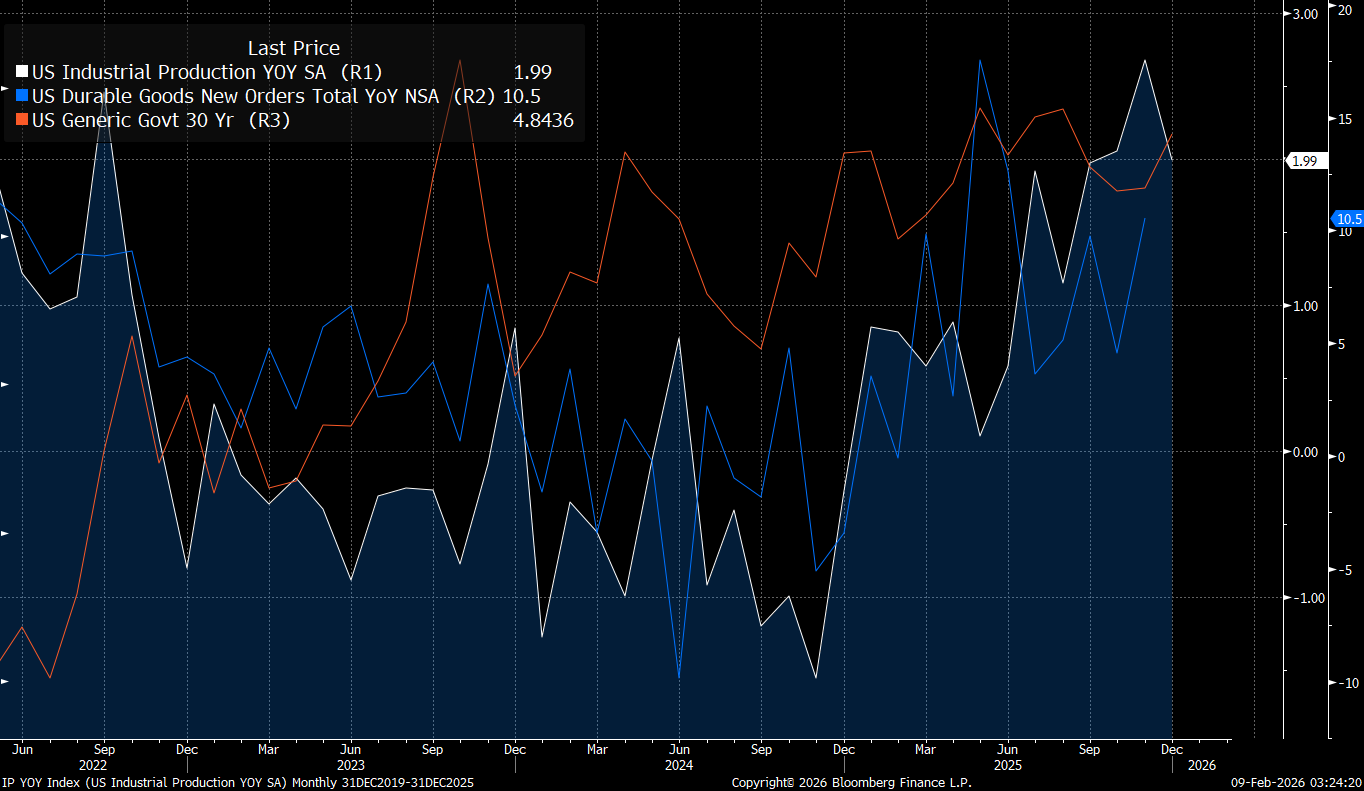

The AI theme is not just an equity story. It is an investment story, and investment requires capital. The historic CapEx cycle being driven by hyperscalers and AI infrastructure buildout is sustaining real economic activity, and that is showing up in the bond market. Long-end interest rates remain elevated, not because inflation expectations are running hot. Inflation swaps are actually lower than they were six months ago.

Rates are elevated because the economy is still absorbing a massive wave of capital investment, and the market is pricing the duration risk of that investment cycle rather than an inflation resurgence. This distinction matters for how you frame the software selloff. The rate environment is directly linked to investment, which is why long-end rates have moved in lockstep with the recent acceleration in industrial production and durable goods orders.

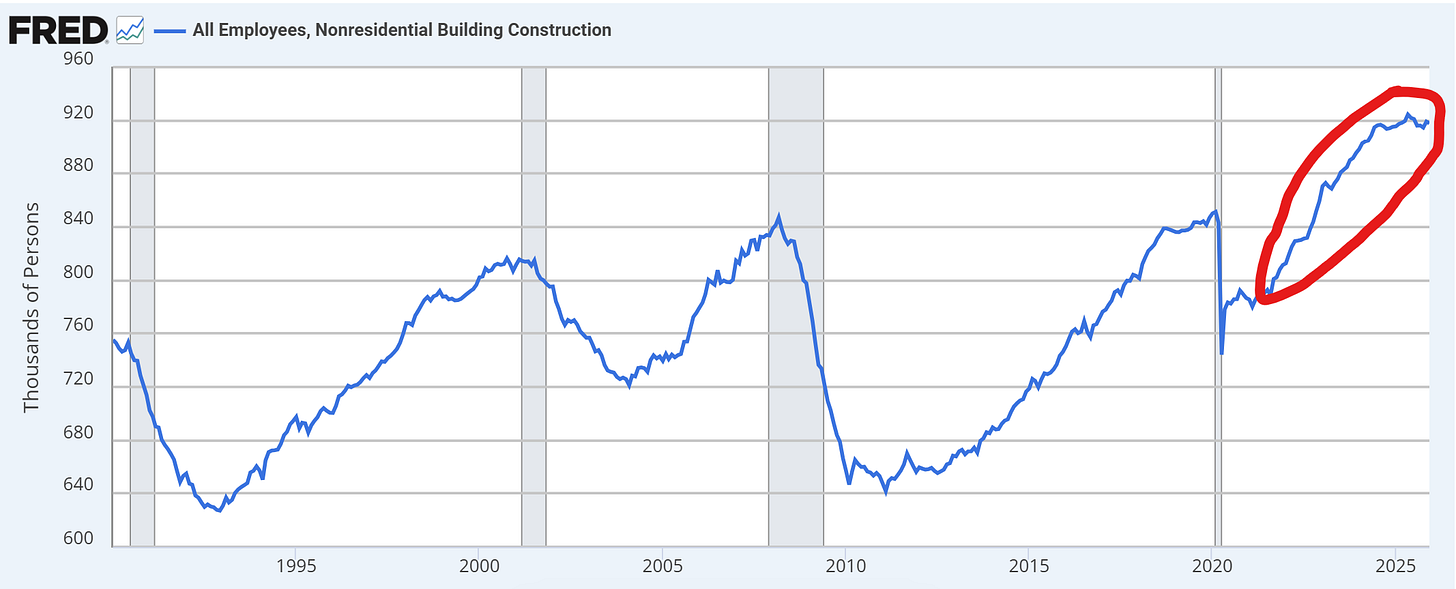

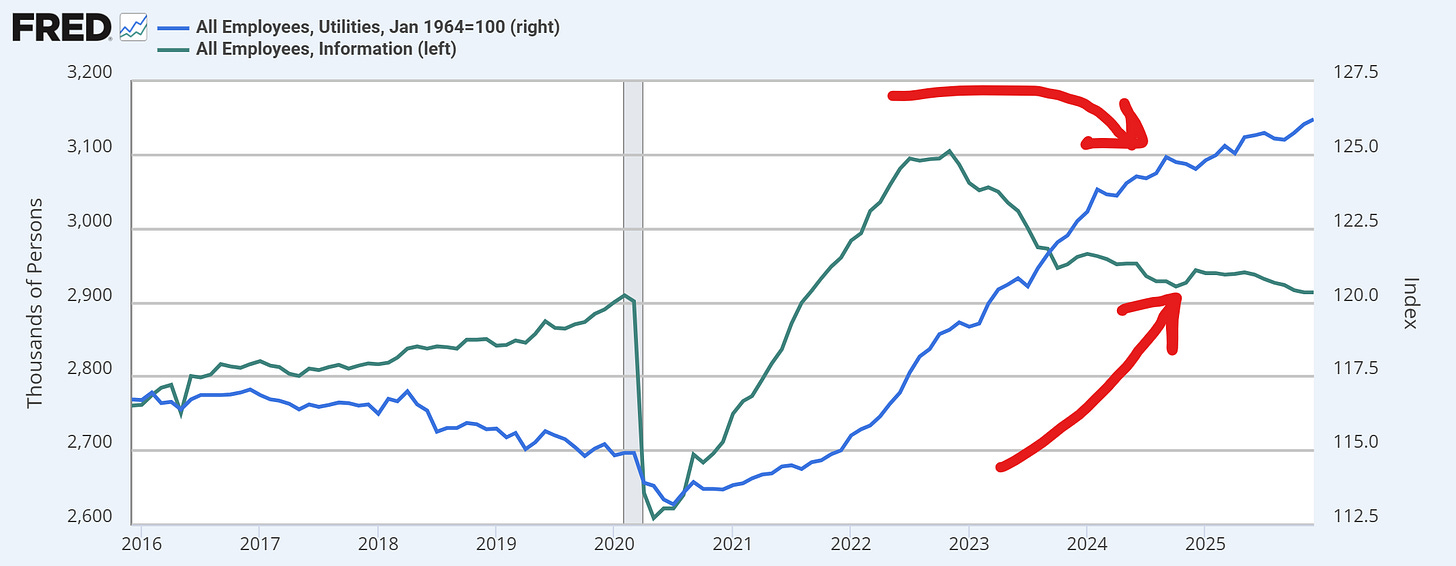

AI investment is accelerating a rebalancing of the labor market: workers displaced from sectors facing AI disruption are being absorbed into the sectors benefiting from the AI buildout itself.

The Japan Election Sweep Is a Positive Liquidity Impulse for Global Markets

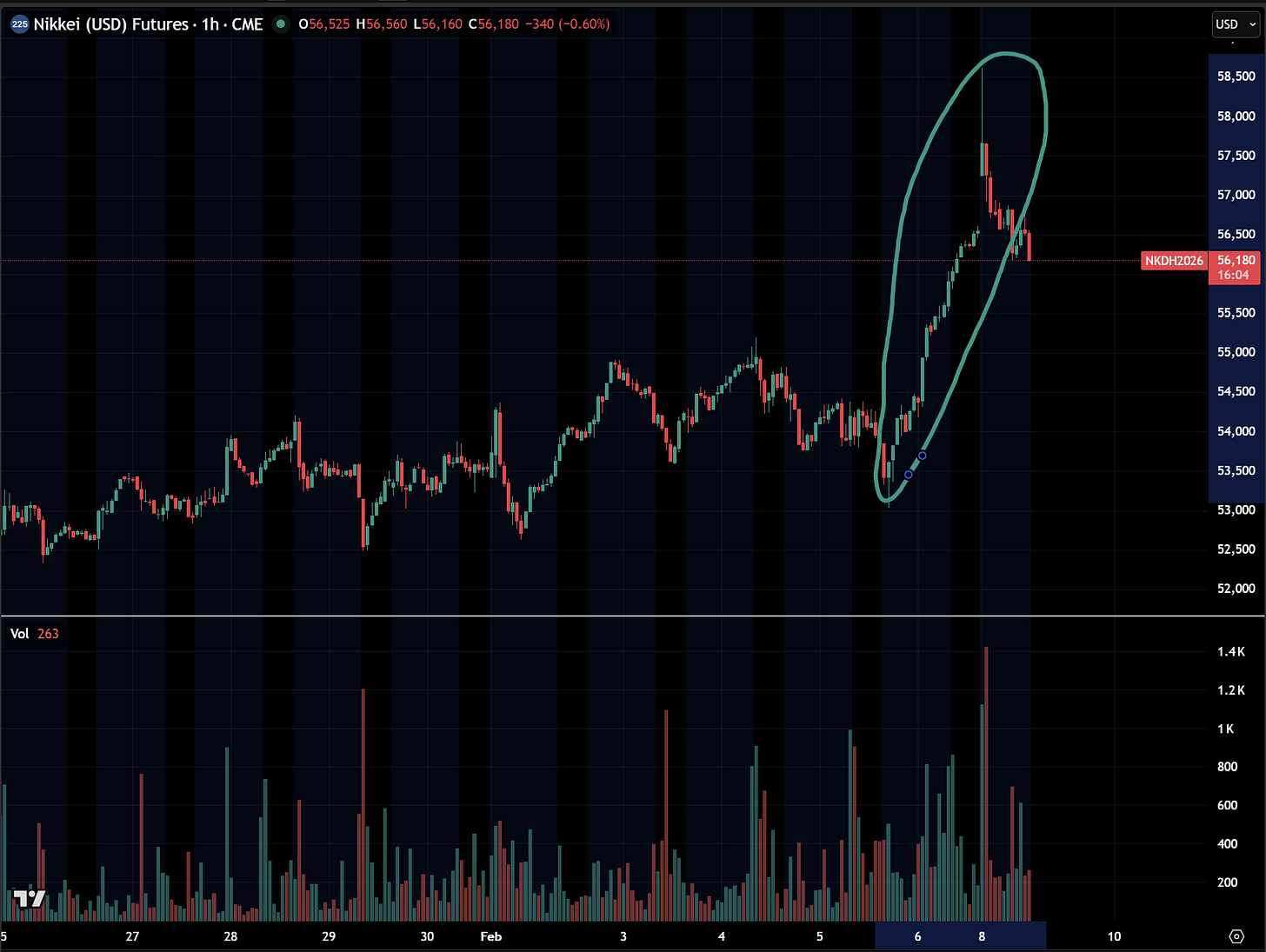

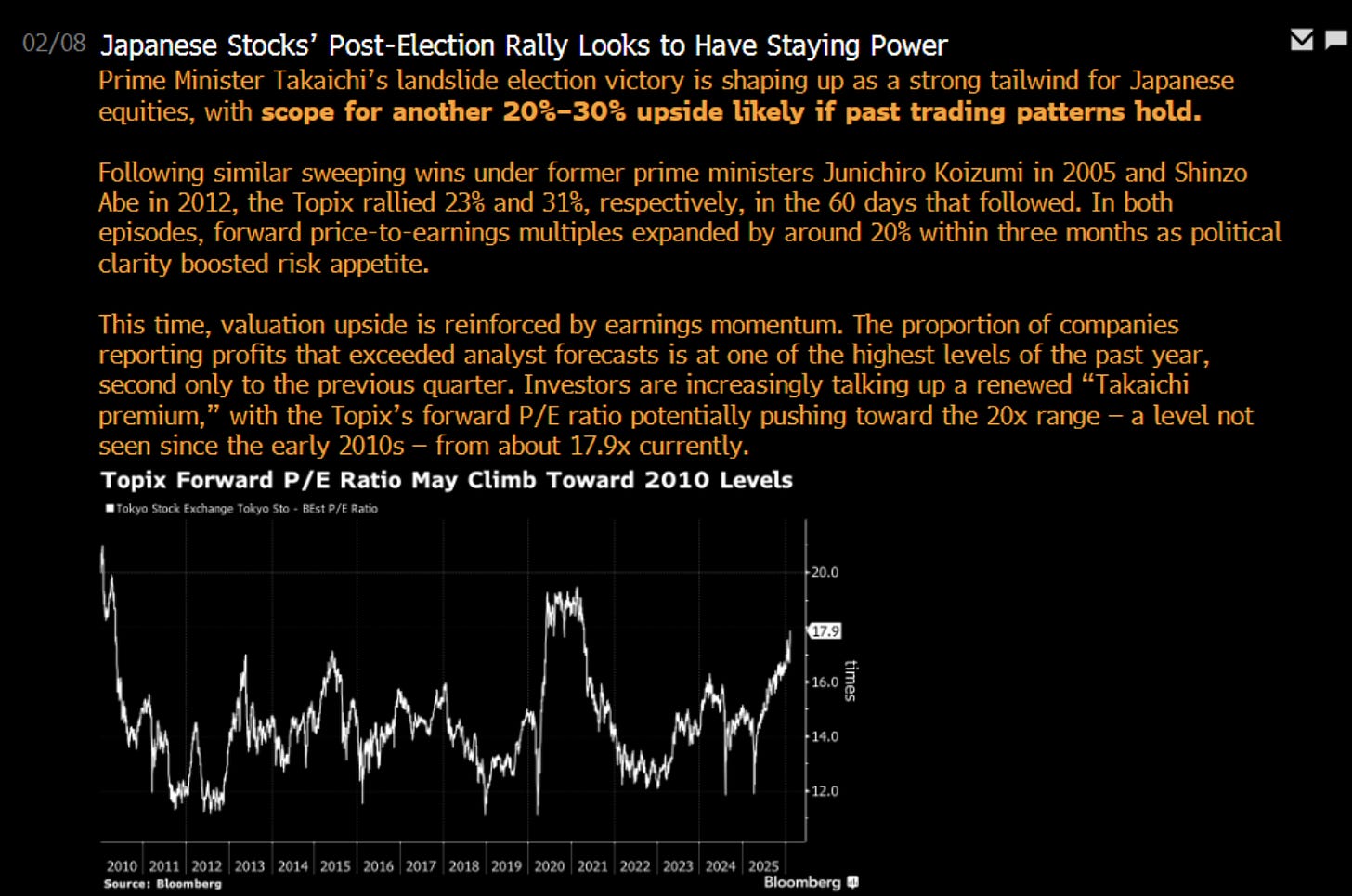

This is the driver most people are ignoring, and it may be the most consequential for near-term price action. Japan’s snap election delivered a historic supermajority for PM Takaichi’s LDP, with the party securing 316 of 465 Lower House seats, the largest single-party result since the LDP’s founding in 1955. This is the outcome I have been laying out as the highest-probability scenario in my recent videos on Japan (link) (link), and the market reaction was immediate.

Cash-settled USD-denominated Nikkei futures on the CME rallied on Friday while Japanese cash markets were closed, front-running the result. The Nikkei opened Monday up 5% to a new record high.

This matters for U.S. equities because the liquidity impulse out of Japan has been seeping into global risk assets for months. Takaichi’s mandate is built on proactive fiscal policy: record government spending, consumption tax cuts, and a multi-year investment framework that abandons the old single-year primary balance constraint. That is a sustained liquidity injection into the world’s fourth-largest economy, and it is running in parallel with a weakening yen that pushes Japanese capital outward into dollar-denominated assets. The Friday rally in U.S. equities did not happen in a vacuum. The combination of the Japan liquidity bid and the tech rebound helped set a near-term floor under U.S. indices at exactly the point where the software rotation had dragged the S&P 500 to the lower end of its mean reversion range.

If you are trying to understand the dynamics of the Yen, see the two videos I published here:

I would also encourage you to read everything by Weston Nakamura on Japan. He is following and trading the situation there better than anyone else.

Interest Rate Strategy: SOFR and Bonds

Each of these drivers directly link to and influence one another in a reflexive feedback loop. If you understand the framework I laid out above, then the interest rate analysis below will begin to set up how you should think about correlations, pricing of the SOFR curve, and bonds as we move into this week.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.