Kevin Warsh Will Engineer the Fed's Regime Change—And Reshape the AI Arms Race

Warsh will fundamentally change the global AI arms race, inflation, and government spending

Kevin Warsh Will Engineer the Fed’s Regime Change—And Reshape the AI Arms Race

The announcement of Kevin Warsh as the new Federal Reserve Chair signals a fundamental shift in both global monetary policy and the AI arms race. These two things are more connected than most realize. AI represents the single asymmetrical point of leverage for the future, and Warsh's appointment is designed to secure it.

Questions like “Will he cut rates?”, “Is he a hawk or a dove?” and “What will he do with the balance sheet?” are all important but miss the larger regime shift that’s already underway.

Understanding WHY Kevin Warsh was selected and HOW he fits into the new system will be the single most important factor heading into 2026.

Kevin Warsh, Stan Druckenmiller, Alex Karp, and Scott Bessent:

Warsh has long been connected to Druckenmiller, Bessent, and Karp at Palantir. Druckenmiller has consistently spoken highly of Warsh’s understanding of global capital flows and financial markets.

In his interview with Bloomberg, Druckenmiller referred to Warsh as his “trusted advisor.”

But the connection goes further, Druckenmiller is an early investor in Palantir and close with Alex Karp: (interview link)

Why does this matter? Because Kevin Warsh is directly connected to Palantir as well. Alex and Kevin recorded an interview in 2022 discussing how the world is heading toward more dislocation and complexity.

“Tomorrow will be a step function in terms of complexity”

The Palantir connection matters because the company is becoming the operational backbone of federal fraud detection. With 42% of its revenues from the US government, Palantir is being deployed across agencies to address excessive fraud and surplus government spending.

Why does this matter?

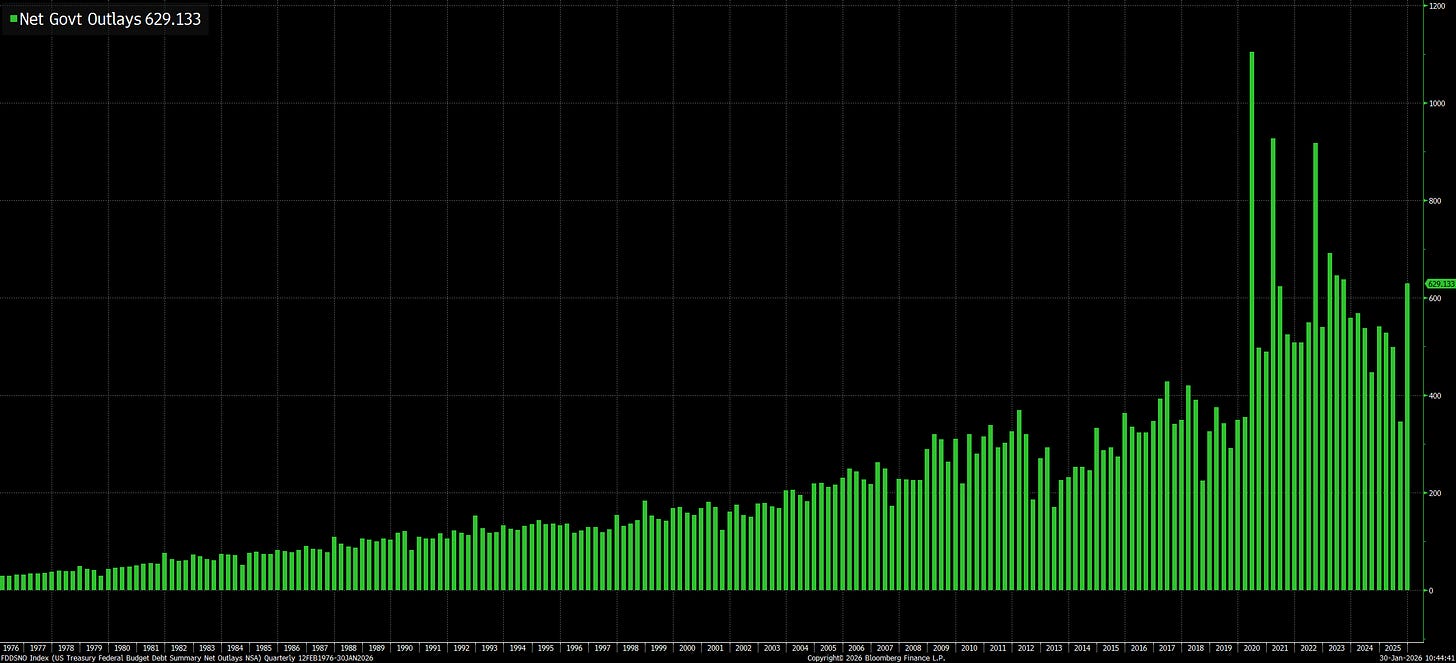

Because Palantir is being used to address all of the excessive fraud and the surplus of government spending.

SBA connection: LINK

Fannie Mae Connection: LINK

The link? The federal government is increasingly deploying Palantir’s fraud detection capabilities across many different domains.

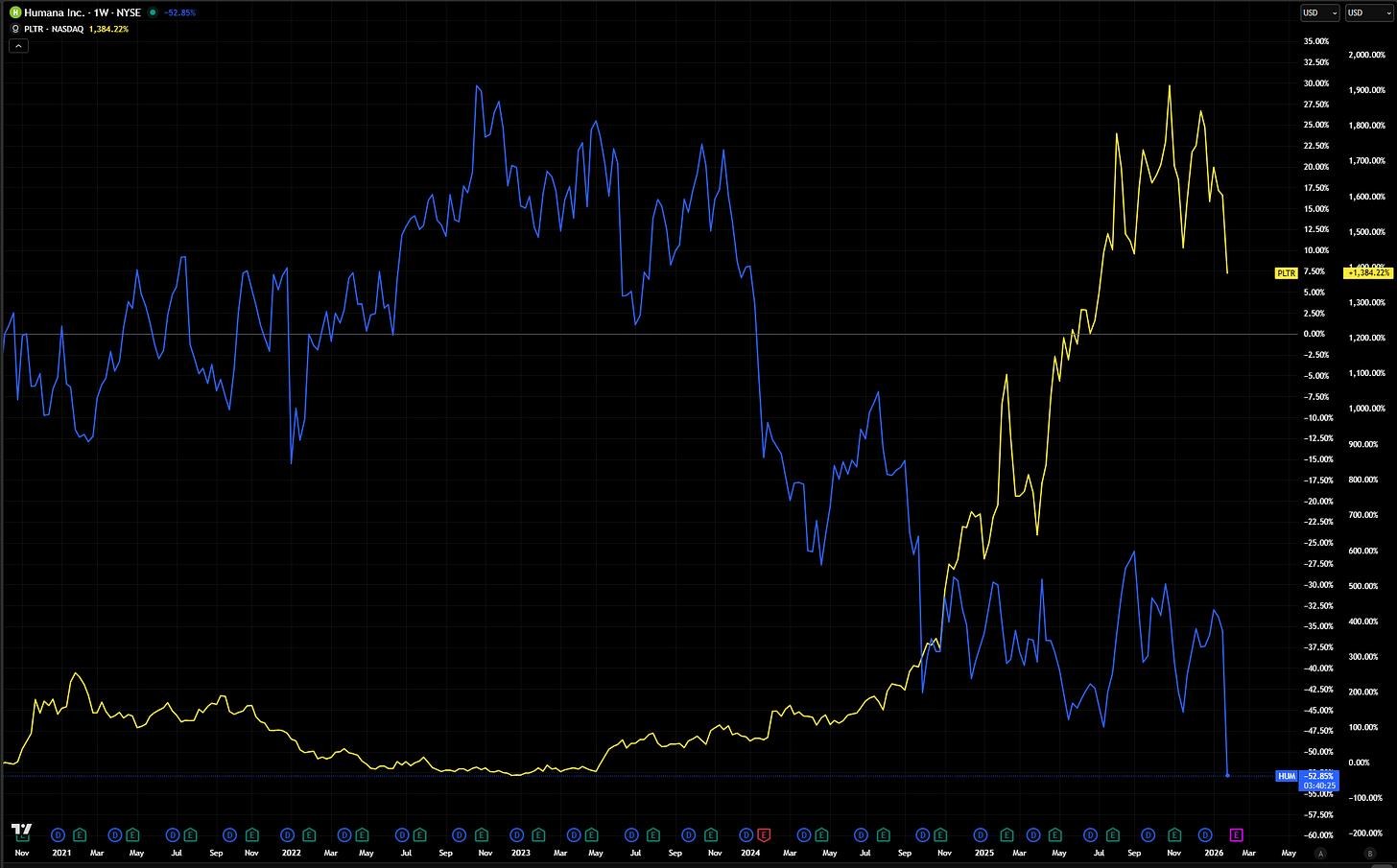

I think it is very interesting that Humana, which has the largest government contract in excess of $100b, has been collapsing ever since Palantir has been rallying.

Whether or not these two stocks are directly connected, the relative performance is worth paying attention to. Humana has built its business around the complexity of government healthcare reimbursement, complexity that has historically been difficult to audit at scale. Palantir is increasingly being deployed to bring transparency to exactly these kinds of programs.

The divergence may be signaling a broader market repricing: companies that benefited from opacity vs. companies that provide visibility. If AI-powered oversight becomes the norm across federal spending, this dynamic could play out across many sectors, not just healthcare.

Where AI and Inflation Meet

Warsh has been calling for “regime change” at the Fed for over a decade. But what does that actually mean?

It starts with a fundamentally different theory of inflation.

The dominant models at the Fed, the ones built in the 1970s and still in use today, assume inflation happens when the economy runs too hot and workers get paid too much. Warsh rejects this entirely. In his view, inflation happens when the government prints too much, spends too much, and lives too well.

This isn’t subtle. He’s said it explicitly:

This is the regime change. It’s not about hawk vs. dove or whether rates go up or down 25 basis points. It’s about rewriting the Fed’s entire framework, from one that blames workers and growth for inflation to one that holds government spending accountable.

And here’s where it gets interesting.

Warsh is also deeply optimistic about AI. In the same interview, he argued that AI is going to make almost everything cost less, and that the US is at the front end of a productivity boom. He believes the current Fed doesn’t see it, that they’re stuck in old models and mistakes economic growth for inflation.

So on one hand, Warsh sees AI as structurally deflationary, a force that will drive costs down across the economy.

On the other hand, he sees excess government spending and fraud as the primary source of inflation, money being pumped into the system without productive output.

These two ideas converge in one place: Palantir.

Palantir is the tool being deployed to cut fraud and waste across federal agencies, from the SBA to Fannie Mae to potentially Medicare. It’s AI being used not to generate inflation, but to eliminate the government inefficiency that Warsh believes causes it.

And Warsh isn’t just intellectually aligned with this vision. He’s personally connected to it via Druckenmiller, Bessent, and his direct relationship with Alex Karp.

This is the architecture of regime change: a Fed Chair who believes inflation is fiscal, a Treasury Secretary aligned on spending restraint, and an AI infrastructure company with deep government contracts positioned to enforce it.

The Macro Implications

This regime change doesn’t just reshape the Fed. It rewires the entire framework for understanding interest rates, the dollar, and global capital flows.

If Warsh is right that inflation is primarily fiscal rather than supply-driven, the traditional playbook breaks down. Rate cuts no longer signal dovishness. They signal confidence that spending discipline and AI-driven efficiency are doing the heavy lifting on inflation. The Fed becomes a partner to fiscal restraint rather than its adversary.

A Fed that refuses to monetize deficits while actively supporting fraud reduction and spending cuts creates a fundamentally different monetary regime than what markets have priced for the last decade.

And globally, this matters enormously. If the US demonstrates that AI can be deployed to enforce fiscal accountability at scale (cutting waste, identifying fraud, streamlining government operations) it becomes a model that other developed economies will either adopt or compete against. The AI arms race isn’t just about chips and models. It’s about who can deploy AI to restructure the relationship between governments and their economies first.

Then there’s the deflationary force of AI itself. Warsh has been explicit: he believes AI will drive costs down across the economy, that we’re at the front end of a productivity boom that the current Fed doesn’t see. If he’s right, we’re entering a period where the structural forces are deflationary (AI productivity gains) while the inflationary pressures are being targeted directly (government waste and fraud). That’s a fundamentally different investment environment than anything we’ve seen since the 1990s.

The old mental models (hawk vs. dove, rates up vs. rates down, risk-on vs. risk-off) won’t capture what’s happening. The question for 2026 isn’t where the Fed funds rate lands. It’s whether this coalition can actually execute on the vision.

Join Me Tomorrow

I’ll be going deep on all of these dynamics (interest rates, FX implications, the changing structure of the economy, and how to position for this regime change) in a live session for paid subscribers tomorrow morning at 11am EST.

In tomorrow’s session, I’ll cover:

How Warsh’s inflation framework changes rate expectations — so you know which fixed income positions are mispriced

The dollar implications of a fiscally-focused Fed — so you can position FX exposure ahead of the shift

Which sectors benefit from AI-driven fraud reduction — so you can identify the companies gaining government leverage

The timeline for regime change execution — so you understand when these shifts hit markets

How to structure a portfolio for deflationary productivity + fiscal tightening — so you’re not running the wrong playbook into 2026

Bring your questions. This one matters. (livestream link below)

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.