Macro End Game With Global Liquidity

How the fundamental structure of financial markets are shifting

Macro End Game With Global Liquidity:

Today I recorded a really good interview with Tyler Neville where we riff about all of the potential outcomes for the global economic system and how the fundamental structures in flows of capital are shifting. These types of conversations are rare in today’s world because everyone is trying to put together the perfectly produced podcast, which never leaves room for creativity and serendipity.

What I wanted to do in this report is expand on the bigger picture things we are seeing develop and share my thoughts into HOW I believe things are changing as they tangibly relate to trading markets.

Macro Liquidity In A World Of Globalization:

One of the most influential books in my thinking for macro liquidity is Trade Wars Are Class Wars because it explains how cross boarder capital flows are directly linked with the import/exports of goods and services, as well as deficits countries like the US run.

MAIN THESIS FROM THE BOOK:

Globalization, as framed in Trade Wars Are Class Wars, redistributed labor and capital across borders in ways that exacerbated income inequality and created structural imbalances in the global financial system. Surplus countries like China and Germany suppressed domestic consumption and wages to drive export-led growth, generating persistent current account surpluses. These surpluses translated into cross-border capital outflows—mostly into U.S. assets—forcing deficit countries like the U.S. to run large current account deficits and accommodate foreign savings via credit expansion. This recycling of global imbalances inflated asset prices and credit markets, boosting macro liquidity. However, it also tethered domestic monetary conditions to external capital flows, weakening the link between domestic fundamentals and financial conditions, and amplifying vulnerability to sudden shifts in global liquidity or trade dynamics. In essence, macro liquidity became less a function of internal policy and more a reflection of asymmetric global capital flows driven by mercantilist policies and suppressed domestic demand abroad.

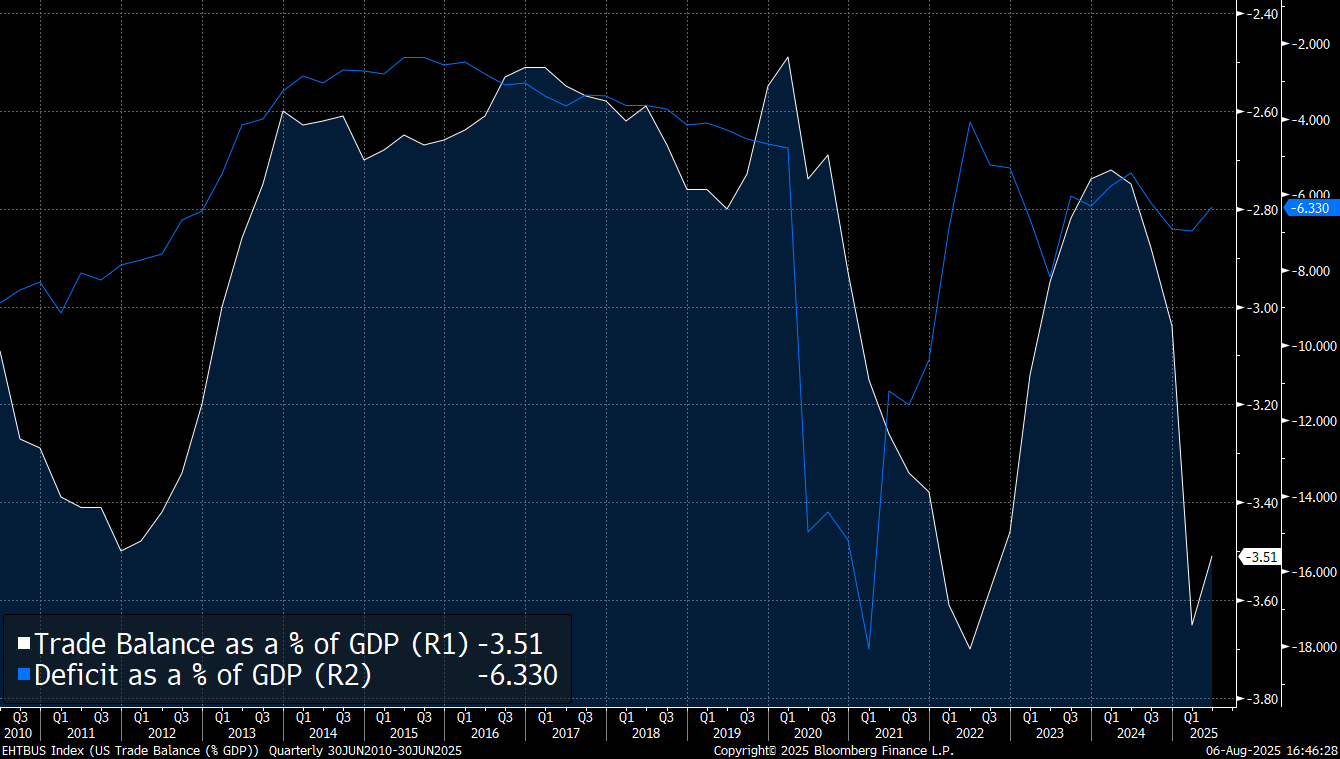

This is why when we have large moves in the trade balance, deficit, and actions by the Fed at the same time, it creates a massive liquidity impulse. Think about 2021 when the US ran a massive deficit due to government spending, imported a ton of durable goods, and the Fed was increasing reserves. All of these factors came together to create one of the largest melt-ups in history.

When countries export goods and services to the U.S., they receive payment in dollars, creating a surplus of USD in their economies. Rather than converting these dollars into local currency and driving domestic inflation, many exporting nations—especially those with managed exchange rates or surplus-driven growth models—recycle the dollars back into U.S. financial assets like Treasuries or corporate debt. This cross-border capital flow supports U.S. asset prices and suppresses interest rates, effectively linking global trade dynamics with U.S. macro liquidity. Thus, the trade of goods and services drives financial flows that deepen the global dollar system and shape domestic monetary conditions.

Does it begin to make sense WHY the tariff dynamic earlier this year impacted macro liquidity and caused equities to sell off? A change in the flow of goods and services is, by definition, a change in the flow of capital across borders.

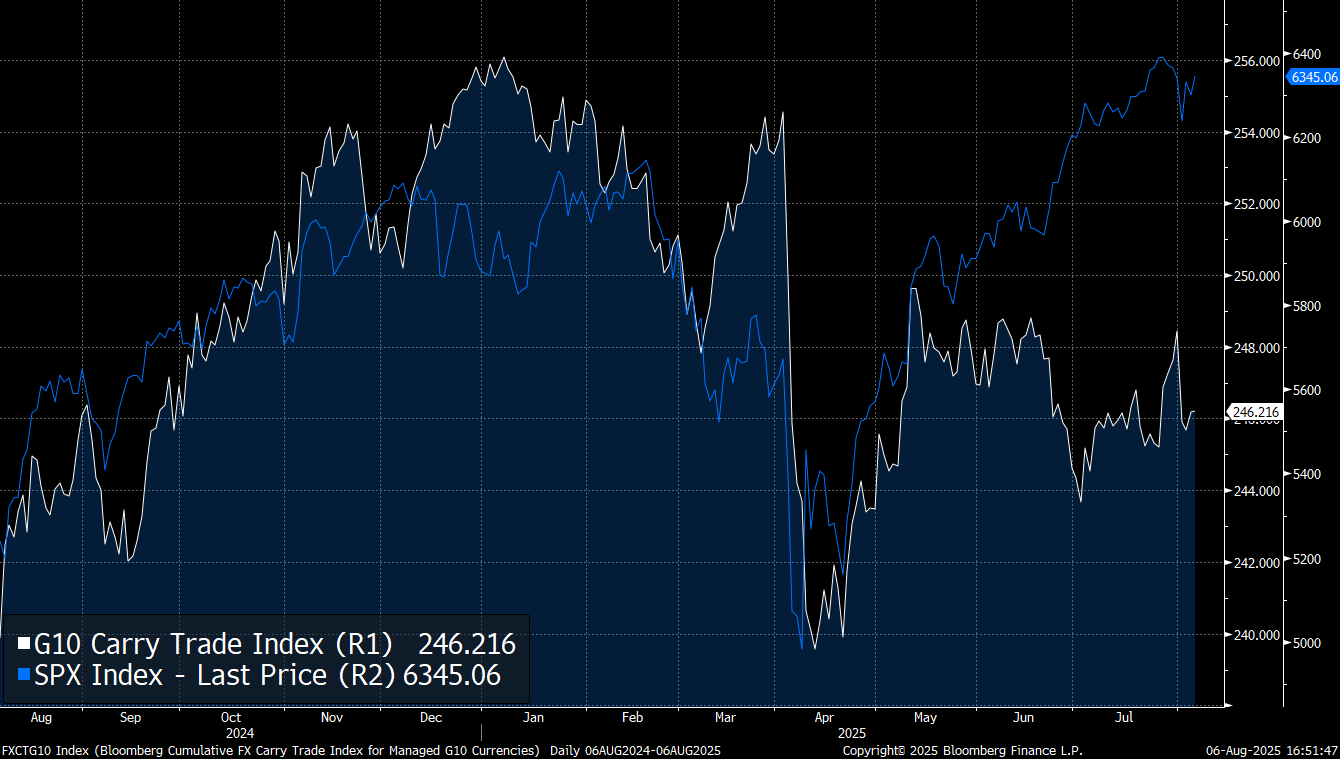

This is WHY the carry trade index collapsed with equities in Q1. A change or even the potential for change in the flow of any good or service shifts how the assets and currencies around those goods/serivces price risk and uncertainty.

The important implication to take away from this is that financial markets and underlying companies in each economy that produce the goods and services reflected in GDP are inherently linked.

Why Does This Matter For Crypto and High-Risk Assets?

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.