Macro Insights/Report: AUDJPY Update and CPI

Failed to breakout

Almost a month ago I brought attention to the situation lining up with AUDJPY:

Since then, AUDJPY has held the level and moved down:

This is key for the TYPE of macro regime we are in. It remains one driven by the liquidity impulse from bonds, specifically the real rate side.

Real rates have come off their high and have been one of the primary drivers of risk on flows:

XCCY continues to show ample dollar liquidity:

And the only currency we are seeing a spike in implied vol with is the Yen. This makes sense given the actions of the BoJ:

But the question is, how long will this TYPE of price action continue? The answer to this is dependent on the inflation situation and FOMC tomorrow.

YoY Core CPI came in line with expectations:

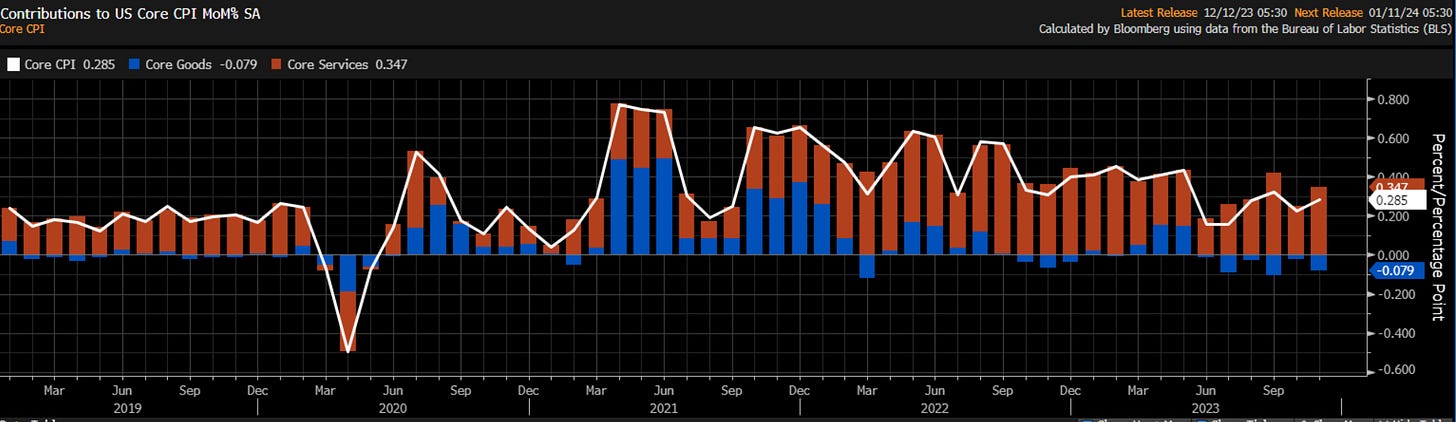

But MoM came in above expectations:

Why does this matter? Well, it matters because the bond market is pricing rate cuts for Q1 of 2024:

I have laid out my views on this in the macro report (link) but I think this is unlikely. Perhaps we get cuts in H2 of 2024 if inflation falls enough.

Remember the cyclical regimes that have taken place: in 2021 we had extremely negative real rates. Then we had the opposite extreme in 2022. Then 2023 showed normalization (see my talk on it here: link). Moving forward we are likely to fall between the two extremes of 2021 and 2022.

All of us know that the extremes are what get the most attention in the media but in reality, it is the incremental shifting of probabilities that need to be monitored and traded.

So, what will Powell say tomorrow? He is likely going to present a very balanced view between the risks of inflation and recession like last time. Why? Because that is the economic situation.

My Bias:

I share the full analysis of trades with paid Subscribers but here is what I will say, we are very close to the bond long. We are at the marginal change in the cycle but we just need to see the dominant impulse in markets to shift.

I don’t typically believe in “generational buying opportunities” except when there is clear liquidation. Why? Well because it is only a generational opportunity in hindsight. When acting under uncertainty with foresight, you always need to be ready to take off a trade. This is why even when the bond long comes, it will still require proper risk management.

This is why having comprehensive cycle strategies and redundancy planning for allocation is critical, especially when trading in size. If you want to chat more about this, feel free to send me an email: Capitalflowsresearch@gmail.com

Thanks for reading!

Excellent insights. Can’t afford a subscription yet but hopefully soon.