Macro Insights/Report: The UK and GBP

Macro analysis of the Pound and UK Rates

The interconnectedness in global markets and the necessity of understanding the FX and rate complex across major countries continue to hold outsized importance in this macro regime. Most participants in markets focus solely on the United States and even if you are running strategies outside the US, the siloes of knowledge are high.

Several weeks ago I shared an entire spreadsheet of resources for analyzing the United Kingdom:

Rigorous research sets the foundation for exceptional execution

The UK:

The growth and liquidity differentials between the US and UK exemplify WHY we are seeing differentials between these countries’ short rates, long rates, and exchange rates.

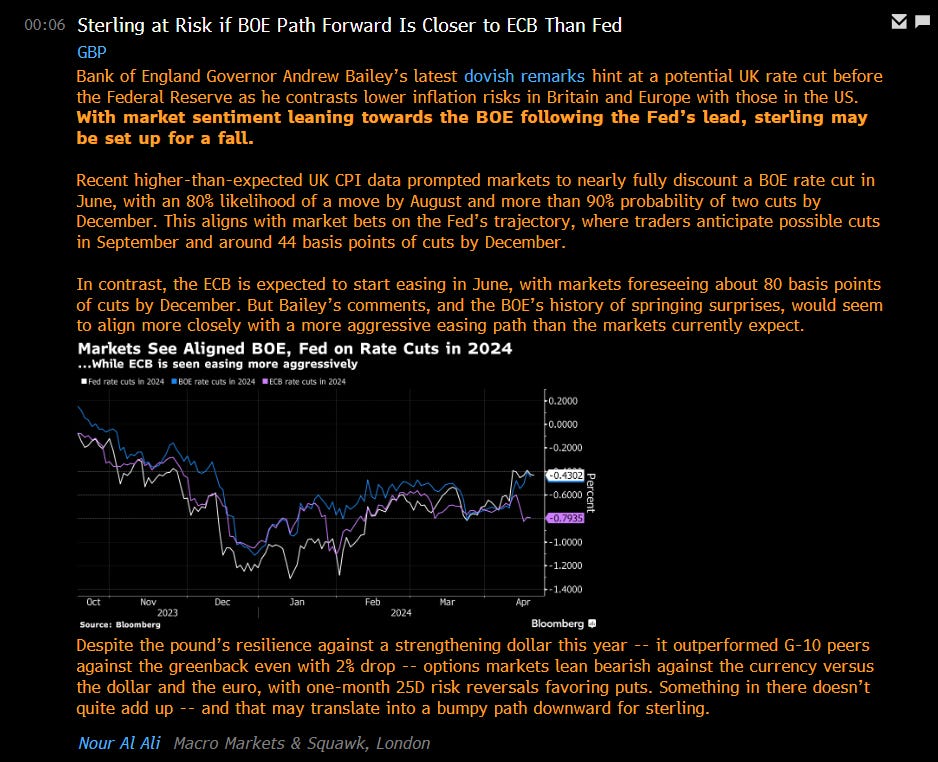

While there are marginal changes that people are focusing on between the meeting dates and respective forward curve pricing between the Fed, ECB, and BoE, I want to zoom out a little more:

US nominal GDP is running at 5.1% with real running at 3.4%. UK nominal GDP is negative -0.2% and real is running at negative -0.3%. As I have stated multiple times in macro reports, growth sets the preconditions and skew for how the path for inflation is likely to develop.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.