On May 2nd I sent a Tweet saying I “punted” some GME 0.00%↑ calls. The term “punt” is a technical term that can be found in the CFA study guide for level 3.

Well here is where we are now:

So I am going to breakdown how you should think about Bitcoin, meme stocks, and short squeezes from a macro liquidity perspective.

Macro Liquidity:

First, I provided a full breakdown of how macro liquidity works here:

Bitcoin Strategy: The Macro Liquidity Release Valve

Welcome to the promised report on how to analyze and trade Bitcoin. The difficulty of operating in today’s world is not primarily one of obtaining data but more about thinking and interpreting data correctly. On top of this, your interpretation of the data must correctly align with the temporal tensions that exist. This is why I always say:

The main idea is that when macro liquidity is increasing then capital moves down the risk curve. As I noted in the BTC article, you want to watch how all sectors and factors are correlating. Notice that the short interest factor is up the most today. This means that positioning for shorts is getting squeezed BIG TIME.

Think about it like this, when you are in a bull market, the last thing you want to do is have short exposure. When dispersion increases or we move into a bear market then shorts pay. It is the regime shifts between these states that cause positioning to get caught offside.

There is a reason that the short interest factor and BTC have a correlation. While Bitcoin has outperformed the short interest factor over the last 6 months, the risk on/risk off moves are still in lockstep.

Why do these move in lockstep? Because they are both impacted by macro liquidity. This is where “stacking edges” come into play. If I can get the macro backdrop correct and then further refine it to a specific sector or factor, then I can increase my risk/reward ratio.

I have laid out all the macro views on growth, inflation and liquidity here:

Week Ahead, Alpha Trades, and Macro Report

We are going to cover a lot in this article but I want to start on an important point. Over the weekend, I spent a lot of time reflecting on the risks in society as a whole and how they are specifically reflected through various sectors. This is one of the reasons I did the podcast on “

There is already excessive focus on the short squeezes across sectors right now. The idea behind this is that if the trash sectors of the market are squeezing, it means there is a lot of support for the quality parts of the market.

On a separate note, any trader worth their salt, is getting out of positions once it hits the top stories on Bloomberg. None of us are getting into positions now. Retail is notorious for being exit liquidity for big money. This is 100% the fault of retail.

Expression of macro liquidity:

With this as a frame of reference, here is the risk-reward of BTC I have shared over and over (link):

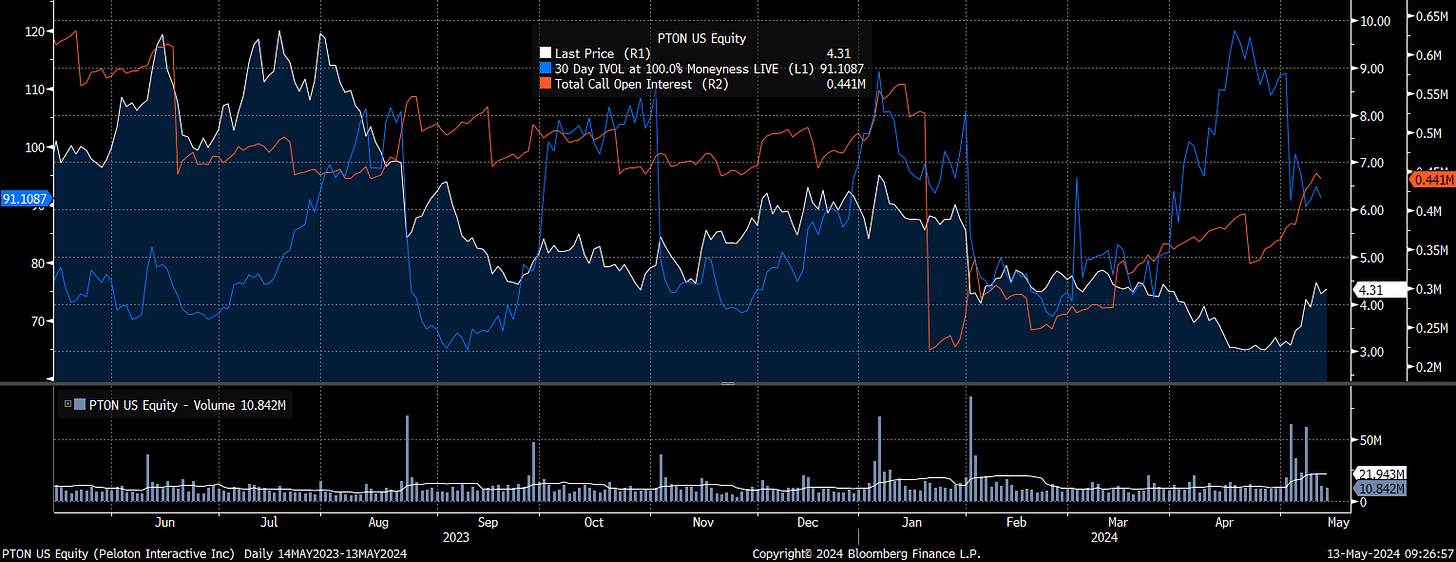

On the PTON 0.00%↑ front, 15% of the float is still short:

Call open interest is climbing and if implied vol blows out, it will expand the probable outcome being priced and constrain market makers to buy more stock to hedge to deltas.

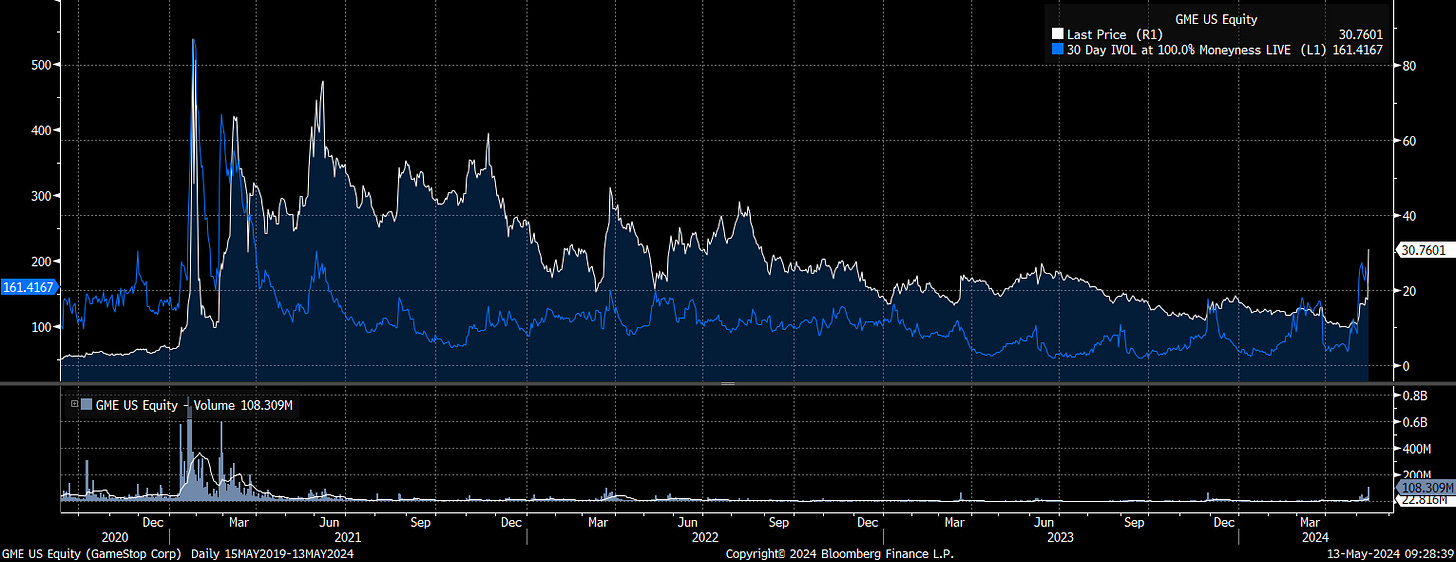

On the GME 0.00%↑ situation, just recognize we could actually blow out in implied vol. We are nowhere near a real capitulation to the upside.

When you have guys like this posting about GME 0.00%↑ it is very possible that we blow out to $50. However, just recognize, it is guys like this that are dumping their bags right now. They aren’t getting long at these levels.

Bring it HOME!

Does any of this feel like 2021? How is it possible since rates are so much higher? The reason is that the QUANTITY of money has risen. On top of this, nominal growth is running hot right now. Liquidity in the system + high nominal growth = a lot of capital moving into the financial system and pushing capital down the risk curve. Just look at the chart of bank reserves:

I will end with this, everyone is focusing on all the news headlines right now. No one is preparing themselves for interpreting the next macro regime. Real traders are always focusing on what is NOT in the headlines and what is likely to happen next.

If you feel completely new to all of this, check out this podcast I did on learning:

Reading, Research and Being Exceptional

Hello everyone, I recently shared a tweet of my workspace/library: https://twitter.com/Globalflows/status/1762198934469153012 At your request, here is the breakdown of how I think about reading and research:

For now, we are bullish

I am unable to share that

However, you’re basically breaking down all sources and netting them out. See conks and Prometheus for this

A motive (in case people inside TRW also reading Capital Flows wanted to know...)

https://rumble.com/v4uvhh0-emergency-meeting-episode-51-i-like-the-stock.html?utm_source=newsletter&utm_medium=email&utm_campaign=Tate%20Speech%20by%20Andrew%20Tate