Macro Regime Tracker: Equity Rally Is Coming

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

See macro videos I recorded today here:

Main Developments In Macro

*FED: PRICES INCREASED AT MODERATE PACE SINCE PREVIOUS REPORT

*FED: EMPLOYMENT LITTLE CHANGED SINCE PREVIOUS REPORT

*FED: US ECONOMIC ACTIVITY HAS DECLINED SLIGHTLY

*FEDERAL RESERVE RELEASES BEIGE BOOK OF US ECONOMIC CONDITIONS

*TRUMP: DEBT LIMIT SHOULD BE ENDED TO PREVENT ECON. CATASTROPHE

*TRUMP: NEED DEFINITIVE ANSWER FROM IRAN SOON

*TRUMP: IRAN HAS BEEN SLOWWALKING THEIR DECISION

*TRUMP: PUTIN SUGGESTED HE'D PARTICIPATE IN IRAN TALKS

*TRUMP: DISCUSSED IRAN WITH PUTIN

*TRUMP: PUTIN SAID HE'D RESPOND TO UKRAINIAN ATTACK

*TRUMP: PUTIN CALL LASTED 1 HOUR 15 MINUTES

*TRUMP: JUST SPOKE TO PUTIN

*LUTNICK TESTIMONY TO SENATE PANEL ENDS

*LUTNICK SAYS LOOKING AT IMPACT OF CHINESE SHIP FEES ON EXPORTS

*SENATOR GRAHAM PRESSES LUTNICK ON CHINA BUYING RUSSIAN OIL

*LUTNICK SAYS HE WAS IN TRUMP MEETING WITH GERMAN AUTO COMPANIES

*LUTNICK: STEEL TARIFFS JUST A COST ISSUE, NOT AN ACCESS ISSUE

*LUTNICK: TRUMP CHOSE IEEPA BECAUSE IT'S QUICK, SWEEPING

*LUTNICK: 'NOW WE'RE TALKING' IF VIETNAM DOESN'T BUY FROM CHINA

*SPEAKER JOHNSON REITERATES JULY 4 TAX BILL DEADLINE WILL BE MET

*LUTNICK IS ASKED WHAT US WOULD DO IF VIETNAM DROPS ALL TARIFFS

*LUTNICK: WOULDN'T REMOVE TARIFFS, BARRIERS RECIPROCALLY

*SPEAKER JOHNSON: CALLED MUSK LAST NIGHT, HE DIDN'T ANSWER

*SPEAKER JOHNSON: MUSK IS 'DEAD WRONG' ON TAX BILL OPPOSITION

*SPEAKER JOHNSON: MUSK SAID MONDAY HE'D HELP GOP KEEP THE HOUSE

*LUTNICK: WE WILL PROTECT US AEROSPACE INDUSTRY, CITES 232

*LUTNICK TOUTS SECTION 232 PROBES

*PUTIN SAYS UKRAINE'D USE CEASEFIRE TO GET WEAPONS: TASS

*BESSENT TO TESTIFY BEFORE HOUSE PANEL JUNE 11: PUNCHBOWL

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

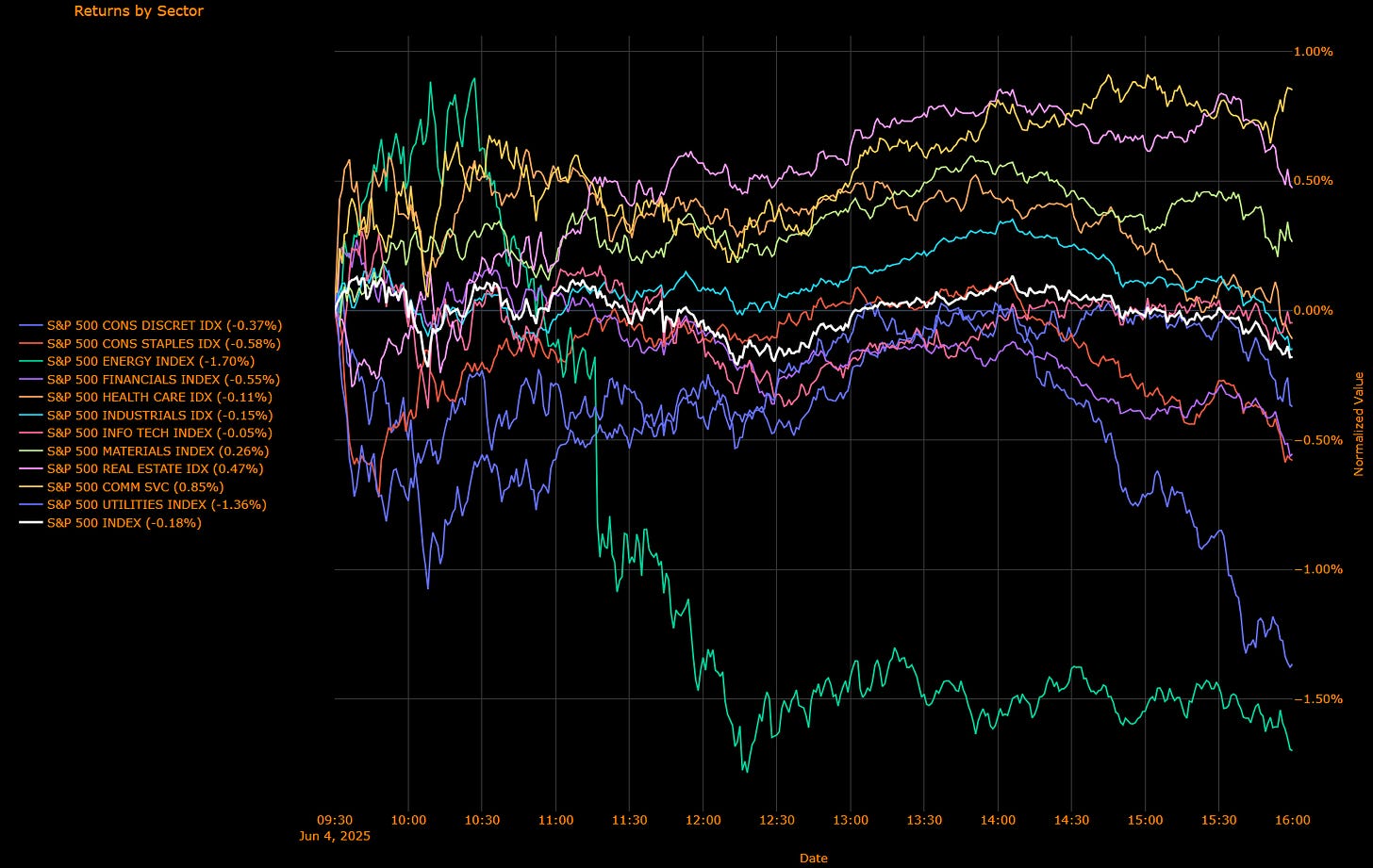

S&P 500 Declines -0.18%, Energy and Utilities Drag; Communication Services Defy Weakness

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Communication Services (+0.08 pp) – Sole positive contributor, buoyed by investor rotation into defensive positioning amid broader market caution.

Materials (+0.01 pp) – Minimal positive impact, reflecting modest resilience amid economic uncertainties.

Real Estate (+0.01 pp) – Slight positive contribution, driven by yield-oriented appeal amid declining bond yields.

Health Care (-0.01 pp) – Slight negative impact, marginally affected by mixed investor sentiment.

Industrials (-0.01 pp) – Modestly negative, reflecting cautious investor outlook following weak economic data.

Utilities (-0.03 pp) – Negative contributor, impacted by broader defensive sector underperformance.

Consumer Staples (-0.03 pp) – Marginally negative, reflecting reduced investor appetite despite sector's defensive qualities.

Financials (-0.08 pp) – Dragged lower by declining yields and heightened economic uncertainties.

Information Technology (-0.02 pp) – Slight negative impact, indicative of cautious investor sentiment amid macroeconomic concerns.

Consumer Discretionary (-0.04 pp) – Negative contribution reflecting increased investor caution over consumer spending outlook.

Energy (-0.05 pp) – Significant negative contributor, weighed down by deteriorating sentiment surrounding global demand concerns and lower oil prices.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Communication Services (+0.85%) – Top-performing sector, highlighting investor preference for defensiveness amid broader market weakness.

Real Estate (+0.47%) – Positive returns driven by declining interest rate environment enhancing yield attractiveness.

Materials (+0.26%) – Modestly higher, reflecting stable demand for commodities despite broader economic concerns.

Health Care (-0.11%) – Slight decline reflecting cautious investor sentiment amid weak economic data.

Industrials (-0.15%) – Negative returns amid increased concerns over economic slowdown following weak services and payroll data.

Information Technology (-0.05%) – Slightly lower as investors reassess growth outlook amid macroeconomic uncertainties.

Financials (-0.55%) – Weakened significantly due to declining yields and broader concerns about economic resilience.

Consumer Discretionary (-0.37%) – Underperformed due to increased caution regarding consumer spending and economic growth.

Consumer Staples (-0.58%) – Negative returns indicating reduced investor appetite despite sector’s typically defensive nature.

Utilities (-1.36%) – Sharp decline as rotation away from defensive yield-sectors intensified.

Energy (-1.70%) – Worst-performing sector, sharply impacted by deteriorating sentiment surrounding global demand outlook.

Macro Overlay

The S&P 500 index closed down -0.18%, primarily pressured by sharp declines in Energy and Utilities sectors amid renewed global growth concerns and declining bond yields. Communication Services provided a rare positive offset, signaling investor rotation into select defensive names. Weak economic reports, including the contractionary ISM Services reading and lower-than-expected ADP payroll gains, raised speculation about potential Fed rate cuts, reinforcing caution.

Bottom Line

The S&P 500 edged lower by -0.18%, with pronounced weakness in Energy and Utilities sectors partially offset by strength in Communication Services. It now more important to closely track upcoming economic data releases and Federal Reserve communications, preparing for potential volatility amid growing macroeconomic uncertainty.

US IG Credit Wrap — Spreads Widen to 55.16 bp as Economic Concerns Intensify

Current Spread: 55.16 bp (▲ ~0.2 bp d/d), reflecting slight widening. The current spread remains below the 5-year historical average (~63.2 bp), but indicates growing investor caution in response to recent weaker-than-expected economic data.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Today's slight widening in IG credit spreads to 55.16 bp highlights increased caution stemming from disappointing economic reports, notably the unexpected contraction in the US services sector and significantly weaker-than-expected private-sector payroll growth. These developments underscore ongoing concerns about the resilience of the US economy amidst elevated tariff impacts and broader macroeconomic uncertainties. Treasury yields moved lower, reflecting increased expectations for potential Federal Reserve easing later in the year, which partially mitigates credit market risks.

The market remains watchful, balancing optimism around potential easing in trade tensions with sustained vigilance regarding evolving economic indicators and central bank policy signals.

Bottom Line

IG credit spreads widened modestly to 55.16 bp, signaling heightened caution in light of recent economic weakness. Close monitoring of economic data, trade negotiations, and Federal Reserve communications is recommended for guidance on market direction.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.