Macro Regime Tracker: Higher inflation incoming

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I laid out the set for equities and bonds as we head into cpi here

Main Developments In Macro

*BESSENT: WE HAD TWO DAYS OF PRODUCTIVE TALKS

*BESSENT: HAVE TO GO BACK TO DC TO TESTIFY BEFORE CONGRESS

*OFFICIALS EXIT LONDON BUILDING WHERE US-CHINA TALKS WERE HELD

*US-CHINA TALKS ONGOING AT PRINCIPAL LEVEL: SOURCE FAMILIAR

*TRUMP POISED TO REPEAL BIDEN’S CURBS ON POWER-PLANT POLLUTION

*TRUMP TOLD NETANYAHU HE STILL WANTS TO DEFUSE IRAN CRISIS:AXIOS

*BESSENT SEEN AS A CONTENDER TO BE NEXT FED CHAIR, PEOPLE SAY

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

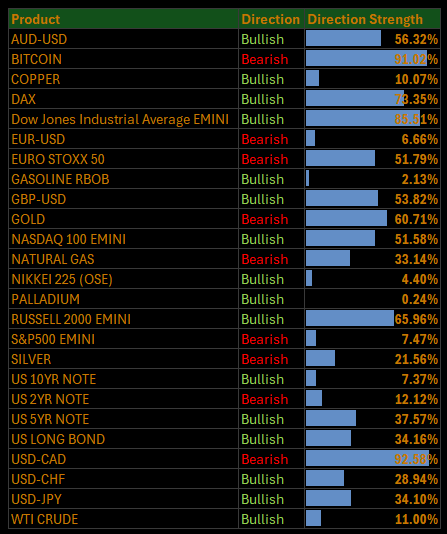

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

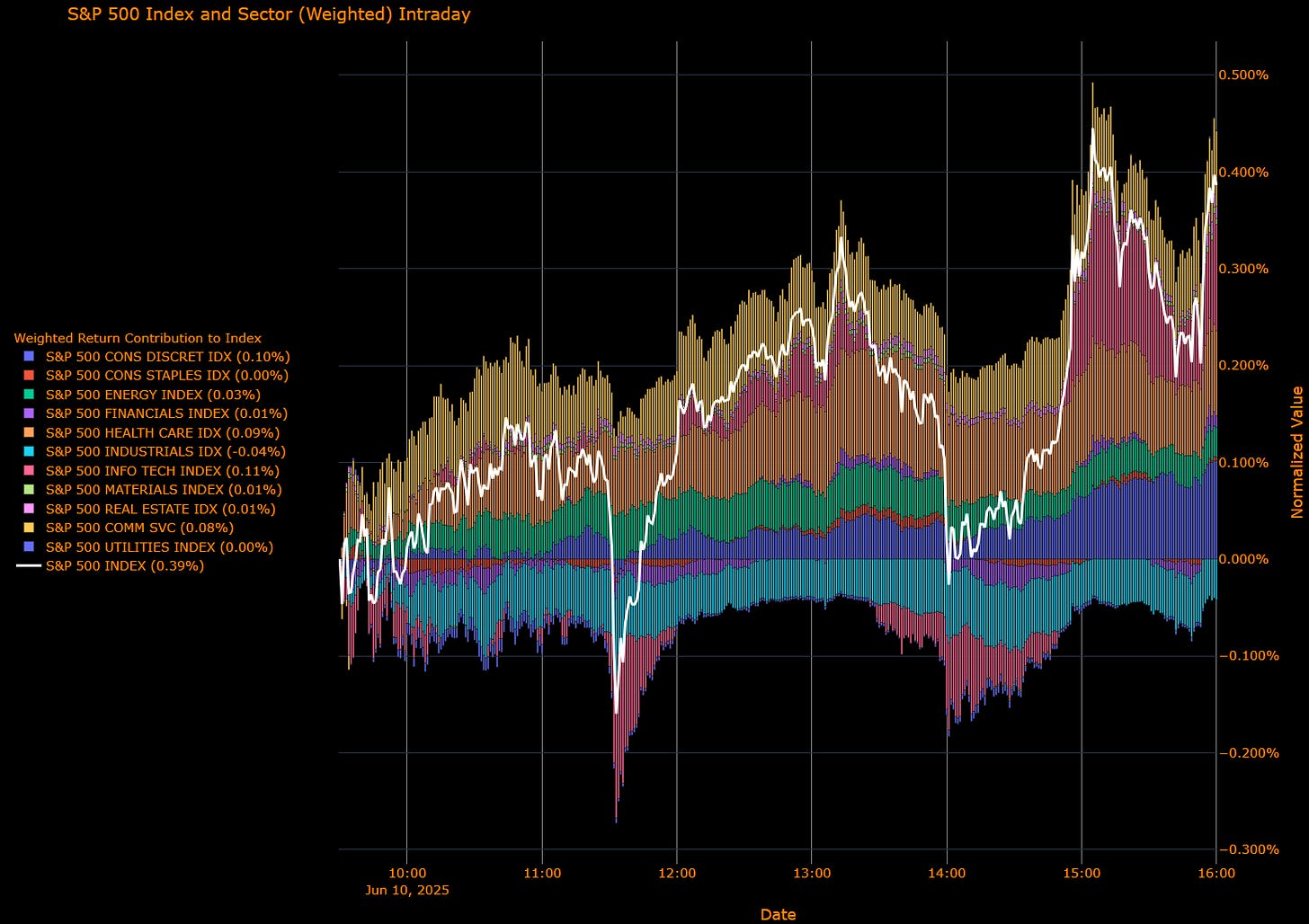

S&P 500 Advances 0.39%, Supported by Strength in Energy and Consumer Discretionary Despite Industrial Weakness

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Information Technology (+0.11 pp) – Leading positive contributor, reflecting investor optimism following constructive US-China trade developments.

Consumer Discretionary (+0.10 pp) – Solid positive impact driven by sustained improvements in consumer sentiment and easing trade tension concerns.

Energy (+0.03 pp) – Benefitted slightly amid cautious optimism in commodity markets awaiting further trade negotiation clarity.

Communication Services (+0.08 pp) – Positive contribution, indicating selective risk-taking among investors.

Real Estate (+0.01 pp) – Slight positive influence, balanced by investor caution on interest rate trends.

Materials (+0.01 pp) – Minor positive contribution reflecting cautious trade optimism.

Financials (+0.01 pp) – Marginally positive as investors assess economic growth prospects amid moderated inflation expectations.

Utilities (0.00 pp) – Neutral contribution, indicating investor ambivalence towards defensive sectors.

Consumer Staples (0.00 pp) – Flat contribution, highlighting stable defensive positioning.

Industrials (-0.04 pp) – Sole negative contributor, reflecting ongoing uncertainty in manufacturing sectors linked to trade issues.

Health Care (+0.09 pp) – Noticeably positive, suggesting improved investor sentiment despite economic uncertainties.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Energy (+1.00%) – Strongest performer, reflecting positive sentiment around potential trade negotiation breakthroughs.

Consumer Discretionary (+0.96%) – Robust performance, supported by continued consumer confidence amid easing trade tensions.

Health Care (+0.92%) – Strong gains as investors show renewed confidence despite broader market uncertainties.

Communication Services (+0.79%) – Solid performance, driven by selective investor optimism.

Real Estate (+0.60%) – Moderate gains reflecting balanced views on yields and interest rate outlooks.

Materials (+0.31%) – Positive performance on cautious trade negotiation optimism.

Information Technology (+0.34%) – Moderate gains, with improved sentiment linked to positive trade dialogue.

Financials (+0.08%) – Slightly positive, with investor sentiment cautiously optimistic on economic outlook.

Consumer Staples (+0.07%) – Marginal positive performance, reflecting defensive stability.

Utilities (+0.02%) – Minor positive, indicating minimal shifts in defensive sector allocations.

Industrials (-0.49%) – Notable underperformance, weighed down significantly by ongoing tariff-related manufacturing concerns.

Macro Overlay

The S&P 500 gained 0.39%, driven primarily by strong performances in Energy and Consumer Discretionary sectors. Investors responded positively to encouraging comments from Commerce Secretary Howard Lutnick indicating productive progress in US-China trade negotiations. Markets remain focused on upcoming inflation data expected to show modest increases driven by tariff-related cost pass-throughs. Long-term yields saw limited movement, suggesting cautious market sentiment ahead of key inflation and trade-related developments.

Bottom Line

Market sentiment improved modestly, boosted by trade optimism, despite lingering sector-specific uncertainties particularly in Industrials. Investors maintain vigilance as they await further clarity from US-China trade talks and critical economic data releases.

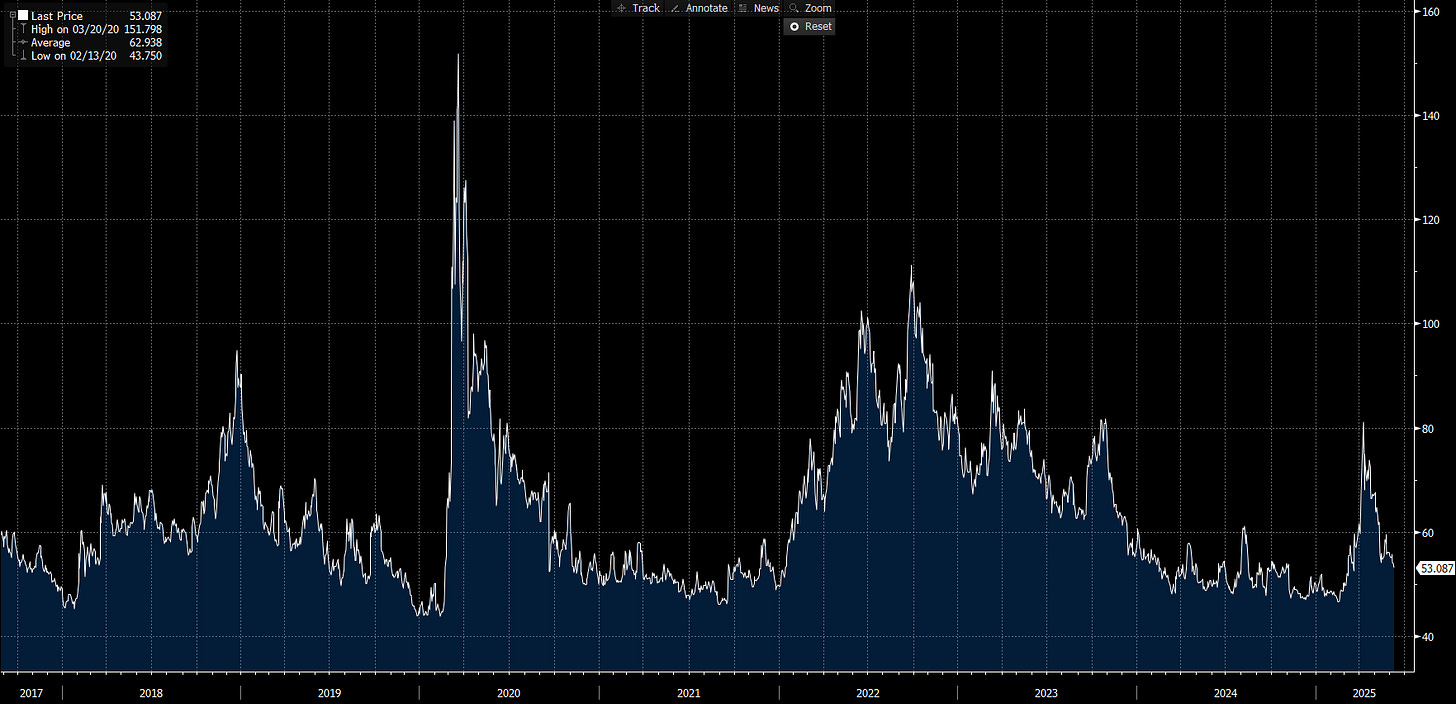

US IG Credit Wrap — Spreads Narrow to 53.09 bp as Optimism Grows Amid Constructive Trade Dialogue

Current Spread: 53.09 bp (▼ ~1.6 bp d/d), indicating further modest tightening. The spread remains comfortably below the 5-year historical average (~63 bp), underscoring investor optimism despite continued macroeconomic uncertainties.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay:

The IG credit spread tightening to 53.09 bp reflects improved investor sentiment supported by positive signals from recent US-China trade discussions led by Commerce Secretary Howard Lutnick. Worth remaining cautiously optimistic, awaiting key economic data releases, particularly the imminent US inflation report, expected to reflect modestly higher inflation from tariff-driven cost pressures. Treasury yields exhibit restrained moves, aligning with tempered expectations regarding Federal Reserve rate actions for the remainder of the year.

Remain attentive to trade dialogue developments, inflation data, and upcoming Federal Reserve communications for prudent risk management.

Bottom Line:

US IG credit spreads tightened slightly to 53.09 bp amid growing optimism on constructive US-China trade discussions. Continued vigilance is crucial given ongoing macroeconomic uncertainties, particularly around inflation outcomes and central bank guidance.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.