Macro Regime Tracker: How Powell's Speech Will Impact Markets

Macro regime and risk assets qualified clearly

Macro Regime Tracker (Daily Systematic Strategies & Models)

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning and cross-asset data, it identifies macro changes and their impact on market positioning.

The launch video for the Macro Regime Tracker is here: Link

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth and Inflation Regime Tracker

Fixed Income and Credit Model

Equity Sector Model

Machine Learning Strategies and Models

Macro Regime Context:

We are entering a consequential period of time as we approach Powell’s speech this week. Trump and Bessent have functionally been talking down the equity market and trying to bully Powell into cutting rates surrounding a supposed “recession.” This creates a path-dependent outcome that is contingent on how Powell guides the forward curve this week.

What does this tangibly mean? If Powell tries to push back and talk rates higher we will almost certainly see further deterioration in growth (and potentially an actual recession). Inversely, if Powell shifts to a dovish extreme and confirms recessionary fears then a reignition in inflation has significantly more potential. Powell needs to BOTH walk a line without losing credibility.

Everyone in the interest rate and equity space is watching the credit market with laser focus because when companies begin having issues getting funding is when the higher credit spreads and lower equity prices actually impact the real economy.

The chart below shows the number of high yield deals that are being transacted by the big banks. In other words, how many companies that fall under the higher risk category of “high yield” are taking out debt? YTD, there is still a clear and consistent flow of credit from financial markets to companies in the real economy.

Many people will talk about how “sentiment has shifted.” In reality, the sentiment shifts are just as useful as the consumer sentiment indices representing republican and democrat consumer sentiment (functionally useless):

Real-time consumer spending data remains squarely positive:

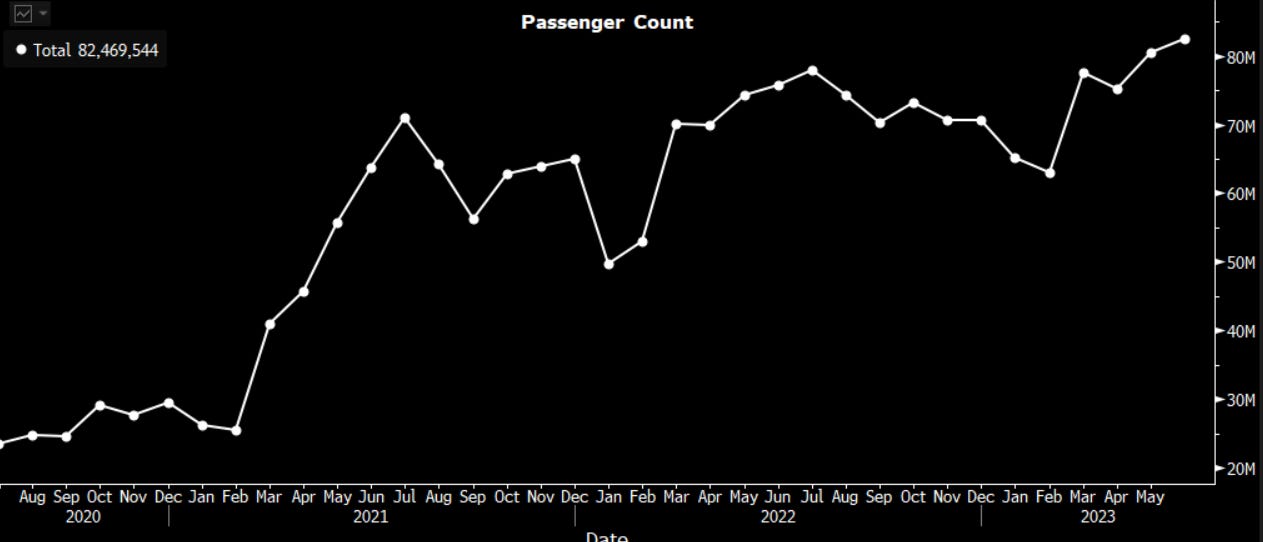

The number of people taking airline flights remains at all-time highs. In other words, the consumer has plenty of money to get on a flight and travel.

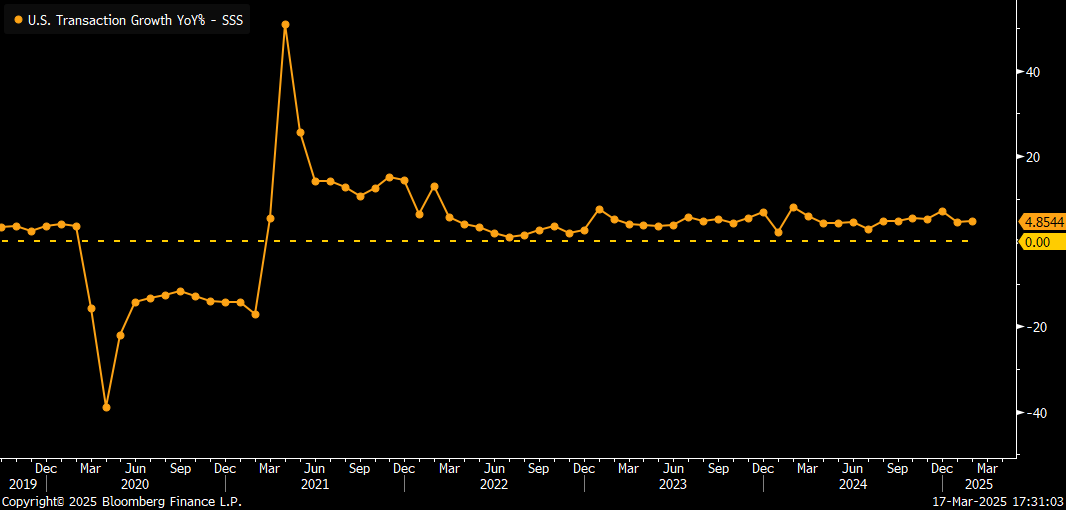

Transactions for all credit cards remain positive in terms of their growth:

The implication of these data points is that we are seeing some marginal weakening on a MoM basis but we are NOT seeing a real-time collapse in the US economy. This is why the tensions I laid out in the trade write-up remain so critical as we move into the next 90 days:

Trade Write-Ups: Equities, Bonds, and Bitcoin

The chart below shows WHERE we have traded in the Z5 SOFR contract, which is pricing the Fed’s actions between now and December. This contract rallied and then retraced its move multiple times during the NFP print and CPI print, indicating 75bps is likely the MAX amount of cuts for this year in light of the current information.

These tensions contextualize the information in the tear sheets and the macro regime tracker below.

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth and Inflation Regime Tracker:

The Macro Regime Model first provides a real-time view of growth and inflation dynamics, then directly connects these insights to upcoming catalysts and the statistical measures that gauge their impact on asset prices.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.