Macro Regime Tracker: Interest Rate Views

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

All of the macro views are here:

Main Developments In Macro

*TRUMP THREATENS 25% TARIFFS ON APPLE IF IPHONES NOT MADE IN US

*TRUMP: RECOMMENDING A 50% TARIFF ON THE EU STARTING JUNE 1

*FED'S GOOLSBEE SAYS NEW TARIFF THREAT 'REALLY SCARY' FOR FIRMS

*GOOLSBEE: BAR FOR RATES MOVE IN ANY DIRECTION IS HIGHER

*GOOLSBEE: FED WILL FACTOR IN HIGHER LONG-RUN MARKET RATES

*GOOLSBEE: FINANCIAL STABILITY WORRIES SO FAR OVERBLOWN

*GOOLSBEE: RATE CUTS STILL POSSIBLE OVER 10-16 MONTH HORIZON

*TRUMP EU TARIFF AN UNREASONABLE ESCALATION, SWEDISH FINMIN SAYS

*BESSENT: 90-DAY PAUSE ON APRIL 2 WAS BASED ON GOOD-FAITH TALKS

*TREASURY SECRETARY SCOTT BESSENT SPEAKS ON FOX NEWS

*BESSENT: TRUMP VIEWS EU PROPOSALS NOT AS GOOD AS OTHERS

*BESSENT: TRUMP 50% TARIFF THREAT IS RESPONSE TO EU'S PACE

*BESSENT: NOT EXPECTING NEED FOR MUCH TAX-BILL CHANGE IN SENATE

*BESSENT: JUST GOT TO BE CAREFUL ON THE TIMING OF TAX BILL

*BESSENT: FAR ALONG WITH INDIA IN TRADE TALKS

*BESSENT: MANY OF ASIAN NATIONS HAVE COME WITH VERY GOOD DEALS

*BESSENT: WITH EXCEPTION OF EU MOST NEGOTIATING IN GOOD FAITH

*BESSENT: DEALS MOVING QUICKLY, AS 90-DAY NEARS MORE ANNOUNCED

*FED'S MUSALEM SAYS BUSINESSES TRYING TO MANAGE UNCERTAINTY

*MUSALEM: EXPECTATIONS FOR INFL. RISING AMONG FIRMS, CONSUMERS

*MUSALEM: WANT TO KEEP LONG-TERM INF. EXPECTATIONS ANCHORED

*BESSENT: TAX PERMANENCE FROM REPUBLICAN BILL TO OFFER CERTAINTY

*TREASURY SECRETARY BESSENT SPEAKS ON BLOOMBERG TV

*BESSENT: AIMING FOR A 3% OR SO FISCAL GAP BY 2028

*BESSENT: 'VERY OPTIMISTIC' ON OUTLOOK FOR DEFICIT

*BESSENT: 'SUBSTANTIAL REVENUE' NOW COMING IN THANKS TO TARIFFS

*BESSENT: SEVERAL HUNDRED BLN DOLLARS A YR. TO COME FROM TARIFFS

*BESSENT: SENSE IS, NEXT COUPLE WEEKS, SEVERAL LARGE TRADE DEALS

*BESSENT: WILL BE NEGOTIATING AGAIN IN PERSON WITH CHINA

*BESSENT: MAY SEE A US-GERMANY RESET UNDER CHANCELLOR MERZ

*BESSENT SAYS BOND MOVES ARE GLOBAL, DISPUTES US TAX BILL IMPACT

*BESSENT: NOT PARTICULARLY WORRIED ABOUT WHAT MARKET'S THINKING

*BESSENT: NOT WORRIED ABOUT US DEBT DYNAMICS

*BESSENT CITES IMPROVED GROWTH PROFILE OF OTHERS IN FX MOVES

*BESSENT: LOT OF RESISTANCE TO GOVERNMENT SPENDING CUTS

*BESSENT: LET'S WAIT AND SEE TRUMP PLAN PLAY OUT, ON US DEFICIT

*BESSENT: DEREGULATION TO KICK IN FOR GROWTH IN Q3, Q4, 2026

*BESSENT: WANT TO MAKE THE US THE MOST ATTRACTIVE FOR CAPITAL

*BESSENT: WAS JUST IN MIDEAST, TRILLIONS OF DOLLARS COMING TO US

*BESSENT: VERY CLOSE TO MOVING SUPPLEMENTARY LEVERAGE RATIO

*BESSENT: WE COULD SEE SLR MOVE OVER THE SUMMER

*BESSENT: SHIFT IN SLR COULD HAVE AN IMPACT ON TREASURY YIELDS

*BESSENT: SLR SHIFT COULD BRING DOWN YIELDS BY TENS OF BASIS PTS

*BESSENT: WHEN TRADE DEALS SORTED, CAN FOCUS ON FANNIE, FREDDIE

*BESSENT: IS THERE A WAY TO SHRINK MORTGAGE-TREASURY RATE SPREAD

*BESSENT: HAD ABOVE-TARGET TAX COLLECTIONS THIS FILING SEASON

*BESSENT: WE WILL SEE IF HARVARD FOLLOWING RULES

*BESSENT: HARVARD IS A GIANT HEDGE FUND

*FED’S COOK SAYS SEEING SIGNS OF STRESS IN SUB-PRIME BORROWERS

*COOK: VULNERABILITIES FROM OVERALL HOUSEHOLD BORROWING MODERATE

*COOK:LARGE INCOME SHOCK COULD TRIGGER HIGHER LOSSES FOR LENDERS

*ORACLE TO BUY $40B OF NVIDIA CHIPS FOR OPENAI US DATA CENTER:FT

*TRUMP SAYS WILL TARIFF APPLE, SAMSUNG BY END OF JUNE

*TRUMP: IF APPLE, SAMSUNG BUILD PLANT IN US, NO TARIFF

*TRUMP: US STEEL WILL REMAIN IN AMERICA

*TRUMP: WILL BE PARTNERSHIP BETWEEN US STEEL, NIPPON STEEL

*TRUMP: US STEEL, NIPPON STEEL PARTNERSHIP ADDS $14B TO ECONOMY

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

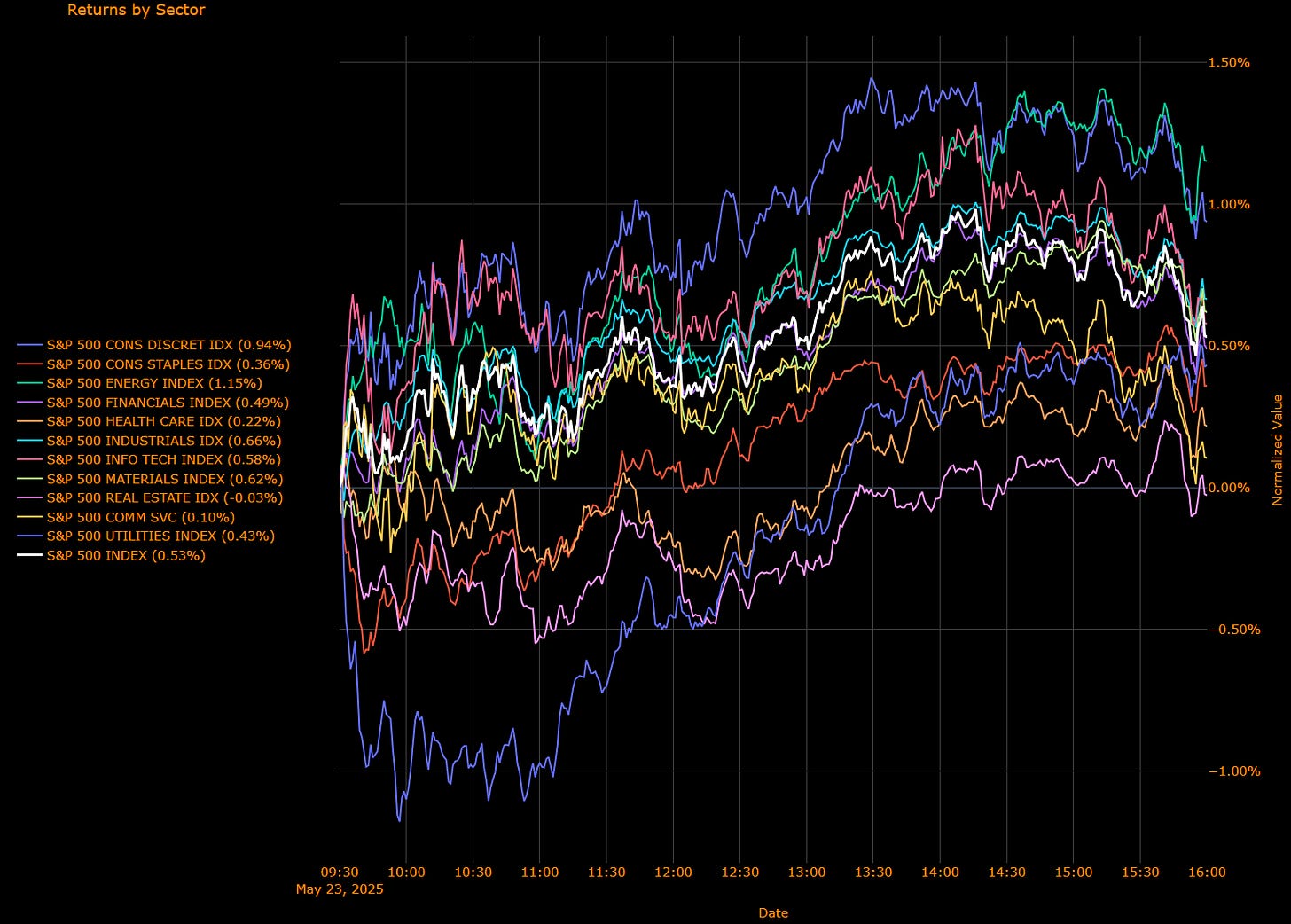

S&P 500 Wrap — Index Advances +0.53% Led by Consumer Discretionary; Energy Drags on Performance

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Consumer Discretionary (+0.10 pp) – Top positive impact, reflecting ongoing investor optimism around resilient consumer spending despite macroeconomic uncertainty.

Financials (+0.07 pp) – Solid contribution, benefiting from marginal stabilization in yields and cautious positioning in financial stocks.

Industrials (+0.06 pp) – Moderately positive, supported by stable expectations around global trade conditions despite ongoing tariff threats.

Information Technology (+0.03 pp) – Modestly positive, underpinned by cautious investor positioning amid sustained fiscal uncertainty and elevated bond yields.

Energy (+0.04 pp) – Slight positive despite being significantly lower in unweighted terms, indicating selective positioning in energy names.

Consumer Staples (+0.02 pp) – Slight positive, reflecting cautious consumer outlook amid persistent inflation pressures.

Health Care (+0.02 pp) – Marginal positive contribution as investors cautiously allocate amid ongoing policy uncertainties.

Communication Services (+0.01 pp) – Mildly positive, recovering marginally amid cautious sector rotations.

Utilities (+0.01 pp) – Slight positive contribution despite elevated bond yields, as cautious defensive positioning continues.

Materials (+0.01 pp) – Small positive, reflecting neutral commodity market sentiment and cautious investor activity.

Real Estate (-0.01 pp) – Slightly negative, pressured by persistently elevated Treasury yields negatively affecting yield-sensitive sectors.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Consumer Discretionary (+0.94%) – Strongest unweighted sector, benefiting from consumer resilience.

Industrials (+0.66%) – Solid gains amid modest optimism about global trade conditions.

Information Technology (+0.58%) – Positive performance, cautiously benefitting from selective risk-taking.

Materials (+0.62%) – Notable gains reflecting stable sentiment in commodities markets.

Financials (+0.49%) – Firm on modest yield stability and cautious sector allocation.

Utilities (+0.43%) – Moderate gains despite elevated bond yields.

Consumer Staples (+0.36%) – Positive, demonstrating cautious investor positioning amid inflation persistence.

Health Care (+0.22%) – Marginal gains amid ongoing policy uncertainty.

Communication Services (+0.10%) – Slightly positive, minimal recovery amid cautious rotations.

Real Estate (-0.03%) – Slightly negative, reflecting continued sensitivity to high yields.

Energy (-1.15%) – Largest drag on index performance unweighted, impacted negatively by continued volatility in oil markets.

Macro Overlay

Market sentiment improved modestly despite ongoing macroeconomic uncertainty surrounding aggressive tariff threats by President Trump targeting the EU and major consumer technology firms. Elevated Treasury yields continue to influence investor positioning, particularly impacting yield-sensitive sectors like real estate. Despite cautious optimism, investors remain vigilant, closely watching upcoming economic data and developments around fiscal policy, including potential regulatory shifts indicated by Treasury Secretary Bessent and cautious policy commentary from Fed officials Goolsbee and Musalem regarding inflation and tariff impacts.

Bottom Line

The S&P 500 advanced +0.53%, driven primarily by strength in consumer discretionary and industrial sectors, though energy notably lagged. Cautious investor sentiment persists amid elevated macroeconomic uncertainties and ongoing tariff risks, suggesting the potential for continued volatility near-term as market participants closely monitor economic releases and fiscal developments.

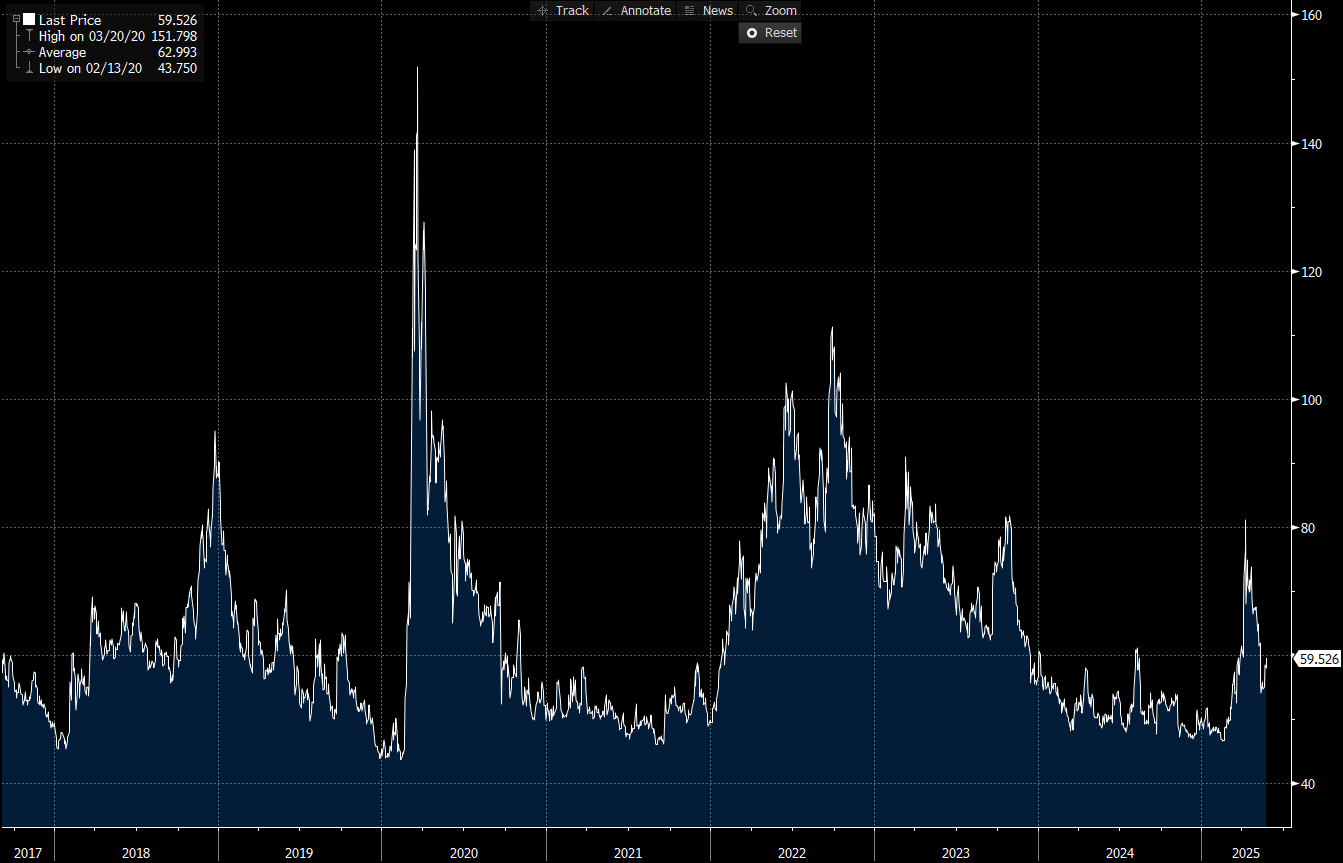

US IG Credit Wrap — Spreads Widen to 59.5 bp Amid Rising Macro Concerns and Intensifying Tariff Risks

Current Spread: 59.5 bp (▲ ~2 bp d/d), marking continued widening from recent levels, highlighting investor uncertainty. Spreads remain slightly below the 5-year historical average (~63 bp), but the recent upward trajectory signals intensifying investor unease.

Credit Context

< 60 bp: Pre-tariff escalation range: supportive of duration-heavy buyers (LDI, insurers).

60–70 bp: Tariff and fiscal uncertainty zone: neutral-to-cautious stance warranted.

> 90 bp: Severe stress breakout: still low probability but increasing vigilance required.

Macro Overlay

Investor sentiment has deteriorated further amid intensified tariff rhetoric from President Trump, particularly the proposed 50% tariffs on EU imports and potential 25% levies on smartphones from Apple and Samsung. Fed commentary highlights growing caution, with officials Goolsbee and Musalem underscoring business uncertainty and elevated near-term inflation risks driven by these trade tensions.

Moreover, fiscal uncertainty persists despite Treasury Secretary Bessent’s optimistic outlook on growth and regulatory adjustments (such as the potential easing of the supplementary leverage ratio). Elevated long-term Treasury yields and continued macroeconomic risks directly feed into heightened caution reflected in recent credit spread movements.

Bottom Line

IG credit spreads have widened to 59.5 bp, clearly capturing heightened investor caution amid escalating tariff threats and persistent fiscal uncertainty. Near-term volatility risks remain elevated, influenced by ongoing policy debates and geopolitical developments. Directional bias remains cautiously skewed toward further spread widening in the short term.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.