Macro Regime Tracker: Interest Rate Curve

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I laid out my view for how to think about the NFP print as we put the labor market data behind us and look to the Sept FOMC meeting:

I continue to believe we are in a credit cycle upturn. I explained on August 28 that due to the changes we are seeing in rates across the curve, I went neutral on bonds:

Its clear post the NFP print that the rally in ZT, ZF, ZN, ZB, and UB was incredibly aggressive. This is really where positioning and marginal cyclical impulses are coming in contact with the larger structural reality. We are in a period of higher nominal GDP and the PATH forward creates significant headwinds for bonds. However, this doesn’t mean we can’t see marginal rallies against the structural regime.

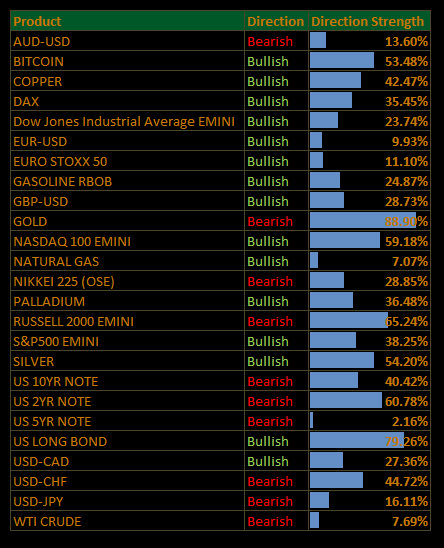

The interest rate sensitivity model (these are linked below) is showing that downward movements in yields are creating an upward skew for equities. In other words, we are between a reflation and Goldilocks regime. We are NOT in a period of time where higher rates are dragging on equities OR a fall in rates is a response to a recession. As we operate in the interium, interest rate risk will define EVERYTHING. The more Goldilocks type pricing we see, the greater the upside for Gold and Equities as the DXY is at risk of moving to 96.

This will be something I cover further in the next report. Thanks

As always, all the systematic models and strategies are updated below.

Main Developments In Macro

Markets & Equities

S&P 500 CLOSES 0.3% LOWER, NASDAQ 100 UP 0.1%

NASDAQ 100 TURNS NEGATIVE AFTER ERASING NEARLY 1% GAIN

NASDAQ 100 FUTURES REBOUND TO 0.7% GAIN

S&P 500 INDEX FUTURES ERASE GAINS AFTER PAYROLLS DATA

Rates & Yields

US TREASURIES SURGE AFTER WEAK AUGUST EMPLOYMENT DATA

US 2- TO 7-YEAR YIELDS FALL AT LEAST 10 BASIS POINTS ON DAY

TREASURY 2-YEAR YIELD FALLS 10 BASIS POINTS ON DAY TO 3.48%

TREASURY 2-YEAR YIELD FALLS TO 3.55%, LOWEST SINCE APRIL 7

TRADERS ADD TO BETS ON FED INTEREST-RATE CUT IN SEPTEMBER

TRADERS PRICE IN CHANCE OF HALF-POINT FED RATE CUT THIS MONTH

BANK OF AMERICA SEES TWO 2025 FED RATE CUTS VS NONE PREVIOUSLY

Fed & Policy Commentary

TRUMP: POWELL SHOULD HAVE LOWERED RATES LONG AGO

BESSENT BLAMES FED FOR REGULATORY OVERREACH

BESSENT: UNCONVENTIONAL POLICIES SHOULD BE COORDINATED W/ GOVT

BESSENT: FED MUST SCALE BACK DISTORTIONS IT CAUSES IN ECONOMY

BESSENT: FED CREDIBILITY JEOPARDIZED BY EXPANSION BEYOND MANDATE

BESSENT SAYS FED FORECASTS RELIED ON 'FLAWED MODELS': WSJ

BESSENT SAYS FED FORECASTS TOO PESSIMISTIC: WSJ

BESSENT SAYS FED TOOL KIT 'TOO COMPLEX TO MANAGE': WSJ

BESSENT WRITES OP-ED ON FED'S MONETARY POLICY IN WSJ

BESSENT SAYS FED MUST CHANGE COURSE: WSJ

BESSENT SAYS 'MISSION CREEP' THREATENS FED INDEPENDENCE: WSJ

GOOLSBEE: THERE'S A LONG HISTORY OF CEA FOLKS COMING TO FED

HASSETT: JOBS NUMBER LITTLE BIT OF A DISAPPOINTMENT RIGHT NOW

HASSETT: INFLATION IS LOW, ECONOMIC GROWTH IS SOLID

HASSETT: US ECONOMY IS PREPARED FOR TARIFFS

HASSETT: NOT CONCERNED ABOUT BENCHMARK REVISIONS

Trade & Tariffs

TRUMP: EU MUST STOP FINES AGAINST US TECH IMMEDIATELY

TRUMP POSTS ON TRUTH SOCIAL ABOUT EUROPEAN FINE ON GOOGLE

TRUMP ON GOOGLE FINE: WON'T ALLOW DISCRIMINATORY ACTIONS

TRUMP THREATENS 301 PROBE OVER TECH FINES

TRUMP THREATENS SECTION 301 TO NULLIFY PENALTIES ON US FIRMS

TRUMP: EUROPE HIT GOOGLE WITH FINE

Energy & Commodities

POSSIBLE BOOST TO OPEC+ SUPPLY MIGHT COME AFTER SUNDAY MEETING

SAUDI ARABIA WANTS OPEC+ TO SPEED UP NEXT OIL PRODUCTION BOOST

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.