Macro Regime Tracker: Is the labor market at risk?

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

My view is that we continue to rally in equity indices and that the seasonality narratives floating around should be faded. I laid out the logic for this in the video today:

I want to cover several additional points.

First, the labor market prints for JOLTS, ADP, and NFP are all this week. My view is people are going to realize the labor market is completely fine and we are NOT at risk of an imminet recession. The UB contract trading BELOW the last NFP level is a critical signal in this:

A lot of people have been asking me about my Bitcoin view and nothing dramatic has changed. Bitcoin remain skewed to the upside on a cyclical basis BUT it is underperforming ES significantly on a volatility adjusted basis. I don’t think there is cause for concern for the larger trend to break down but I always weigh being leverage long Bitcoin against being leverage long ES.

I expect the Nikkei to rally, but we have been consolidating in a range over the last two trading days:

I am in the process of writing a macro report for paid subscribers to cover all of this further, so more on this then.

As always, all the systematic models and strategies are updated below. Thanks

Main Developments In Macro

US Macro & Policy

BESSENT TO START FED CHAIR INTERVIEWS ON FRIDAY: WSJ

US INDEX FUTURES RISE; NASDAQ 100 CONTRACTS GAIN 0.4%

US AUG. ISM MANUFACTURING INDEX RISES TO 48.7; EST. 49

US S&P GLOBAL AUG. MANUFACTURING PMI AT 53 VS 49.8 PRIOR

US REGULATORS POSTPONE, SCALE BACK OR CANCEL BANK EXAMS: RTRS

Trump / Trade / Tariffs

TRUMP ENDS REMARKS IN OVAL OFFICE

TRUMP ON PUTIN: MAY TAKE DIFFERENT STANCE IF NOTHING COMES

TRUMP: WILL SEE IF ANYTHING COMES OUT OF ALASKA PUTIN SUMMIT

TRUMP: WOULD HAVE TO GIVE BACK TARIFFS IF APPEAL DENIED

TRUMP: US IS IN 'SERIOUS TROUBLE' WITHOUT TARIFFS

TRUMP SAYS LOSING APPEAL ON TARIFFS WOULD BE ECONOMIC DISASTER

TRUMP: WE'LL SEE A `REVERBERATION' IF WE DON'T WIN ON TARIFFS

TRUMP REPEATS GLOBAL TARIFF IS AN ECONOMIC EMERGENCY

TRUMP SAYS HE WILL APPEAL TARIFF RULING

TRUMP ANNOUNCEMENT TODAY RELATED TO DEFENSE DEPT: FOX

TRUMP ADMIN PLANS TO MOVE SPACE COMMAND HQ TO ALABAMA: REUTERS

TRUMP TO ANNOUNCE SPACE COMMAND HEADQUARTERS AT 2 PM EASTERN

TRUMP SAYS US SPACE COMMAND WILL MOVE TO ALABAMA FROM COLORADO

Fed / Housing Commentary

PULTE: POWELL NOT HOLDING LISA COOK ACCOUNTABLE

PULTE: TRUMP FOCUSED ON GETTING HOUSING MARKET BOOMING

PULTE ON FED'S LISA COOK: DOCUMENTS ARE AUTHENTIC

Global Macro – Europe

ECB’S MULLER SAYS IT MAKES SENSE TO HOLD RATES, WATCH ECONOMY

ECB GOVERNING COUNCIL MEMBER MULLER SPEAKS TO BLOOMBERG ADRIA

ECB'S VILLEROY: INFLATION ALLOWS FOR FAVORABLE INTEREST RATES

ECB'S VILLEROY: URGENT TO TACKLE FRENCH DEFICIT, DEBT CHALLENGE

ECB'S VILLEROY: INFLATION IS WELL UNDER CONTROL

ECB'S SIMKUS HINTS AT DECEMBER RATE CUT, ECONOSTREAM SAYS

SIMKUS: RISKS TO INFLATION, GROWTH TO DOWNSIDE: ECONOSTREAM

SIMKUS: MORE TRUE THAN NOT THAT ANOTHER CUT COMING: ECONOSTREAM

ECB'S SIMKUS: CUT COULD BE DISCUSSED IN OCTOBER: ECONOSTREAM

ECB'S SIMKUS: SOME RISKS TO ECONOMY MATERIALIZING: ECONOSTREAM

ECB'S SIMKUS SEES NO REASON TO ADJUST RATES NOW: ECONOSTREAM

ECB'S KOCHER ADVOCATES CAUTION AHEAD OF NEXT ECB RATE DECISION

FRENCH 30-YEAR YIELD RISES ABOVE 4.5% FOR FIRST TIME SINCE 2011

EUROPE BOND SALES TOP €49.6 BILLION IN RECORD-BREAKING DAY

VILLEROY REAFFIRMS FRANCE'S NEED TO TARGET 3% DEFICIT IN 2029

Global Macro – Other

BRAZIL 2Q GDP RISES 0.4% Q/Q; EST. +0.3%

ARGENTINA SAYS IMF OK WITH FX INTERVENTION: CLARIN

ARGENTINA'S TREASURY TO INTERVENE IN OFFICIAL FX MARKET: QUIRNO

KREMLIN: RUSSIA, US DIALOG FOCUSES ON UKRAINE NOW: TASS

RUSSIA, US FOREIGN MINISTRIES TO HOLD CONSULTATIONS: IFX

PUTIN: UNACCEPTABLE FOR RUSSIA TO HAVE UKRAINE JOIN NATO

PUTIN: RUSSIA IS NOT AGAINST UKRAINE IN EU

PUTIN: NEW US ADMINISTRATION HEARS OUR POINT OF VIEW

PUTIN SEES WAYS FOR CONSENSUS ON UKRAINE'S SECURITY GUARANTEES

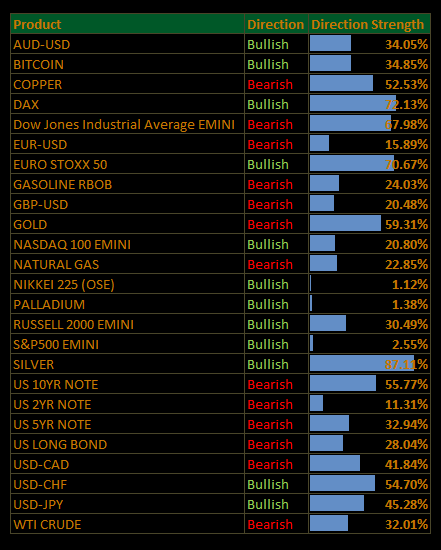

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.