Macro Regime Tracker: Macro Views

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I recorded a livestream breaking down all my macro views here:

Nothing has changed in my views. See the notes in the chat here:

I am working on the next report explaining all the major trades I am thinking about connected to the credit cycle. More on this soon.

As always, the models and strategies are updated below. Thanks.

Main Developments In Macro

US Macro & Policy

US TO PRESS G-7 ON CHINA, INDIA TARIFFS TOMORROW: FT

US TREASURY SAYS G-7 PARTNERS NEED TO 'STEP UP': FT

US TO CALL ON G-7 TO TARIFF CHINA, INDIA OVER RUSSIAN OIL: FT

FED DISCOUNT-WINDOW LOANS $5.37B IN WEEK ENDED SEPT. 10 AFTER $4.37B

US MONEY-MARKET FUND ASSETS HIT RECORD $7.30 TRILLION AT ICI

TRUMP ASKS COURT TO PAUSE ORDER LETTING LISA COOK STAY AT FED

BESSENT AIMS TO ADD 1, 2 MORE NAMES TO FED CHAIR SHORTLIST: CNBC

HOUSE DEMOCRATS ASK FHFA INSPECTOR TO REVIEW PROBE ON COOK: NBC

US BUDGET GAP $345B FOR AUG., $1.97T FOR 11 MTHS THROUGH AUG.

US 30Y BONDS DRAW 4.651%, MATCHES PRE-SALE WHEN-ISSUED YIELD

US AWARDS 62.0% OF 29-YR 11-MO BONDS TO INDIRECT BIDDERS

US AWARDS 28.0% OF 29-YR 11-MO BONDS TO DIRECT BIDDERS

US 29-YR 11-MO BONDS DRAW 4.651%; ALLOTTED AT HIGH 44.54%

US 29-YR 11-MO BONDS BID/COVER RATIO 2.38 VS. 2.27 PREVIOUS AUCTION

TREASURY WI 30Y YIELD 4.651% BEFORE $22 BILLION AUCTION

US JOBLESS CLAIMS 263,000 IN SEPT. 6 WEEK; EST. 235K

US AUG. CORE CPI RISES 0.3% M/M; EST. +0.3%

US AUG. CONSUMER PRICES RISE 0.4% M/M; EST. +0.3%

EIA SAYS US NATURAL-GAS STOCKPILES ROSE 71 BCF LAST WEEK

International – Macro & Policy with US Linkages

ECB INCLINED TO KEEP RATES UNCHANGED BARRING ECONOMIC SHOCK

GOLD SURPASSES INFLATION-ADJUSTED RECORD HIGH SET IN 1980

IMF: ENCOURAGE ARGENTINA TO REBUILD FX RESERVES

IMF: OUR SENSE IS, FED HAS SCOPE TO BEGIN TO LOWER RATES

IMF: FED SHOULD ‘PROCEED CAUTIOUSLY’ IN LOWERING RATES

IMF: SOME STRAINS BEGINNING TO SHOW IN US ECONOMY

CHINA TO TAKE STEPS TO PROTECT INTERESTS IF NEEDED: SPOKESPERSON

CHINA HOPES MEXICO TO BE `EXTRA PRUDENT' IN PLANNED TARIFFS

SHEINBAUM: WE ARE NOT LOOKING FOR A CONFLICT W/CHINA TARIFFS

OPEC Still Sees Tight Oil Market Despite Supply Increases

Trump & Trade Commentary

LUTNICK: CONFIDENT SUPREME COURT WILL SIDE W/ US ON TARIFFS

LUTNICK: CHINA PAYING AVERAGE TARIFF OF 52%

LUTNICK: GOVERNMENT OF CHINA IS EATING MOST OF ITS TARIFF

LUTNICK: CHINESE CARS ARE NOT COMPETITIVE, THEY'RE GOV-BACKED

LUTNICK: EUROPEANS WILL BLOCK CHINESE CARS, THEY'LL LEARN

LUTNICK: WILL SEE GDP GROWTH NEXT YEAR OVER 4%

LUTNICK: TARIFFS BRINGING IN $40B A MONTH

LUTNICK: WILL SORT INDIA OUT WHEN THEY STOP BUYING RUSSIAN OIL

LUTNICK: BIG DEAL COMING WITH TAIWAN

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

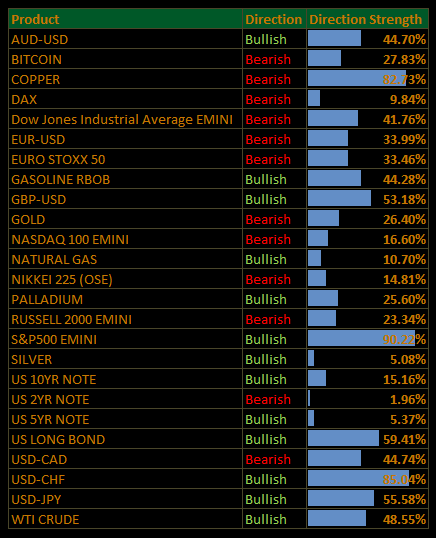

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.