Macro Regime Tracker: Melt Up Mode In ES

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

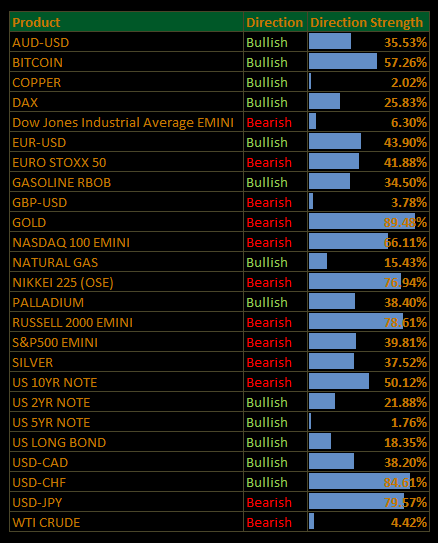

Macro Regime Tracker Index:

We are seeing ES rally in lockstep with the risk reward I previously laid out (see report linked below):

This is starting off the month of September to show that the uninformed narratives around bearish seasonality are misplaced:

As I laid out in the macro report, the flows of capital are systematically moving out the risk curve as the Fed is taking its stance. A cut for Sept is fuctionally a done deal and completely priced now. The entire question from here will be if we get 25bps or 50bps of additional cuts before the end of the year.

As always, the systematic strategies and models are laid out below.

Main Developments In Macro

US Macro / Fed Policy

FED DISCOUNT-WINDOW LOANS $4.37B IN WEEK ENDED SEPT. 3 AFTER $4.19B

TRUMP SIGNED AN ORDER IMPLEMENTING US-JAPAN TRADE AGREEMENT: WH

TRUMP ASKS SUPREME COURT TO LET HIM FIRE FTC COMMISSIONER

NY FED'S JOHN WILLIAMS TALKS TO REPORTERS AFTER NEW YORK SPEECH

FED'S WILLIAMS: MARKETS COMING TO OWN CONCLUSION ON SEPT. MOVE

WILLIAMS: MARKETS ARE FOCUSED ON FUNDAMENTALS OF THE ECONOMY

WILLIAMS: NOTHING IN YIELD CURVE IS ACTING THAT ABNORMALLY

WILLIAMS: FED IS FULL OF DEDICATED PEOPLE WHO AREN'T PARTISAN

WILLIAMS: NOT EXPECTING PERSISTENT INFLATION FROM TARIFFS

WILLIAMS: MY CONCERN IS JOB MARKET COOLS FURTHER THAN DESIRABLE

WILLIAMS: CLEARLY THE CASE DOWNSIDE EMPLOYMENT RISKS INCREASED

FED'S WILLIAMS: WILL BECOME APPROPRIATE TO CUT RATES OVER TIME

WILLIAMS: TOO RESTRICTIVE POLICY TOO LONG COULD RISK EMPLOYMENT

WILLIAMS: RESERVES TO DECLINE MORE MEANINGFULLY GOING FORWARD

WILLIAMS: FED'S BALANCE SHEET WIND-DOWN IS GOING VERY SMOOTHLY

Fed Independence / Miran Nomination

MIRAN IS ASKED IF PRESIDENT CAN FIRE GOVERNOR OVER RATE VIEWS

MIRAN DECLINES ANSWER ON VIEW OF TRUMP THREATS TO FIRE POWELL

MIRAN: WHAT I RECOMMENDED WAS A PACKAGE OF CHECKS, BALANCES

MIRAN: I DIDN'T RECOMMEND GIVING PRESIDENT CONTROL OF THE FED

MIRAN: MY INFLATION VIEW ISN'T JUST INFORMED BY MONETARY POLICY

MIRAN: CHANGE TO BORDER POLICY 'ACTUALLY QUITE DEFLATIONARY'

MIRAN: US GOODS INFLATION HAVEN'T DIVERGED FROM GLOBAL PATTERN

MIRAN: NO EVIDENCE TARIFFS HAD INFLATIONARY EFFECT ON PRICES

MIRAN: DON'T ANTICIPATE BOND MARKET WORRY ON FED INDEPENDENCE

MIRAN: BLS DATA ALSO DETERIORATED BECAUSE OF RESPONSE-RATE DROP

MIRAN: BLS DATA DETERIORATION IN PART DUE TO FAILURE TO CORRECT

MIRAN: UNWISE FOR FED TO ADVOCATE ONE FISCAL PLAN OVER ANOTHER

MIRAN: NO MATERIAL EVIDENCE SMALL BUSINESS WALLOPED BY TARIFFS

MIRAN: IN LONG RUN, EXPORTING NATIONS BEAR TARIFF BURDEN

MIRAN: IN SHORT RUN, CAN BE VOLATILITY IN BURDEN OF TARIFFS

MIRAN SUGGESTS BORDER POLICY CAN RELIEVE PRESSURE ON RENTS

MIRAN: TRUMP'S VARIETY OF POLICIES IS 'QUITE DISINFLATIONARY'

MIRAN SAYS NOBODY ASKED HIM TO PLEDGE TO VOTE FOR RATE CUTS

MIRAN DECLINES TO SAY HE'D ADVISE TRUMP NOT TO FIRE FED MEMBERS

MIRAN: FED'S ACTIONS ON CLIMATE CHANGE WERE HIGHLY POLITICAL

MIRAN: PRESIDENT IS ENTITLED TO A VIEW ON MONETARY POLICY

MIRAN: NO DETECTABLE INCREASE IN AGGREGATE PRICES FROM TARIFFS

MIRAN: I BELIEVE BLS WAS COMPLACENT IN LETTING DATA DETERIORATE

MIRAN: IF CONFIRMED FOR THIS ROLE, I WILL ACT INDEPENDENTLY

MIRAN: PRESIDENT NOMINATED ME BECAUSE HE LIKES MY POLICY VIEWS

MIRAN: FED INDEPENDENCE IS OF PARAMOUNT IMPORTANCE FOR ECONOMY

FED NOMINEE MIRAN ANSWERS QUESTIONS AT SENATE BANKING HEARING

Energy / Commodities

CUSHING CRUDE OIL INVENTORIES ROSE 1.59 MLN BBL, EIA SAYS

DISTILLATE INVENTORIES ROSE 1.68 MLN BARRELS, EIA SAYS

US REFINERY UTILIZATION FELL 0.30% LAST WEEK, EIA SAYS

GASOLINE INVENTORIES FELL 3.80 MLN BARRELS, EIA SAYS

CRUDE OIL INVENTORIES ROSE 2.42 MLN BARRELS, EIA SAYS

EIA SAYS US NATURAL-GAS STOCKPILES ROSE 55 BCF LAST WEEK

Trade / Geopolitics

US 15% TARIFF ON JAPANESE AUTOS GOES INTO EFFECT WITHIN 7 DAYS

US, TAIWANESE DEFENSE OFFICIALS HELD SECRET TALKS IN ALASKA: FT

TRUMP TELLS EUROPE MUST PLACE ECONOMIC PRESSURE ON CHINA: RTRS

TRUMP TELLS EUROPEAN LEADERS MUST STOP BUYING RUSSIAN OIL: RTRS

Legal / Oversight

DOJ OPENED CRIMINAL INVESTIGATION INTO FED'S COOK: WSJ

DOJ ISSUES SUBPOENAS IN PROBE INTO FED'S LISA COOK: WSJ

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.