Macro Regime Tracker: New Geopolitical Risk

Macro regime and risk assets qualified clearly

Macro Regime Tracker:

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

The farther we progress into the new macro regime, the more I believe that the following are becoming increasingly important to understand:

The tariffs are likely to cause underlying rotation and redistribution across the global economy. I don’t believe an explicit recession or inflation upturn is the base case. The stance of monetary policy and intentionality by the political administration indicate that they are here to accomplish their goals on a geopolitical front but underlying deleveraging isn’t taking place.

The Bank of America Earnings release today illustrates this tension:

Summary:

Bank of America reported stronger-than-expected Q1 2025 earnings, with net income rising to $7.4 billion, or $0.90 per share, exceeding forecasts. Solid performance in trading and higher net interest income drove the beat, despite weakness in investment banking. Management maintained its NII guidance and continues to streamline operations amid a cautious economic backdrop.

Key Developments:

Trading revenue jumped 9% YoY, with record equity trading and strong fixed income performance.

Net interest income rose 3% to $14.4B, with full-year guidance reaffirmed.

Investment banking fees fell 3% due to slower M&A and IPO activity.

Credit loss provisions increased to $1.5B, reflecting ongoing credit risk vigilance.

Workforce reductions continued, bringing total headcount down slightly to 212,732.

AI is likely beginning the transition of Mag7 tech names into more of a utility-like stance as opposed to them being disruptive in nature. When companies like Apple (the largest weighting in the index) show a continual absence of innovation, they become complacent with the moat that they possess.

The supply chain and value chain face uncertainty and constraints due to the tariffs. When deciding whether to invest in domestic capital expenditures (CapEx) to avoid tariffs or absorb the tariffs as ongoing costs, companies face a high-stakes trade-off between long-term strategic positioning and short-term flexibility. Onshoring requires significant upfront investment, which may become a sunk cost if tariffs are later removed, effectively making the decision a costly hedge against policy volatility. Conversely, choosing to pay the tariffs preserves optionality but risks being structurally uncompetitive if rivals onshore and lower their long-term unit costs. The uncertainty around geopolitical tensions and trade policy cycles compounds this dilemma, as firms must weigh durability of tariffs against the speed of potential reversals. Inaction or indecision can be just as risky, as market leaders who commit early may secure supply chain resilience and pricing power before others react.

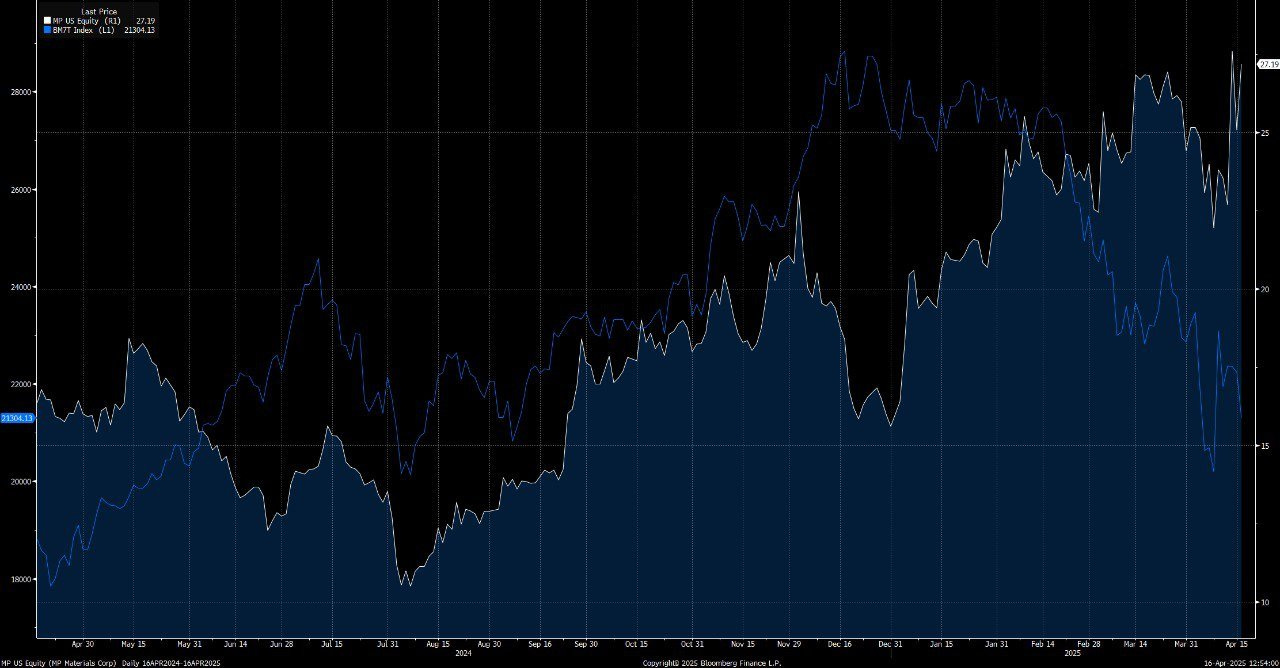

Finally, the tariffs are creating greater focus and concentration on base rare earth metals. Companies like MP 0.00%↑ illustrate this in their outperformance against Mag7 (blue).

(As a reminder, the Macro Regime Tracker won’t be published tomorrow or Friday due to the holiday. I will be publishing some additional big picture pieces diving into trade ideas connected to the tariffs though.)

Main Developments In Macro

*CHINA REPEATS IT WILL 'FIGHT TILL THE END' IF INTERESTS HARMED

*CHINA: WILL IGNORE 'NUMBERS GAME' BY US

*WTO SLASHES GLOBAL GOODS TRADE OUTLOOK, SEEING 2025 CONTRACTION

Fed’s Hammack Sees Strong Case for Steady Rates Amid Uncertainty

*HAMMACK: LOOKS LIKE INF. EXP. STILL CLOSE TO WHERE WE WANT THEM

*POWELL: FEDERAL DEBT IS NOT AT AN UNSUSTAINABLE LEVEL

*POWELL: TARIFFS LARGER THAN WE EXPECTED EVEN IN OUR UPSIDE CASE

*POWELL: UNEMPLOYMENT IS LIKELY TO GO UP AS ECONOMY SLOWS

*TRUMP: WE'RE LOOKING AT VENEZUELA VERY CAREFULLY

*TRUMP: BIG PROGRESS MADE WITH JAPANESE DELEGATION

*NEW ZEALAND ANNUAL INFLATION ACCELERATES TO 2.5%; EST. 2.4%

*FED'S SCHMID SAYS US ECONOMY STILL IN GOOD SHAPE

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.