Macro Regime Tracker: Real Estate Cycle

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I just published the new real estate model and real estate report here:

and the video breakdown of it here:

Main Developments In Macro

*TOKYO MAY CPI EX-FRESH FOOD, ENERGY RISES 3.3% Y/Y; EST. +3.2%

*TOKYO MAY OVERALL CONSUMER PRICES RISE 3.4% Y/Y; EST. +3.4% *TOKYO MAY CORE CONSUMER PRICES RISE 3.6% Y/Y; EST. 3.5%

*LUTNICK: TRUMP IS CONFIDENT ON APPEAL

*LUTNICK: TRADE POLICY IS GOING FORWARD

*BESSENT: THINK THE DEFICIT WILL BE SMALLER THIS YEAR THAN LAST

*BESSENT: TARIFFS NOT SEPARATE FROM BUDGET

*BESSENT: BELIEVE CHINESE WILL COME TO TABLE WITH TRUMP INVOLVED

*BESSENT: EXPECT MORE CHINA TALKS IN NEXT FEW WEEKS

*BESSENT: CHINA TALKS 'A BIT STALLED'

*BESSENT: EU IN MOTION ALSO

*BESSENT: JAPANESE DELEGATION COMING TO MY OFFICE TOMORROW

*BESSENT: 'INAPPROPRIATE' FOR JUDICIARY TO WEIGH IN ON TARIFFS

*DALY: I REALLY BELIEVE IN OUR MANDATES AND 2% INFLATION TARGET

*DALY: WHAT I SEE IS A GENERAL SENSE OF CAUTIOUS OPTIMISM

*DALY: MARKETS WILL FLUCTUATE, BUT ECONOMY IS IN A GOOD PLACE

*DALY: NOT NECESSARILY MY FORECAST TO ACHIEVE 2% INF. THIS YEAR

*DALY: SEEING BALANCE IN LABOR MKT WE NEED FOR 2% INFLATION

*HASSETT: APPEALS RULING IS 'BIG VICTORY FOR THE PRESIDENT'

*HASSETT: PLEASED WITH LATEST APPEALS RULING

*NAVARRO: COURT TOLD US TO GO DO IT ANOTHER WAY

*NAVARRO: WILL HEAR IN THE NEXT DAY OR TWO FROM USTR

*TRUMP TARIFF RULING TEMPORARILY PAUSED BY APPEALS COURT

*FEDERAL CIRCUIT COURT SAYS IT NEEDS TIME TO CONSIDER FILINGS

*KUGLER: MONITORING POTENTIAL LOWER DESIRABILITY OF US ASSETS

*KUGLER: CRUCIAL TO EXAMINE POSSIBLE CHANGING ROLE OF US ASSETS

*FED’S KUGLER SAYS IN PREPARED REMARKS FOR EVENT IN WASHINGTON

*LEAVITT: CALL WITH JAPAN WAS GOOD DISCUSSION

*LEAVITT: TRUMP SPOKE TO JAPAN LEADER THIS MORNING

*LEAVITT: THE DOGE LEADER NOW IS TRUMP AND CABINET

*LEAVITT: CABINET WILL WORK WITH DOGE EMPLOYEES IN FUTURE

*LEAVITT: EXPECT DEFENSE TO COME UP AT G-7 WITH CANADA

*LEAVITT: TRUMP TOLD CANADA US IS SUBSIDIZING THEIR DEFENSE

*LEAVITT: TRUMP TOLD POWELL IT'S A MISTAKE NOT TO LOWER RATES

*LEAVITT CONFIRMS TRUMP, POWELL MET AT WHITE HOUSE EARLIER

*LEAVITT: TRUMP HAS OTHER LEGAL AUTHORITIES FOR TARIFFS

*LEAVITT: US WILL CONTINUE WITH TRADE NEGOTIATIONS

*LEAVITT: EXPECT TO TAKE TARIFF BATTLE TO THE SUPREME COURT

*LEAVITT SAYS DC JUDGE RULED AGAINST TRUMP'S 'TARIFF POWER'

*LEAVITT: US IS FIGHTING BLOCK FROM TRADE COURT

*LEAVITT SAYS THERE WILL BE NO INCREASE TO DEFICIT FROM TAX BILL

*LEAVITT: TAX BILL CBO ESTIMATE IS A SHODDY ASSUMPTION

*LEAVITT SAYS SUPREME COURT MUST END TARIFF CHALLENGE

*LEAVITT: SUPREME COURT MUST PUT AN END TO THIS

*LEAVITT: COURTS SHOULD HAVE NO ROLE HERE

*LEAVITT: TRADE COURT ABUSED JUDICIAL POWER

*LEAVITT: TRUMP'S RATIONALE IS LEGALLY SOUND

*FED RELEASES STATEMENT THURSDAY ABOUT POWELL, TRUMP MEETING

*POWELL SAID FED WILL SET POLICY SOLELY ON OBJECTIVE ANALYSIS

*POWELL STRESSED POLICY PATH DEPENDS ON INCOMING DATA, OUTLOOK

*POWELL AND TRUMP DISCUSSED GROWTH, EMPLOYMENT AND INFLATION

*FED SAYS POWELL MET WITH PRESIDENT TRUMP TODAY AT WHITE HOUSE

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

New stock bond tear sheet here:

normal tear sheets here:

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

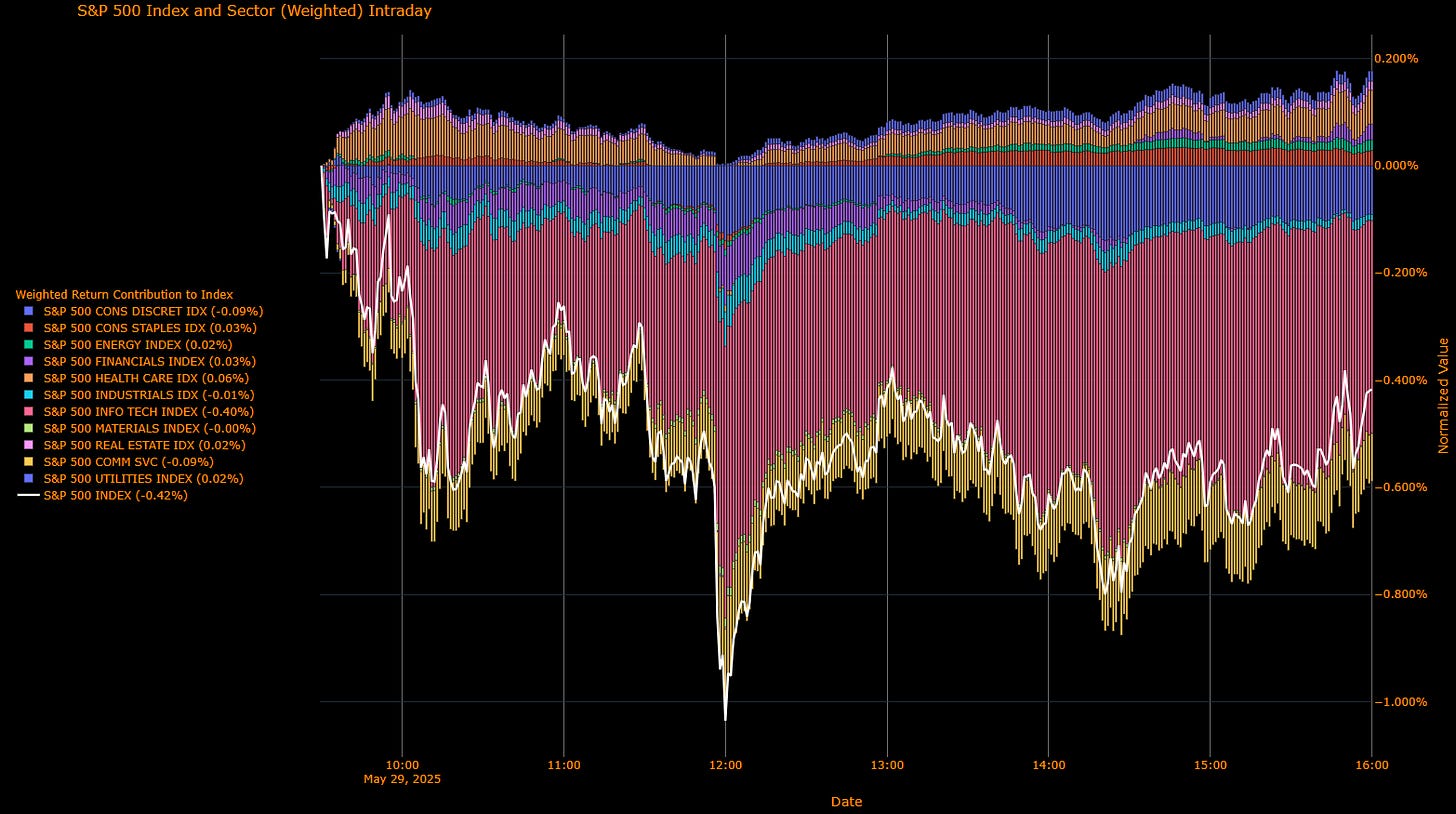

S&P 500 Wrap — Index Declines -0.42%, Information Technology and Communication Services Lead Losses; Real Estate and Utilities Outperform

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Information Technology (-0.40 pp) – Largest negative contributor, pressured by broad concerns around U.S.-China trade relations and lingering uncertainties in semiconductor export restrictions despite some strong earnings.

Communication Services (-0.09 pp) – Weighed down by broader market cautiousness and ongoing regulatory uncertainty impacting key constituents.

Consumer Discretionary (-0.09 pp) – Negative impact driven by consumer caution amid lingering tariff concerns.

Industrials (-0.01 pp) – Slightly negative due to continued worries over global trade tensions and a weaker manufacturing outlook.

Materials (~0.00 pp) – Essentially neutral amid commodity price volatility and mixed global demand signals.

Financials (+0.03 pp) – Slight positive contribution, benefiting from recent stability in yield curves despite broader equity pressures.

Energy (+0.02 pp) – Modestly positive as investors balanced concerns over global growth with stable short-term energy prices.

Real Estate (+0.02 pp) – Positive contribution reflecting investors' preference for yield amid easing long-term bond yields.

Utilities (+0.02 pp) – Outperformed slightly, highlighting defensive rotations amid broad market uncertainty.

Consumer Staples (+0.03 pp) – Small positive impact, consistent with defensive positioning during market volatility.

Health Care (+0.06 pp) – Best positive contributor today, benefiting from its defensive profile and lower sensitivity to macroeconomic risks.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Information Technology (-1.25%) – Worst-performing sector, under pressure from intensified trade tensions and semiconductor sector regulatory concerns.

Communication Services (-0.93%) – Negatively impacted by regulatory uncertainties and overall cautious investor sentiment.

Consumer Discretionary (-0.85%) – Dragged down by tariff-related uncertainties and cautious consumer sentiment.

Industrials (-0.13%) – Mild losses reflecting ongoing global trade uncertainties and subdued industrial outlook.

Materials (-0.02%) – Slight losses amid commodity price volatility and uncertain global economic conditions.

Financials (+0.20%) – Outperformed moderately, benefiting from yield curve stability despite broader market pressures.

Energy (+0.67%) – Strong gains driven by short-term stability in oil prices and selective investor positioning.

Real Estate (+0.80%) – Among top performers, supported by easing Treasury yields and attractive yield-driven investor interest.

Utilities (+0.75%) – Strong relative performance reflecting defensive investor preferences amid broader market volatility.

Consumer Staples (+0.49%) – Benefited from investor rotations into defensive assets amid uncertainty.

Health Care (+0.66%) – Gained moderately due to defensive nature and lower vulnerability to macroeconomic risks.

Macro Overlay

Market sentiment was subdued, with the S&P 500 declining by -0.42%, primarily driven by significant losses in Information Technology and Communication Services. Despite some sectors like Real Estate and Utilities outperforming due to defensive positioning and stable bond yields, broader equity markets were pressured by persistent uncertainties surrounding regulatory measures impacting technology exports to China and tariff-related headwinds. Caution remains elevated amid mixed economic data, ongoing trade disputes, and shifting expectations regarding Federal Reserve rate policy.

Bottom Line

The S&P 500 declined by -0.42%, led lower predominantly by Information Technology and Communication Services sectors. Defensive sectors, including Real Estate and Utilities outperformed. Expect continued volatility as markets navigate trade tensions, regulatory uncertainties, and evolving economic outlooks.

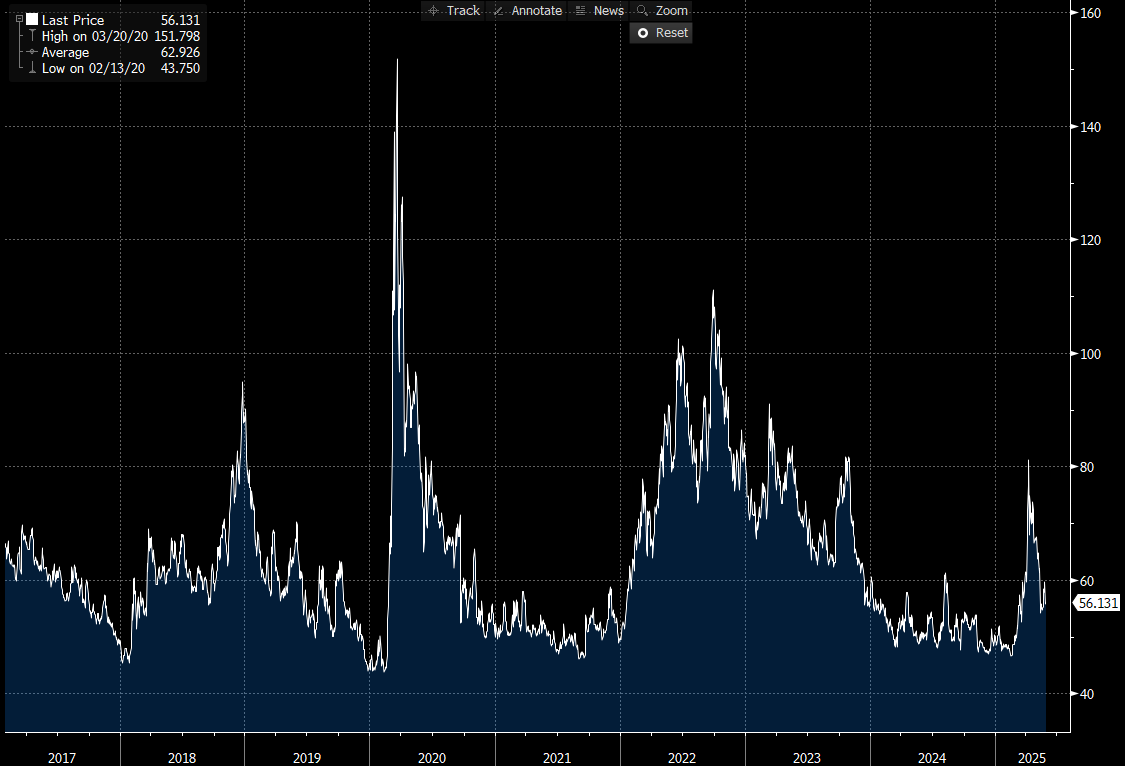

US IG Credit Wrap — Spreads Ease to 56.1 bp Amid Persistent Macro Concerns and Regulatory Uncertainty

Current Spread: 56.1 bp (▲ ~0.4 bp d/d), indicating slight widening. Spreads remain below the 5-year historical average (~62.9 bp), influenced by ongoing macroeconomic and regulatory uncertainties.

Credit Context

< 60 bp: Pre-tariff escalation range: supportive of duration-heavy positioning (e.g., LDI managers, insurers).

60–70 bp: Tariff and fiscal uncertainty zone: neutral-to-cautious stance warranted.

> 90 bp: Severe stress breakout: low probability under current conditions.

Macro Overlay

Today's marginal widening in IG credit spreads reflects regulatory uncertainties, notably the Trump administration's potential tightening of semiconductor software exports to China. Initial market optimism from the U.S. trade court's ruling blocking global tariffs faded due to broader concerns driven by persistent upward pressure on long-dated Treasury yields and heightened Federal Reserve vigilance regarding inflation persistence and economic slowdown risks. The credit environment remains cautiously constructive amid elevated macroeconomic uncertainty.

Bottom Line

IG credit spreads widened slightly to 56.1 bp amid renewed regulatory and macroeconomic concerns. The immediate risk environment remains stable yet fragile, with spreads sensitive to evolving geopolitical developments and fiscal policy news. Directional bias remains neutral-to-cautious, pending greater clarity on regulatory and economic dynamics.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.